Telus 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182

|

|

TELUS 2010 annual report . 1

WHY INVEST IN TELUS?

AT A

GLANCE

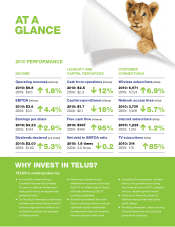

2010 PERFORMANCE

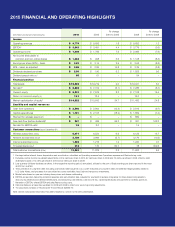

INCOME

Operating revenues (billions)

2010: $9.8

2009: $9.6 1.8%

EBITDA (billions)

2010: $3.6

2009: $3.5 4.4%

Earnings per share

2010: $3.23

2009: $3.14 2.9%

Dividends declared (per share)

2010: $2.00

2009: $1.90 5.3%

CUSTOMER

CONNECTIONS

Wireless subscribers (000s)

2010: 6,971

2009: 6,524 6.9%

Network access lines (000s)

2010: 3,739

2009: 3,966 5.7%

Internet subscribers (000s)

2010: 1,229

2009: 1,215 1.2%

TV subscribers (000s)

2010: 314

2009: 170 85%

.Successfully implementing a

consistent decade-long strategy

focused on national wireless and

data growth led by an experienced

leadership team

.Continuing to leverage our advanced

wireless network and future friendly®

customer approach to enhance our

competitive position and generate

profitable growth

.Delivering a superior home

entertainment experience through

Optik TV and High Speed Internet,

while also enhancing TELUS’

bundling capabilities

.Generating increased free cash

flow by realizing a return on recent

significant capital investments,

increasing earnings and lowering

interest costs and cash taxes

.Increasing the prospective dividend

payout ratio guideline and raising

the dividend twice in 2010, consistent

with our dividend growth model

.Adhering to financial policies to

maintain strong investment grade

credit ratings

.Providing transparent, award-winning

financial disclosure and corporate

governance practices.

TELUS is creating value by:

LIQUIDITY AND

CAPITAL RESOURCES

Cash from operations (billions)

2010: $2.5

2009: $2.9 12%

Capital expenditures (billions)

2010: $1.7

2009: $2.1 18%

Free cash flow (millions)

2010: $947

2009: $485 95%

Net debt to EBITDA ratio

2010: 1.8 times

2009: 2.0 times 0.2