Telus 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 67

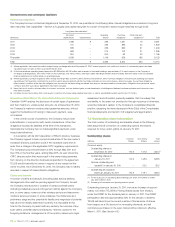

.Long-term debt issue in July 2010 with early partial redemption

of U.S. dollar Notes in September 2010

On July 23, 2010, the Company successfully closed a public offering

of 5.05%, Series CH Notes maturing in July 2020, for gross pro-

ceeds of $1 billion. These Notes are redeemable at the option of the

Company, in whole at any time, or in part from time to time, on not

fewer than 30 and not more than 60 days’ prior notice, at a redemp-

tion price equal to the greater of (i) the present value of the Notes

discounted at the Government of Canada yield plus 47 basis points,

or (ii) 100% of the principal amount thereof. In addition, accrued and

unpaid interest, if any, will be paid to the date fixed for redemption.

Net proceeds of approximately $993 million were used to fund

the early partial redemption of U.S.$607 million of the Company’s

publicly held U.S. dollar, 8% Notes with a June 2011 maturity, as well

as payments to terminate cross currency interest rate swaps asso-

ciated with the redeemed Notes. The U.S. dollar Notes have an

effective interest rate of approximately 8.5%. The early redemption

resulted in a third quarter, pre-tax charge of $52 million, or after tax,

approximately $37 million or 12 cents per share.

These financing activities, as well as a similar Note issue and

early partial redemption in December 2009, reduced the face value of

long-term debt maturing in June 2011 by approximately U.S.$1.2 bil-

lion and extended the average maturity of long-term debt to 5.7 years

at December 31, 2010 (five years at December 31, 2009).

.Long-term debt issues in May and December 2009 with early partial

redemption of U.S. dollar Notes in December 2009

The comparative consolidated statement of cash flows for 2009

reflects a successful $700 million public offering in May of 4.95%,

Series CF Notes maturing in May 2014. In December, the Company

also successfully closed a $1 billion public offering of 5.05%,

Series CG Notes maturing in December 2019. The net proceeds of

the December issue were used to fund the early partial redemption of

U.S.$577 million of the Company’s publicly held U.S. dollar, 8% Notes

with a June 2011 maturity, as well as payments to terminate cross

currency interest rate swaps associated with the redeemed Notes.

10

09

08

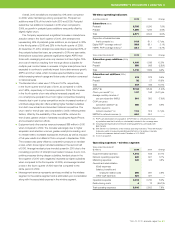

DEBT (REDUCTION) INCREASE, NET ($ millions)

10 (402)

(132)

1, 316

09

08

08

Debt increased in 2008 to help fund acquisitions and AWS spectrum purchases.

10

09

08

CASH RETURNED TO SHAREHOLDERS ($ millions)

10 642

601

864

280584

09

08

08

Dividends declared Normal course issuer bid

MANAGEMENT’S DISCUSSION & ANALYSIS: 7

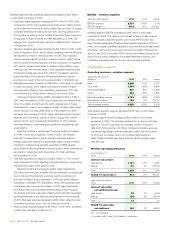

.Wireless segment

Capital expenditures decreased by $307 million in 2010 when

compared to 2009 due to the major activity in the prior year to

construct the HSPA+ network, which was substantially completed

and launched in November 2009, as well as lower expenditures

for the mature CDMA network. This was partly offset by new

expenditures for increased capacity as well as the HSPA+ dual-cell

technology project begun in the second half of 2010 that is expected

to approximately double the data download speed of the network.

(See Section 2 – Building national capabilities.)

Wireless capital intensity decreased to 9% in 2010 from 16%

in 2009. Wireless cash flow (EBITDA less capital expenditures) was

$1,568 million in 2010, up by $405 million or 35% year-over-year.

.Wireline segment

Capital expenditures decreased by $75 million in 2010 when

compared to 2009 due to lower expenditures for the largely com-

pleted ADSL2+ network technology upgrade, partly offset by

increased expenditures for TELUS Optik TV, VDSL2 and gigabit

passive optical network (GPON) technology, pushing fibre deeper

into the network and shortening loop lengths from the home, as

well as efficiency initiatives including service delivery improvement,

workforce management and purchase of a leased building to

facilitate consolidation of contact centre real estate space.

Wireline capital intensity remained at 26% in 2010, unchanged

from 2009. Wireline cash flow (EBITDA less capital expenditures)

improved to $354 million in 2010, up by $129 million or 57%

year-over-year.

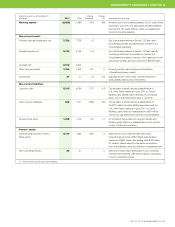

7.3 Cash (used) provided by financing activities

Net cash used by financing activities increased by $124 million in 2010

when compared to 2009.

.Cash from Common Shares and Non-Voting Shares issued was

$15 million in 2010 as compared to $1 million in 2009.

.Cash dividends paid to holders of Common Shares and Non-Voting

Shares were $473 million in 2010, comprised of dividends declared

net of amounts reinvested in TELUS Non-Voting Shares issued from

treasury at a 3% discount under the Company’s dividend reinvest-

ment and share purchase (DRISP) program. In 2009, cash dividend

payments were $602 million and no shares were issued from treasury

in respect of reinvested dividends. Effective March 1, 2011, TELUS

will change the practice of issuing shares from treasury at a 3%

discount and switch to purchasing shares from the open market

with no discount (see Section 4.3).

.Bank facilities and commercial paper

The Company often shifts among short-term financing sources

to take advantage of interest cost differentials. In 2010, commercial

paper was reduced by $363 million to $104 million at December 31,

2010. No amounts were drawn against the 2012 credit facility at

December 31, 2010 (unchanged from December 31, 2009).

In 2009, commercial paper increased by $35 million to $467 mil-

lion at December 31, while net amounts drawn on the 2012 credit

facility were reduced by $980 million to $nil in the second quarter of

2009, primarily as a result of the successful Note issue in May 2009.

.Maturity and repayment of smaller debt issues in 2010

The Company repaid $50 million for matured 12% TCI Debentures

in May 2010 and $30 million for matured 11.5% TCI First Mortgage

Bonds in July 2010.