Telus 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

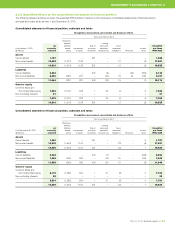

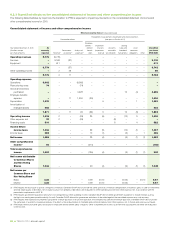

86 . TELUS 2010 annual report

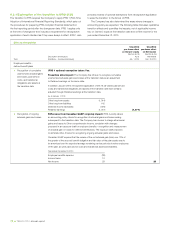

8.2.4 Effects on other measures

The Company does not expect the changeover to have a significant impact on its segmented operating indicators, or Consolidated statements

of cash flows, policy metrics and other reported measures.

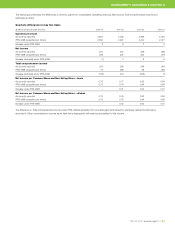

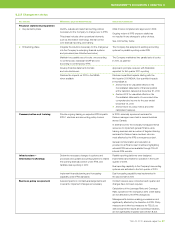

Measures Expectation or result

Defined benefit plan expenses recognized in Net income Will be reduced, as shown in the previous section, and will

experience lower volatility after changeover, as actuarial gains

and losses will be charged to Other comprehensive income.

EBITDA EBITDA is a non-GAAP measure that after

changeover to IFRS is equivalent to Operating

income before Depreciation and Amortization

expenses

For the year ended December 31, 2010, unaudited pro forma

EBITDA is $3,650 million, as compared to $3,643 million

currently measured and reported. See Section 11.1 for additional

information on the transition differences in the measurement

of 2010 EBITDA.

Segmented Subscriber measures Unaffected

Revenue and EBITDA Not materially affected

Wireless measures currently reported such as

ARPU, COA per gross subscriber addition and

Retention spend as a percentage of network

revenue

No significant impacts expected

Consolidated statements of cash flows Presentation differences only

Policy measures Net debt to EBITDA – excluding restructuring

costs

Policy of 1.5 to 2.0 times – unchanged.

Historical measure immaterially affected (see table below).

Dividend payout ratios Policy of 55 to 65% of sustainable net earnings on a prospective

basis – unchanged.

Historical measures based on reported and adjusted earnings –

not materially affected (see table below).

Other measures Earnings coverage

EBITDA – excluding restructuring

costs interest coverage

Free cash flow

Net debt to total capitalization

Not materially affected (see table below).

The Company’s policy for Net debt to EBITDA – excluding restructuring costs continues to be in the range of 1.5 to 2.0 times, and the policy

for dividend payout ratio of sustainable net earnings on a prospective basis continues to be 55% to 65%.

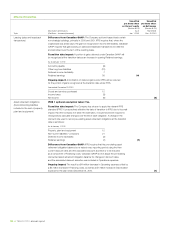

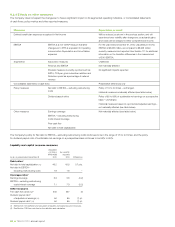

Liquidity and capital resource measures

Unaudited

pro forma As currently

IFRS-IASB reported

As at, or years ended, December 31 2010 2010 Differences

Debt ratios(1)

Net debt to total capitalization (%) 46.2 45.5 0.7 pts.

Net debt to EBITDA –

excluding restructuring costs 1.8 1.8 –

Coverage ratios(1)

Earnings coverage 3.6 3.8 (0.2)

EBITDA – excluding restructuring

costs interest coverage 7.1 7.3 (0.2)

Other measures

Free cash flow ($ millions)(2) 940 947 (7)

Dividend payout ratio(1)

of adjusted net earnings (%) 64 65 (1) pt.

Dividend payout ratio(1) (%) 64 65 (1) pt.

(1) See Section 11.4 Definition and calculation of liquidity and capital resource measures.

(2) See Section 11.2 Free cash flow for the definition and calculation.