Telus 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 89

It is also expected that major mobile platforms will ramp up efforts

to sell streaming content services in 2011 such as music, TV and video

as consumers become more comfortable with cloud-based computing,

a web-based way to cost-effectively process, manage and store data.

It is expected that major mobile platforms will make the transition to

supporting cloud-based services to allow customers to access both

corporate and personal data (i.e. photos, streaming video, music)

from virtually anywhere and on any device.

The demand for wireless data services has been growing strongly

and it is projected that this demand will further accelerate. This growth is

driven by increasing levels of broadband penetration, ongoing investment

in new network technologies such as HSPA+ and dual-cell that provide

faster data speeds and allow for a richer user experience and applications

of greater utility, increasing need for personal connectivity and network-

ing, increasing affordability and selection of smartphones and Internet-only

devices including mobile Internet keys and emerging products such

as tablets and e-book readers, increasingly rich multimedia services and

applications, increasing wireless competition, and more affordable data

plans. The increasing levels of data traffic represent a growing challenge

to wireless carriers’ networks and their ability to serve this traffic.

To better manage anticipated increases in wireless data traffic and

to capitalize on Canada’s wireless growth opportunity, Canadian wireless

providers continue to roll out faster, next generation high-speed wireless

networks, increasing network capacity. TELUS and Bell successfully

launched an extensive next generation network based on HSPA+ tech-

nology in 2009, which delivers manufacturer-rated data download speeds

of up to 21 Mbps and now covers approximately 97% of Canada’s

population. TELUS continued to enhance this HSPA+ network into 2011

with the planned commercial launch of HSPA+ dual-cell technology,

which offers manufacturer-rated data speeds of up to 42 Mbps. The

HSPA+ network positions the Company to meet data capacity demands

in the foreseeable future. This complements TELUS’ two other wire-

less networks and technologies – code division multiple access (CDMA)

and Mike (iDEN), which provide customers access to a nationwide

high-speed EVDO service and the industry-leading Push to Talk Mike

service, respectively.

In addition to the superior capabilities and higher capacity delivered

by HSPA+, this wireless infrastructure supports the company’s migration

to long-term evolution (LTE), which is emerging as the global standard.

LTE technologies are expected to deliver data speeds of up to 100 Mbps,

while at the same time introducing significant improvements in network

capacity and performance. The ecosystem for LTE devices is expected to

evolve in 2011 with Verizon Wireless launching an LTE wireless network

in 38 cities in December 2010, covering more than 110 million people

in the United States. Verizon expects to expand this coverage by rolling

out LTE over its existing network footprint by 2013. In early 2011, AT&T

announced plans to accelerate and launch its LTE network by mid-2011,

with the network to be largely complete by year-end 2013. However, wide

availability of compatible devices usually lags by one to two years.

To support technology evolution and increasing demand for capacity,

TELUS will focus on increasing its spectrum position. The ability to acquire

additional spectrum to address future requirements is dependent on the

timing and the rules established by Industry Canada. Industry Canada

initiated a consultation on the 700 MHz band with an auction likely in late

2011 or 2012. There is no guarantee that the Canadian government

will not reserve spectrum for new entrants or adopt some open access

provisions for some of this spectrum, as was done in the U.S.

MANAGEMENT’S DISCUSSION & ANALYSIS: 9

Wireless

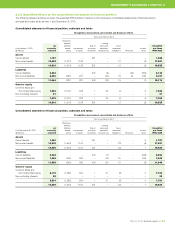

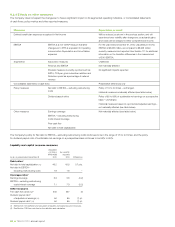

The Canadian wireless industry experienced increased growth in

2010 with estimated year-over-year revenue and EBITDA increasing by

approximately 5% and 3%, respectively (3.2% and 3.1% in 2009).

The Canadian wireless market continues to grow at a reasonable

pace with an estimate of more than 1.7 million new subscribers in 2010,

or an approximate 4.4 percentage point increase in penetration to

approximately 73% of the population (in 2009, 1.4 million new subscribers

for an approximate 3.6 percentage point increase in penetration). The

wireless penetration rate in Canada is expected to further increase in

2011 by approximately 4.5 to five percentage points. At 73% penetration,

the wireless market in Canada continues to present a meaningful

growth opportunity and is most comparable to the U.S., which has

a penetration rate of approximately 97%.

Wireless penetration rates in many Western European countries have

approached and even surpassed 100%. These rates are not exactly

comparable to Canada for several reasons, including: Canada’s wireline

local service rates are among the lowest of Organization for Economic

Co-operation and Development (OECD) countries, priced as flat-rate

monthly charges that include all local calls to wireless phones; Europe

has a calling party pays regime for wireline local calls; the dominance

of global system for mobile communication (GSM) networks in Europe

allows for multiple subscriptions on a single handset that are used to

arbitrage roaming charges and inflate subscription numbers; and a much

lower population density in Canada affects the economic efficiency and

speed of providing coverage to 99% of the population (i.e. 34 million

people within nine million square kilometres in Canada compared to

730 million people within 10 million square kilometres in Europe). These

factors, historically, have reduced the demand for wireless substitution

in Canada as compared to Europe.

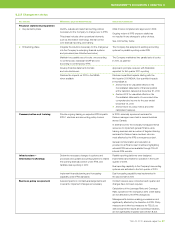

A key driver of wireless revenue growth continues to be the increased

adoption and usage of data services such as email, text, picture, video

and instant messaging, social networking, web browsing, application

usage, gaming and video-streaming. In 2010, wireless data in Canada

represented an estimated 25% of industry ARPU. This compares to

approximately 46% in Asia-Pacific, 27% in Europe and 34% in the U.S.,

suggesting a significant ongoing growth opportunity in Canada. The

higher data proportion in Asia is due in part to a very low rate of penetra-

tion of wired Internet to households in many Asian countries. The higher

data proportion in Europe is partly a result of the popularity of short

messaging service (SMS) and the earlier wide availability of 3G+ facilitated

by greater urban density. The higher proportion of data usage in the U.S.

is due in part to the introduction of the iPhone in that market by Apple

and AT&T two years earlier.

This data growth is being facilitated by the increasing availability and

popularity of iPhone, BlackBerry and Android smartphones, as well as

increased adoption of mobile Internet keys. The increasing adoption of

a wider range of smartphones, which are more expensive than traditional

wireless phones, is impacting industry margins. With a multi-year sales

agreement, there is usually a large upfront device subsidy provided by

wireless carriers with initial negative returns but with higher ARPU and

lower churn rates resulting in higher average lifetime revenue. Tablet

devices that operate on mobile networks or on Wi-Fi are expected to

be an accelerating growth segment in 2011, as customers are expected

to buy more new computing devices that are not traditional personal

computers. Customers increasingly want to remain connected to the

Internet and experience an enhanced portable computing experience.