Telus 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 73

MANAGEMENT’S DISCUSSION & ANALYSIS: 8

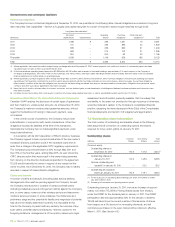

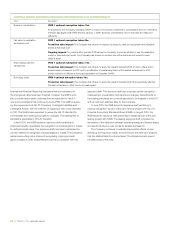

8.1 Critical accounting estimates

TELUS’ significant accounting policies are described in Note 1 of the

Consolidated financial statements. The preparation of financial statements

in conformity with generally accepted accounting principles requires

management to make estimates. Management’s estimates affect the

reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities at the date of the financial statements, as well

as the reported amounts of revenues and expenses during the reporting

period. Actual results could differ from those estimates. The Company’s

critical accounting estimates are described below and are generally

discussed with the Audit Committee each quarter, and refer to Canadian

GAAP and IFRS-IASB where noted.

General

.The Company has considered in determining its critical accounting

estimates, trends, commitments, events or uncertainties that it

reasonably expects to materially affect the methodology or assump-

tions, subject to the items identified in the Caution regarding

forward-looking statements section of this MD&A.

.In the normal course, changes are made to assumptions underlying

all critical accounting estimates to reflect current economic conditions,

updating of historical information used to develop the assumptions

and changes in the Company’s credit ratings, where applicable.

Unless otherwise specified in the discussion of the specific critical

accounting estimates, it is expected that no material changes in

overall financial performance and financial statement line items would

arise either from reasonably likely changes in material assumptions

underlying the estimate or from selection of a different estimate from

within a valid range of estimates.

.All critical accounting estimates are uncertain at the time of making

the estimate and affect the following Consolidated statements of

income and other comprehensive income line items: Income taxes

(except for estimates about goodwill) and Net income. Similarly, all

critical accounting estimates affect the following Consolidated state-

ments of financial position line items: Current assets (Income and

other taxes receivable); Current liabilities (Income and other taxes

payable and Current portion of future income taxes (as currently

reported)); Future income tax liabilities (Deferred income tax liabilities

under IFRS-IASB); and Common Share and Non-Voting Share

equity (retained earnings). The discussion of each critical accounting

estimate does not differ between the Company’s two segments,

wireless and wireline, unless explicitly noted.

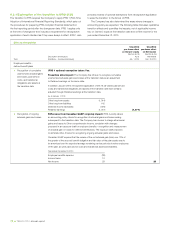

.For fiscal year 2010, critical accounting estimates affected line items

on the Consolidated statements of income and other comprehensive

income, and line items on the Consolidated statements of financial

position, as follows:

8

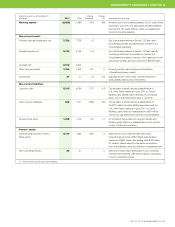

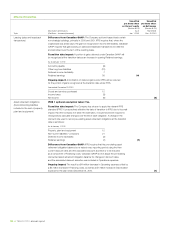

CRITICAL ACCOUNTING ESTIMATES AND ACCOUNTING POLICY

DEVELOPMENTS

Accounting estimates that are critical to determining financial results; and a summary

of differences arising because of the convergence of Canadian GAAP with International

Financial Reporting Standards as issued by the International Accounting Standards

Board (IFRS-IASB), including unaudited pro forma quantified transition effects

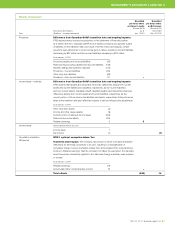

Consolidated statements of income and other comprehensive income

Operating expenses

Operating Amortization of Other

Consolidated statements of financial position revenues Operations Depreciation intangible assets expense, net

Accounts receivable X

Inventories X

Property, plant and equipment, net X

Intangible assets, net, and Goodwill, net(1) X

Investments X

Price cap deferral account

Advance billings and customer deposits X

Other long-term liabilities X

Employee defined benefit pension plans X X(2) X(2)

(1) Accounting estimate, as applicable to intangible assets with indefinite lives and goodwill, primarily affects the Company’s wireless segment.

(2) Accounting estimate impact due to internal labour capitalization rates.