Telus 2010 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144 . TELUS 2010 annual report

With respect to certain issuances of restricted stock units, the Company entered into cash-settled equity forward agreements that fix the cost to

the Company; that information, as well as a schedule of the Company’s non-vested restricted stock units outstanding as at December 31, 2010, is set

out in the following table.

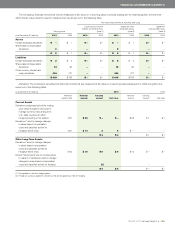

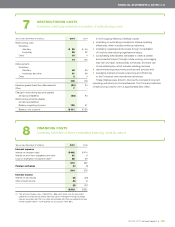

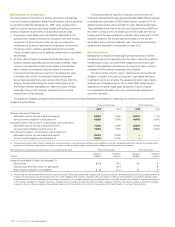

Number of Cost fixed to Number of Total number

fixed-cost the Company variable-cost of non-vested

restricted per restricted restricted restricted

stock units stock unit stock units stock units

Vesting in years ending December 31:

2 011 390,000 $ß33.79

50,000 $ß44.43

440,000 184,857 624,857

2012 420,000 $ß35.91

100,000 $ß46.01

520,000 214,209 734,209

960,000 399,066 1,359,066

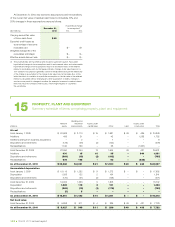

(e) Unrecognized, non-vested share-based

compensation

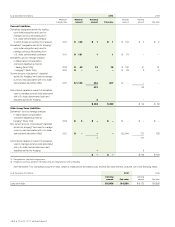

As at December 31, 2010, compensation cost related to non-vested

share-based compensation that has not yet been recognized is set out

in the following table and is expected to be recognized over a weighted

average period of 1.7 years (2009 – 1.6 years).

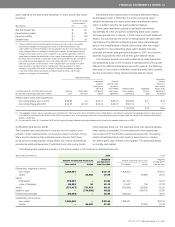

As at December 31 (millions)(1) 2010 2009

Share option awards $ß 9 $ß12

Restricted stock units(2) 27 22

$ß36 $ß34

(1) These disclosures are not likely to be representative of the effects on reported net

income for future periods for the following reasons: these amounts reflect an estimate

of forfeitures; these amounts do not reflect any provision for future awards; these

amounts do not reflect any provision for changes in the intrinsic value of vested

restricted stock units; these amounts do not reflect any provision for the impacts of

future, if any, modification of share option awards allowing for net-cash settlement;

and for non-vested restricted stock units, these amounts reflect intrinsic values as

at the statement of financial position dates.

(2) The compensation cost that has not yet been recognized in respect of non-vested

restricted stock units is calculated based upon the intrinsic value of the non-vested

restricted stock units as at the statement of financial position dates, net of the

impacts of associated cash-settled equity forward agreements.

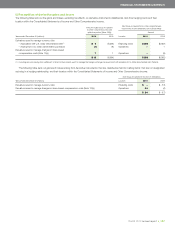

(d) Employee share purchase plan

The Company has an employee share purchase plan under which eligible

employees up to a certain job classification can purchase Common

Shares through regular payroll deductions by contributing between 1%

and 10% of their pay; for more highly compensated job classifications,

employees may contribute between 1% and up to 55% of their pay.

For every dollar contributed by an employee, up to a maximum of 6%

o

f eligible employee pay, the Company is required to contribute a

percentage between 20% and 40% as designated by the Company.

For the year ended December 31, 2010, the Company contributed

40% (2009 – 40%) for employees up to a certain job classification; for

more highly compensated job classifications, the Company contributed

35% (2009 – 35%). The Company records its contributions as a com-

ponent of operating expenses and, prior to fiscal 2010, there were no

vesting requirements. Subsequent to 2009, the Company’s contribution

vests on the earlier of a plan participant’s last day in the Company’s

employ or the last business day of the calendar year of the Company’s

contribution, unless the plan participant’s employment was terminated

with cause, in which case the plan participant will forfeit their in-year

Company contribution.

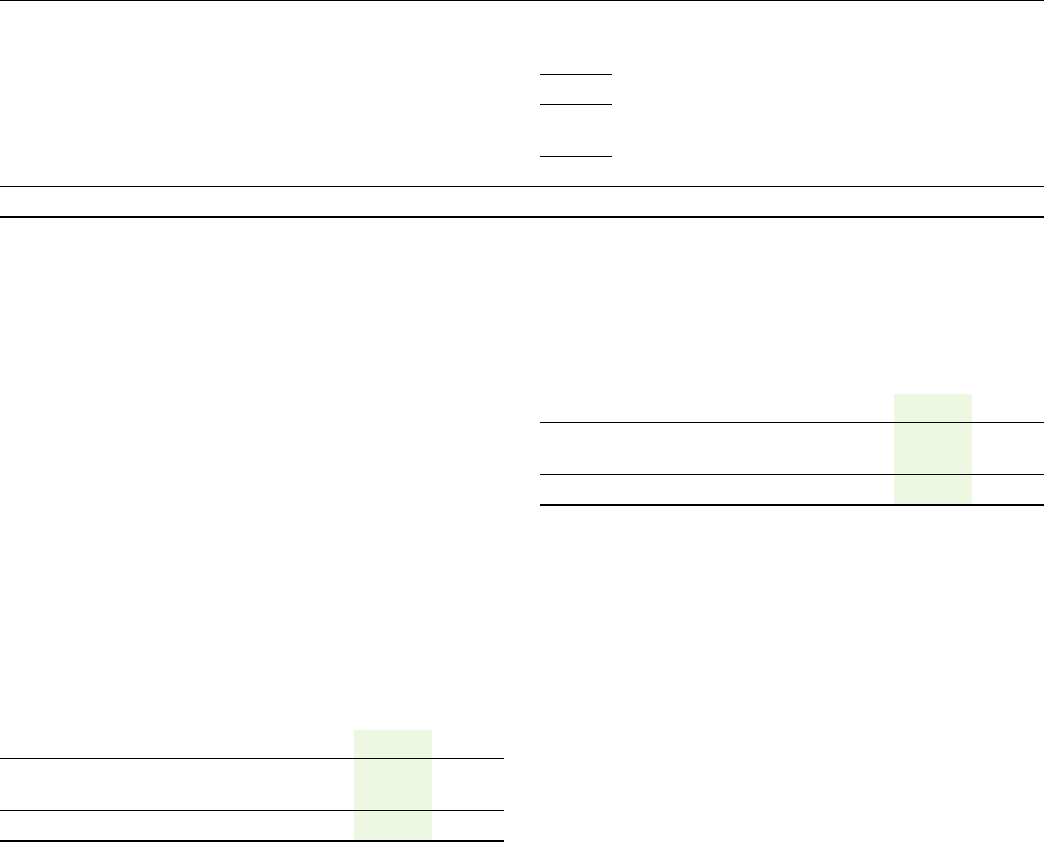

Years ended December 31 (millions) 2010 2009

Employee contributions $ß 73 $ß 79

Company contributions 27 29

$ß100 $ß108

Under this plan, the Company has the option of offering shares from

Treasury or having the trustee acquire shares in the stock market. For the

years ended December 31, 2010 and 2009, all Common Shares issued

to employees under the plan were purchased in the stock market at

normal trading prices.