Telus 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 109

The discussion in this section is qualified in its entirety by the Caution

regarding forward-looking statements at the beginning of the MD&A.

IFRS-based financial information provided in this section is subject

to change, as described further in Section 8.2 Accounting policy

developments.

11.1 Earnings before interest, taxes, depreciation

and amortization (EBITDA)

EBITDA is not a calculation based on Canadian GAAP, IFRS-IASB

or U.S. GAAP. EBITDA should not be considered an alternative to Net

income in measuring the Company’s performance, nor should it be

used as an exclusive measure of cash flow. TELUS has issued guidance

on and reports EBITDA because it is a key measure that management

uses to evaluate performance of segments and the Company. EBITDA –

excluding restructuring costs is also utilized in measuring compliance

with debt covenants (see description in Section 11.4). EBITDA is a mea-

sure commonly reported and widely used by investors as an indicator

of a company’s operating performance and ability to incur and service

debt, and as a valuation metric. While EBITDA has been disclosed

herein to permit a more complete comparative analysis of the Company’s

operating performance and debt servicing ability relative to other

companies, investors are cautioned that EBITDA as reported by TELUS

may not be comparable in all instances to EBITDA as reported by

other companies.

After changeover to IFRS, management intends to present standard-

ized EBITDA (CICA guideline) in its disclosures, and may periodically

also calculate an adjusted EBITDA that will exclude items of an unusual

nature that do not reflect normal or ongoing telecommunications oper-

ations, that should not be considered in a valuation metric or should not

be included in assessment of ability to service or incur debt.

The CICA’s Canadian Performance Reporting Board defined

standardized EBITDA to foster comparability of the measure between

entities. Standardized EBITDA is an indication of an entity’s capacity

to generate income from operations before taking into account manage-

ment’s financing decisions and costs of consuming tangible and

intangible capital assets, which vary according to their vintage, tech-

nological currency and management’s estimate of their useful life.

Accordingly, standardized EBITDA comprises revenue less operating

costs before interest expense, capital asset amortization and

impairment charges, and income taxes. Management’s definition

of EBITDA differs from standardized EBITDA, as illustrated below:

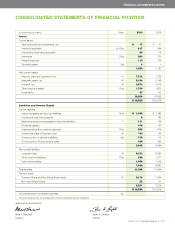

Calculation of EBITDA

Unaudited

pro forma

Years ended December 31 IFRS-IASB As currently reported

($ millions) 2010 2010 2009

Net income 1,052 1,038 1,002

Financing costs 522 510 532

Income taxes 335 328 203

Depreciation 1,339 1,333 1,341

Amortization of intangible assets 402 402 381

Impairment losses (reversals)

for capital assets – – –

Standardized EBITDA

(CICA guideline) 3,650 3,611 3,459

Other expense, net 32 32

EBITDA (management’s definition) 3,643 3,491

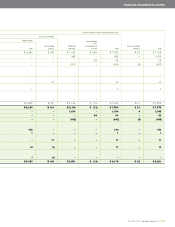

As EBITDA is often used as a valuation metric, an analysis of the pro

forma difference in EBITDA arising from the transition to IFRS is presented

in the following table. The effects of transition on individual line items on

the Consolidated statement of income and other comprehensive income

are presented in more detail in Section 8.2.3.

Analysis of the difference in management’s

definition of EBITDA following the transition to IFRS

Year ended December 31 ($ millions) 2010

EBITDA (as currently reported) 3,643

IFRS recognition, measurement, presentation

and disclosure effects

Other operating income (in revenues

rather than Other expense, net) 2

Charitable donations expense

(in Operating expenses rather

than Other expense, net) (26)

Employee benefits – defined benefit plans 39

Leasing – sales and leaseback transactions (12)

Asset retirement obligations 4

EBITDA (unaudited pro forma IFRS-IASB) 3,650

Management also calculates EBITDA less capital expenditures

as a simple proxy for cash flow at a consolidated level and in its two

reportable segments. EBITDA less capital expenditures may be used

for comparison to the reported results for other telecommunications

companies over time and is subject to the potential comparability issues

of EBITDA described above.

MANAGEMENT’S DISCUSSION & ANALYSIS: 11

11 DEFINITIONS AND RECONCILIATIONS

Definitions of operating, liquidity and capital resource measures, including calculation

and reconciliation of certain non-GAAP measures used by management