Telus 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 . TELUS 2010 annual report

7.8 Financial instruments, commitments and contingent liabilities

Financial instruments (Note 5 of the Consolidated financial statements)

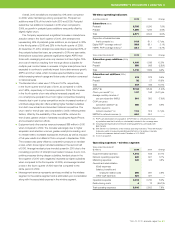

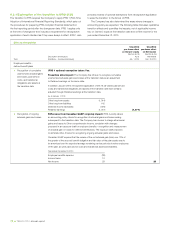

The Company’s financial instruments and the nature of risks that they may be subject to are set out in the following table:

Risks

Market risks

Financial instrument Credit Liquidity Currency Interest rate Other price

Measured at cost or amortized cost

Cash and temporary investments X X X

Accounts receivable X X

Accounts payable X X

Restructuring accounts payable X

Short-term obligations X X

Long-term debt X X X

Measured at fair value

Short-term investments X X

Long-term investments X

Foreign exchange derivatives(1) X X X

Share-based compensation derivatives(1) X X X

Cross currency interest rate swap derivatives(1) X X X X

(1) Use of derivative financial instruments is subject to a policy which requires that no derivative transaction be entered into for the purpose of establishing a speculative or

leveraged position (the corollary being that all derivative transactions are to be entered into for risk management purposes only) and sets criteria for the creditworthiness

of the transaction counterparties.

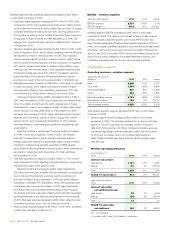

Credit risk

Credit risk associated with cash and temporary investments is minimized

substantially by ensuring that these financial assets are placed with

governments, major financial institutions that have been accorded strong

investment grade ratings by a primary rating agency, and/or other credit-

worthy counterparties. An ongoing review is performed to evaluate

changes in the status of counterparties.

Credit risk associated with accounts receivable is minimized by the

Company’s large and diverse customer base, which covers substantially

all consumer and business sectors in Canada. The Company follows

a program of credit evaluations of customers and limits the amount of

credit extended when deemed necessary. The Company maintains

allowances for potential credit losses, and any such losses to date have

been within management’s expectations. As at December 31, 2010,

the weighted average life of past-due customer accounts receivable

is 59 days (2009 – 72 days).

The Company must make significant estimates in respect of the

allowance for doubtful accounts. Current economic conditions, historical

information, why the accounts are past due and line of business from

which the customer accounts receivable arose are all considered when

determining whether past-due accounts should be allowed for; the

same factors are considered when determining whether to write off

amounts charged to the allowance account against the customer

account receivable. The provision for doubtful accounts is calculated

on a specific-identification basis for customer accounts receivable

over a specific balance threshold and on a statistically derived allowance

basis for the remainder. No customer accounts receivable are written

off directly to the provision for doubtful accounts.

Aside from the normal customer accounts receivable credit risk

associated with its retained interest, the Company has no continuing

exposure to credit risk associated with its trade receivables, which

are sold to an arm’s-length securitization trust.

Counterparties to the Company’s cross currency interest rate swap

agreements, share-based compensation cash-settled equity forward

agreements and foreign exchange derivatives are major financial institu-

tions that have all been accorded investment grade ratings by a primary

rating agency. The dollar amount of credit exposure under contracts with

any one financial institution is limited and counterparties’ credit ratings

are monitored. The Company does not give or receive collateral on swap

agreements and hedging items due to its credit rating and those of its

counterparties. While the Company is exposed to credit losses due to

the non-performance of its counterparties, the Company considers the

risk of this remote. The Company’s derivative liabilities do not have credit-

risk-related contingent features.

Liquidity risk

As a component of capital structure financial policies, discussed under

Section 4.3 Liquidity and capital resources, the Company manages

liquidity risk by maintaining a daily cash pooling process, which enables

the Company to manage its liquidity surplus and liquidity requirements

according to the actual needs of the Company and its subsidiaries,

by maintaining bilateral bank facilities and syndicated credit facilities,

by maintaining a commercial paper program, by the sales of trade

receivables to an arm’s-length securitization trust, by continuously

monitoring forecast and actual cash flows and by managing maturity

profiles of financial assets and financial liabilities.