Telus 2010 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166 . TELUS 2010 annual report

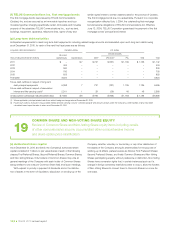

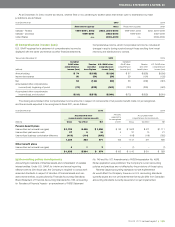

Common Share and Non-Voting Share equity

Accumulated

other

Common Non-Voting Contributed Retained comprehensive

As at December 31, 2009 (millions) Shares Shares surplus earnings income (loss) To t a l

Under Canadian GAAP $ß2,216 $ß3,070 $ß181 $ß2,159 $ß (72) $ß7,554

Adjustments:

Merger of BC TELECOM and TELUS (a), (c), (d) 1,733 883 – (1,508) (829) 279

Share-based compensation (b) 10 53 31 (94) – –

Acquisition of Clearnet Communications Inc.

Goodwill (d) – 131 – (8) – 123

Convertible debentures – (3) (1) 4 – –

Under U.S. GAAP $ß3,959 $ß4,134 $ß211 $ 553 $ß(901) $ß7,956

Share-based compensation: Both Canadian GAAP and U.S. GAAP

require the use of the fair value method of accounting for share-based

compensation for awards made after 2001 and 1994, respectively.

On a prospective basis, commencing January 1, 2006, there is no

longer a difference between Canadian GAAP and U.S. GAAP share-

based compensation expense recognized in the results of operations

arising from current share-based compensation awards accounted

for as equity instruments. As share option awards granted subsequent

to 1994 and prior to 2002 are captured by U.S. GAAP, but are not

captured by Canadian GAAP, differences in owners’ equity accounts

arising from these awards will continue.

Substantially all of the Company’s outstanding share option awards

that were granted prior to January 1, 2005, have a net-cash settlement

feature; the optionee has the choice of exercising the net-cash settlement

feature. The affected outstanding share option awards largely take on

the characteristics of liability instruments rather than equity instruments;

the minimum expense recognized for the affected share option awards

will be their grant-date fair values. Under U.S. GAAP, the grant-date

fair values of affected outstanding share option awards granted subse-

quent to 1994 affected the transitional amount whereas Canadian

GAAP only considered grant-date fair values for affected outstanding

share option awards granted subsequent to 2001; for the year ended

December 31, 2010, this resulted in the U.S. GAAP expense being greater

than the Canadian GAAP expense by $2 million (2009 – $1 million).

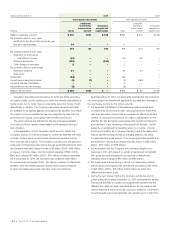

(c) Operating expenses –

Amortization of intangible assets

As TELUS’ intangible assets on acquisition have been recorded at their

fair value (see (a)), amortization of such assets, other than for those with

indefinite lives, needs to be included under U.S. GAAP; consistent with

prior years, amortization is calculated using the straight-line method.

(a) Merger of BC TELECOM and TELUS

The business combination between BC TELECOM and TELUS

Corporation (renamed TELUS Holdings Inc., which was wound up

June 1, 2001) was accounted for using the pooling of interests

method under Canadian GAAP. Under Canadian GAAP, the application

of the pooling of interests method of accounting for the merger of

BC TELECOM and TELUS Holdings Inc. resulted in a restatement of prior

periods as if the two companies had always been combined. Under U.S.

GAAP, the merger is accounted for using the purchase method.

Use of the purchase method resulted in TELUS (TELUS Holdings Inc.)

being acquired by BC TELECOM for $4,662 million (including merger

related costs of $52 million) effective January 31, 1999.

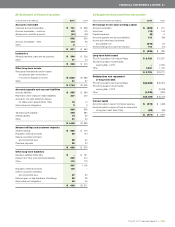

(b) Operating expenses – Operations

Future employee benefits: Under U.S. GAAP, TELUS’ future employee

benefit assets and obligations have been recorded at their fair values

on acquisition. Accounting for future employee benefits under Canadian

GAAP changed to become more consistent with U.S. GAAP effective

January 1, 2000. Canadian GAAP provides that the transitional balances

can be accounted for prospectively. Therefore, to conform to U.S. GAAP,

the amortization of the transitional amount needs to be removed from

the future employee benefit expense.

Unlike Canadian GAAP, U.S. GAAP requires the full recognition

of obligations associated with employee future benefit plans. Under

U.S. GAAP, the funded states of the Company’s plans are shown gross

on the consolidated statements of financial position and the difference

between the net funded plan states and the net accrued benefit assets

or liabilities are included as a component of accumulated other com-

prehensive income.

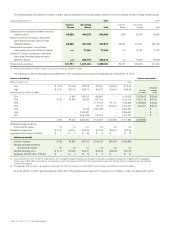

The incremental amounts recorded as intangible assets arising from the TELUS acquisition above are as follows:

Accumulated Net book value

As at December 31 (millions) Cost amortization 2010 2009

Intangible assets subject to amortization

Subscribers – wireline $ß1,950 $ 543 $ß1,407 $ß1,457

Intangible assets with indefinite lives

Spectrum licences(1) 1,833 1,833 – –

$ß3,783 $ß2,376 $ß1,407 $ß1,457

(1) Accumulated amortization of spectrum licences is amortization recorded prior to 2002 and the transitional impairment amount.