Duke Energy 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

PART II

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Duke Energy Corporation

Charlotte, North Carolina

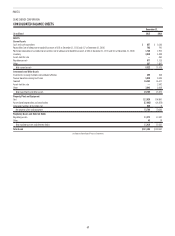

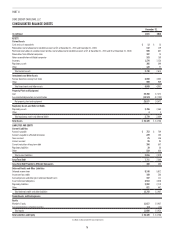

We have audited the accompanying consolidated balance sheets of Duke Energy Corporation and subsidiaries (the “Company”) as of December 31, 2015 and

2014, and the related consolidated statements of operations, comprehensive income, changes in equity, and cash flows for each of the three years in the period

ended December 31, 2015. We also have audited the Company’s internal control over financial reporting as of December 31, 2015, based on criteria established in

Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. The Company’s management is

responsible for these financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal

control over financial reporting, included in the accompanying Management’s Annual Report On Internal Control Over Financial Reporting. Our responsibility is to

express an opinion on these financial statements and an opinion on the Company’s internal control over financial reporting based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that

we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective

internal control over financial reporting was maintained in all material respects. Our audits of the financial statements included examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and

evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control

over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control

based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits

provide a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed by, or under the supervision of, the company’s principal executive and principal

financial officers, or persons performing similar functions, and effected by the company’s board of directors, management, and other personnel to provide reasonable

assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted

accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records

that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that

transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts

and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable

assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the

financial statements.

Because of the inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls,

material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the

internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that

the degree of compliance with the policies or procedures may deteriorate. In our opinion, the consolidated financial statements referred to above present fairly, in all

material respects, the financial position of Duke Energy Corporation and subsidiaries as of December 31, 2015 and 2014, and the results of their operations and their

cash flows for each of the three years in the period ended December 31, 2015, in conformity with accounting principles generally accepted in the United States of

America. Also, in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2015, based on

the criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

As discussed in Note 22 to the consolidated financial statements, Duke Energy Corporation and subsidiaries adopted ASU 2015-17, Income Taxes (Topic 740);

Balance Sheet Classification of Deferred Taxes effective December 31, 2015, on a prospective basis.

/s/ Deloitte & Touche LLP

Charlotte, North Carolina

February 25, 2016