Duke Energy 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

PART II

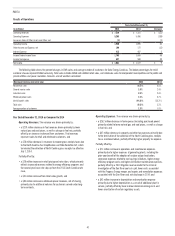

Results of Operations

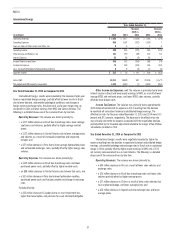

Years Ended December 31,

(in millions) 2015 2014 Variance

Operating Revenues $ 7,229 $ 7,351 $ (122)

Operating Expenses 5,268 5,456 (188)

Losses on Sales of Other Assets and Other, net (1) — (1)

Operating Income 1,960 1,895 65

Other Income and Expense, net 160 172 (12)

Interest Expense 412 407 5

Income Before Income Taxes 1,708 1,660 48

Income Tax Expense 627 588 39

Net Income $ 1,081 $ 1,072 $ 9

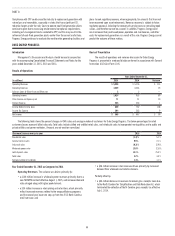

The following table shows the percent changes in GWh sales and average number of customers for Duke Energy Carolinas. The below percentages for retail

customer classes represent billed sales only. Total sales includes billed and unbilled retail sales, and wholesale sales to incorporated municipalities and to public and

private utilities and power marketers. Amounts are not weather normalized.

(Decrease) increase over prior year 2015 2014

Residential sales (0.2)% 4.0%

General service sales 1.0% 2.4%

Industrial sales 2.6% 2.4%

Wholesale power sales 1.5% 5.7%

Joint dispatch sales (44.8)% (25.7)%

Total sales (0.3)% 2.2%

Average number of customers 1.3% 1.0%

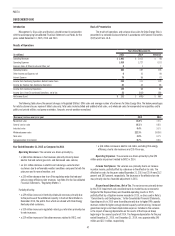

Year Ended December 31, 2015 as Compared to 2014

Operating Revenues. The variance was driven primarily by:

• a $219 million decrease in fuel revenues driven primarily by lower

natural gas and coal prices, as well as change in fuel mix, partially

offset by an increase in demand from customers. Fuel revenues

represent sales to retail and wholesale customers; and

• a $78 million decrease in revenues to recover gross receipts taxes due

to the North Carolina Tax Simplification and Rate Reduction Act, which

terminated the collection of North Carolina gross receipts tax effective

July 1, 2014.

Partially offset by:

• a $78 million increase in retail pricing and rate riders, which primarily

reflects increased revenues related to energy efficiency programs and

the second year base rate step-up from the 2013 South Carolina rate

case;

• a $51 million increase from retail sales growth; and

• a $40 million increase in wholesale power revenues, net of sharing,

primarily due to additional volumes for customers served under long-

term contracts.

Operating Expenses. The variance was driven primarily by:

• a $252 million decrease in fuel expense (including purchased power)

primarily related to lower natural gas and coal prices, as well as change

in fuel mix; and

• a $47 million decrease in property and other tax expenses primarily due

to the termination of the collection of the North Carolina gross receipts

tax as mentioned above, partially offset by higher property tax expense.

Partially offset by:

• a $71 million increase in operations and maintenance expenses

primarily due to higher expenses at generating plants, including the

prior-year benefit of the adoption of nuclear outage levelization,

severance expenses related to cost savings initiatives, higher energy

efficiency program costs and higher distribution maintenance expenses,

partially offset by a 2014 litigation reserve related to the criminal

investigation of the Dan River coal ash spill, lower costs associated

with the Progress Energy merger, and repairs and remediation expenses

associated with the Dan River coal ash discharge in 2014; and

• a $42 million increase in depreciation and amortization expense

primarily due to higher depreciation as a result of additional plant in

service, partially offset by lower nuclear decommissioning costs and

lower amortization of certain regulatory assets.