Duke Energy 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

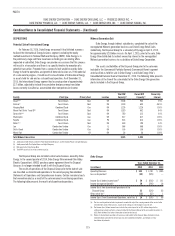

Combined Notes to Consolidated Financial Statements – (Continued)

Certain prior year amounts have been reclassified to conform to the

current year presentation.

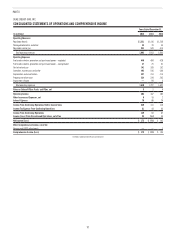

Other Current and Noncurrent Assets and Liabilities

The following table provides detail of amounts included in Other within

Current Assets or Current Liabilities on the Consolidated Balance Sheets.

December 31,

(in millions) Location 2015 2014

Duke Energy

Accrued compensation Current Liabilities $ 621 $ 638

Duke Energy Carolinas

Accrued compensation Current Liabilities $ 213 $ 216

Collateral liabilities Current Liabilities 141 128

Progress Energy

Income taxes receivable Current Assets $ 129 $ 718

Customer deposits Current Liabilities 373 360

Derivative liabilities Current Liabilities 201 271

Duke Energy Progress

Income taxes receivable Current Assets $ 111 $ 272

Customer deposits Current Liabilities 141 135

Accrued compensation Current Liabilities 108 116

Derivative liabilities Current Liabilities 76 108

Duke Energy Florida

Income taxes receivable Current Assets $ –– $ 177

Customer deposits Current Liabilities 232 225

Derivative liabilities Current Liabilities 125 163

Duke Energy Ohio

Income taxes receivable Current Assets $ 59 $ 40

Other receivable Current Assets 33 39

Accrued litigation reserve Current Liabilities 80 —

Collateral Liabilities Current Liabilities 48 42

Duke Energy Indiana

Income taxes receivable Current Assets $–– $ 98

Collateral liabilities Current Liabilities 44 43

The current portion of deferred tax assets is included within Other in

Current Assets at December 31, 2014. Due to the adoption of new accounting

guidance issued by the Financial Accounting Standards Board (FASB) related to

the balance sheet classification of deferred taxes, all deferred tax assets and

liabilities are classified as noncurrent at December 31, 2015. See Note 22 for

information related to the presentation of deferred tax assets and liabilities on

the Consolidated Balance Sheets.

Discontinued Operations

The results of operations of the nonregulated Midwest generation

business have been classified as Discontinued Operations on the Consolidated

Statements of Operations. Duke Energy has elected to present cash flows of

discontinued operations combined with cash flows of continuing operations.

Unless otherwise noted, the notes to these consolidated financial statements

exclude amounts related to discontinued operations for all periods presented,

assets held for sale and liabilities associated with assets held for sale as of

December 31, 2014. See Note 2 for additional information.

For the year ended December 31, 2015, Duke Energy’s Income from

Discontinued Operations, net of tax was primarily related to results of operations

of the nonregulated Midwest generation business and Duke Energy Retail Sales,

LLC (collectively, the Disposal Group) prior to its sale on April 2, 2015, partially

offset by a charge for a litigation reserve related to the Disposal Group. For

the year ended December 31, 2014, Duke Energy’s Loss from Discontinued

Operations, net of tax was primarily related to a write-down of the carrying

amount of the assets to the estimated fair value of the Disposal Group, based

on the transaction price included in the purchase sale agreement, and the

operations of the Disposal Group. For the years ended December 31, 2013, Duke

Energy’s Income From Discontinued Operations, net of tax was primarily related

to the operations of the Disposal Group. See Note 2 for additional information.

For the years ended December 31, 2015, 2014 and 2013, Progress

Energy’s (Loss) Income From Discontinued Operations, net of tax was primarily

due to tax impacts related to prior sales of diversified businesses.

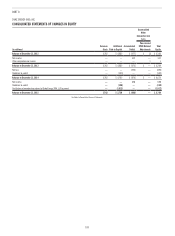

Amounts Attributable to Controlling Interests

For the year ended December 31, 2015, the amount of Income from

Discontinued Operations, net of tax presented on the Consolidated Statements

of Operations is fully attributable to controlling interests.

During 2014, Duke Energy and Progress Energy’s amount of Income

(Loss) from Discontinued Operations, net of tax presented on the Consolidated

Statements of Operations includes amounts attributable to noncontrolling

interest. The following table presents Net Income Attributable to Duke Energy

Corporation for continuing operations and discontinued operations for the years

ended December 31, 2014 and 2013.

Years ended December 31,

2014 2013

(in millions)

Duke

Energy

Progress

Energy

Duke

Energy

Progress

Energy

Income from Continuing Operations $ 2,465 $ 880 2,590 659

Income from Continuing Operations Attributable to Noncontrolling Interests 14 5 16 3

Income from Continuing Operations Attributable to Duke Energy Corporation $ 2,451 $ 875 $ 2,574 $ 656

(Loss) Income From Discontinued Operations, net of tax $ (576) $ (6) 86 16

Loss from Discontinued Operations Attributable to Noncontrolling Interests, net of tax (8) — (5) —

(Loss) Income From Discontinued Operations Attributable to Duke Energy Corporation, net of tax $ (568) $ (6) $ 91 $ 16

Net Income $ 1,889 $ 874 $ 2,676 $ 675

Net Income Attributable to Noncontrolling Interests 6 5 11 3

Net Income Attributable to Duke Energy Corporation $ 1,883 $ 869 $ 2,665 $ 672