Duke Energy 2015 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

151

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

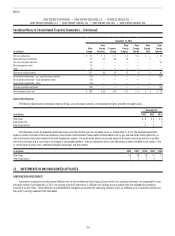

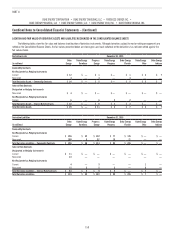

Combined Notes to Consolidated Financial Statements – (Continued)

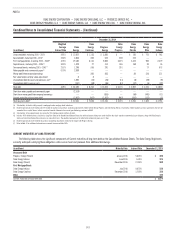

December 31, 2014

(in millions)

Estimated

Useful Life

(Years)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Land $ 1,459 $ 403 $ 704 $ 380 $ 324 $ 114 $ 108

Plant – Regulated

Electric generation, distribution and transmission 2 - 138 82,206 31,751 33,672 20,616 13,056 3,956 11,911

Natural gas transmission and distribution 12 - 67 2,230 — — — — 2,230 —

Other buildings and improvements 9 - 100 1,445 465 607 286 318 200 173

Plant – Nonregulated

Electric generation, distribution and transmission 1 - 30 2,380 — — — — — —

Other buildings and improvements 5 - 50 2,498 — — — — — —

Nuclear fuel 2,865 1,676 1,190 1,190 — — —

Equipment 3 - 34 1,762 341 506 388 118 330 166

Construction in process 4,519 2,081 1,215 908 307 97 481

Other 5 - 80 3,497 655 756 439 310 214 195

Total property, plant and equipment(a)(d) 104,861 37,372 38,650 24,207 14,433 7,141 13,034

Total accumulated depreciation – regulated(b)(c)(d) (32,628) (12,700) (13,506) (9,021) (4,478) (2,213) (4,219)

Total accumulated depreciation – nonregulated(c)(d) (2,196) — — — — — —

Generation facilities to be retired, net 9 — — — — 9 —

Total net property, plant and equipment $ 70,046 $ 24,672 $ 25,144 $15,186 $ 9,955 $ 4,937 $ 8,815

(a) Includes capitalized leases of $1,548 million, $40 million, $315 million, $146 million, $169 million, $98 million, and $30 million at Duke Energy, Duke Energy Carolinas, Progress Energy, Duke Energy Progress, Duke Energy

Florida, Duke Energy Ohio and Duke Energy Indiana, respectively, primarily within Plant – Regulated. The Progress Energy, Duke Energy Progress and Duke Energy Florida amounts are net of $72 million, $5 million and

$67 million, respectively, of accumulated amortization of capitalized leases.

(b) Includes $1,408 million, $847 million, $561 million and $561 million of accumulated amortization of nuclear fuel at Duke Energy, Duke Energy Carolinas, Progress Energy and Duke Energy Progress, respectively.

(c) Includes accumulated amortization of capitalized leases of $52 million, $8 million, $25 million and $6 million at Duke Energy, Duke Energy Carolinas, Duke Energy Ohio and Duke Energy Indiana, respectively.

(d) Includes gross property, plant and equipment cost of consolidated VIEs of $1,873 million and accumulated depreciation of consolidated VIEs of $257 million at Duke Energy.

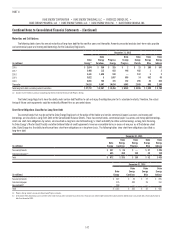

The following table presents capitalized interest, which includes the debt component of AFUDC.

Years Ended December 31,

(in millions) 2015 2014 2013

Duke Energy $98 $ 75 $ 89

Duke Energy Carolinas 38 38 41

Progress Energy 24 11 19

Duke Energy Progress 20 10 16

Duke Energy Florida 41 3

Duke Energy Ohio 10 10 11

Duke Energy Indiana 66 9

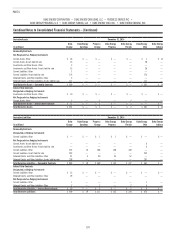

Operating Leases

Duke Energy’s Commercial Portfolio segment operates various renewable

energy projects and sells the generated output to utilities, electric cooperatives,

municipalities, and commercial and industrial customers through long-term

contracts. In certain situations, these long-term contracts and the associated

renewable energy projects qualify as operating leases. Rental income from

these leases is accounted for as Operating Revenues in the Consolidated

Statements of Operations. There are no minimum lease payments as all

payments are contingent based on actual electricity generated by the renewable

energy projects. Contingent lease payments were $172 million, $164 million

and $154 million for the years ended December 31, 2015, 2014 and 2013.

As of December 31, 2015, renewable energy projects owned by Duke Energy

and accounted for as operating leases had a cost basis of $2,455 million

and accumulated depreciation of $258 million. These assets are principally

classified as nonregulated electric generation and transmission assets.