Duke Energy 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

9

Nuclear

The industrial processes for producing nuclear generating fuel generally

involve the mining and milling of uranium ore to produce uranium concentrates,

and services to convert, enrich, and fabricate fuel assemblies.

Regulated Utilities has contracted for uranium materials and services

to fuel its nuclear reactors. Uranium concentrates, conversion services and

enrichment services are primarily met through a diversified portfolio of long-

term supply contracts. The contracts are diversified by supplier, country of origin

and pricing. Regulated Utilities staggers its contracting so that its portfolio of

long-term contracts covers the majority of its fuel requirements in the near

term and decreasing portions of its fuel requirements over time thereafter.

Near-term requirements not met by long-term supply contracts have been and

are expected to be fulfilled with spot market purchases. Due to the technical

complexities of changing suppliers of fuel fabrication services, Regulated

Utilities generally sources these services to a single domestic supplier on a

plant-by-plant basis using multiyear contracts.

Regulated Utilities has entered into fuel contracts that cover 100 percent

of its uranium concentrates, conversion services, and enrichment services

requirements through at least 2017 and cover fabrication services requirements

for these plants through at least 2019. For future requirements not already

covered under long-term contracts, Regulated Utilities believes it will be able to

renew contracts as they expire, or enter into similar contractual arrangements

with other suppliers of nuclear fuel materials and services.

Natural Gas and Oil

Natural gas and oil supply for Regulated Utilities’ generation fleet

is purchased under term and spot contracts from various suppliers. Duke

Energy Carolinas, Duke Energy Progress, Duke Energy Florida and Duke Energy

Indiana use derivative instruments to limit a portion of their exposure to

price fluctuations for natural gas. Regulated Utilities has certain dual-fuel

generating facilities that can operate with both natural gas and oil. The cost of

Regulated Utilities’ natural gas and oil is either at a fixed price or determined

by market prices as reported in certain industry publications. Regulated

Utilities believes it has access to an adequate supply of gas and oil for the

reasonably foreseeable future. Regulated Utilities’ natural gas transportation

for its gas generation is purchased under long-term firm transportation

contracts with interstate and intrastate pipelines. Regulated Utilities may

also purchase additional shorter-term transportation for its load requirements

during peak periods. The Regulated Utilities natural gas plants are served by

several supply zones and multiple pipelines.

Purchased Power

Regulated Utilities purchases a portion of its capacity and system

requirements through purchase obligations, leases and purchase contracts.

Regulated Utilities believes it can obtain adequate purchased power capacity

to meet future system load needs. However, during periods of high demand,

the price and availability of purchased power may be significantly affected.

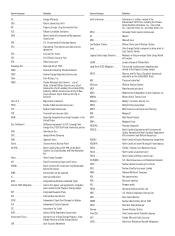

The following table summarizes purchased power the previous three years:

2015 2014 2013

Purchase obligations and leases (in millions of megawatt-hours (MWh))(a) 14.9 14.3 11.7

Purchases capacity under contract (in MW)(b) 4,573 4,500 3,800

(a) Represents approximately 5 percent of total system requirements for all years presented.

(b) These agreements include approximately 421 MW of firm capacity under contract by Duke Energy Florida with QFs.

Natural Gas for Retail Distribution

Regulated Utilities is responsible for the purchase and the subsequent

delivery of natural gas to retail customers in its Ohio and Kentucky service

territories. Regulated Utilities’ natural gas procurement strategy is to buy firm

natural gas supplies and firm interstate pipeline transportation capacity during

the winter season and during the non-heating season through a combination of

firm supply and transportation capacity along with spot supply and interruptible

transportation capacity. This strategy allows Regulated Utilities to assure

reliable natural gas supply for its non-curtailable customers during peak winter

conditions and provides Regulated Utilities the flexibility to reduce its contract

commitments if firm customers choose alternate gas. In 2015, firm supply

purchase commitment agreements provided approximately 71 percent of the

natural gas supply.

Inventory

Generation of electricity is capital intensive. Regulated Utilities must

maintain an adequate stock of fuel and materials and supplies in order to

ensure continuous operation of generating facilities and reliable delivery to

customers. As of December 31, 2015, the inventory balance for Regulated

Utilities was $3,702 million. For additional information on inventory see Note 1

to the Consolidated Financial Statements, “Summary of Significant Accounting

Policies.”

Ash Basin Management

On September 20, 2014, the North Carolina Coal Ash Management Act of

2014 (Coal Ash Act) became law and was amended on June 24, 2015, by the

Mountain Energy Act. The Coal Ash Act established a Coal Ash Management

Commission (Coal Ash Commission) to oversee handling of coal ash within the

state and requires closure of ash impoundments by no later than December 31,

2029 based on risk rankings, amongst other detailed requirements. The Coal

Ash Act leaves the decision on cost recovery determinations related to closure

of coal combustion residual (CCR) surface impoundments (ash basins or

impoundments) to the normal ratemaking processes before utility regulatory

commissions. Duke Energy has and will periodically submit to applicable

authorities required site-specific coal ash impoundment remediation or closure

plans. These plans and all associated permits must be approved before any work

can begin.

On April 17, 2015, the EPA published Resource Conservation and Recovery

Act (RCRA) in the Federal Register, establishing rules to regulate the disposal

of coal combustion residuals (CCR) from electric utilities as solid waste. The

RCRA, and the Coal Ash Act, as amended, finalized the legal framework related

to coal ash management practices and ash basin closure.

Duke Energy has advanced the strategy and implementation for the

remediation or closure of coal ash basins. In 2015, Duke Energy began activities

at certain sites within North Carolina specified as high risk by the Coal Ash Act

with coal ash moving off-site for use in structural fill or to lined landfills.