Duke Energy 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

PART II

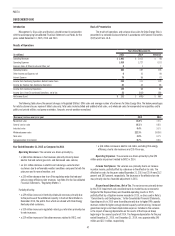

CASH FLOWS FROM OPERATING ACTIVITIES

The relatively stable operating cash flows of Regulated Utilities compose

a substantial portion of Duke Energy’s cash flows from operations. Regulated

Utilities’ cash flows from operations are primarily driven by sales of electricity

and natural gas and costs of operations. Weather conditions, working capital

and commodity price fluctuations, and unanticipated expenses including

unplanned plant outages, storms, and legal costs and related settlements can

affect the timing and level of cash flows from operations.

Duke Energy believes it has sufficient liquidity resources through the

commercial paper markets, and ultimately, the Master Credit Facility, to support

these operations. Cash flows from operations are subject to a number of other

factors, including, but not limited to, regulatory constraints, economic trends

and market volatility (see Item 1A, “Risk Factors,” for additional information).

At December 31, 2015, Duke Energy had cash and cash equivalents and

short-term investments of $857 million, of which approximately $534 million

is held by entities domiciled in foreign jurisdictions. In December 2014, Duke

Energy declared a taxable dividend of historical foreign earnings in the form of

notes payable that was expected to result in the repatriation of approximately

$2.7 billion of cash held and expected to be generated by International Energy

over a period of up to eight years. In 2015, approximately $1.5 billion was

remitted.

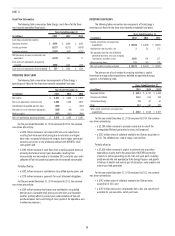

As of December 31, 2015, Duke Energy’s intention was to indefinitely

reinvest undistributed earnings generated by Duke Energy’s foreign subsidiaries.

As a result, no U.S. tax is recorded on such earnings of approximately

$250 million. The amount of unrecognized deferred tax liability related to

undistributed earnings was approximately $12 million. On February 18, 2016,

Duke Energy announced it had initiated a process to divest the International

Energy business segment, excluding the investment in NMC. See Note 2 for

further information. Accordingly, Duke Energy no longer intends to indefinitely

reinvest the undistributed foreign earnings of International Energy and will

therefore record U.S. taxes related to International Energy’s undistributed foreign

earnings during the first quarter of 2016.

Proceeds from the notes payable or from a successful sale of International

Energy will principally be used to fund the operations and growth of its domestic

businesses.

DEBT ISSUANCES

Depending on availability based on the issuing entity, the credit rating of

the issuing entity, and market conditions, the Subsidiary Registrants prefer to

issue first mortgage bonds and secured debt, followed by unsecured debt. This

preference is the result of generally higher credit ratings for first mortgage bonds

and secured debt, which typically result in lower interest costs. Duke Energy

Corporation primarily issues unsecured debt.

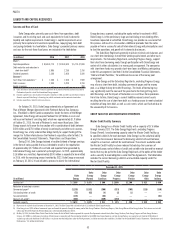

Duke Energy’s capitalization is balanced between debt and equity as

shown in the table below.

Projected 2016 Actual 2015 Actual 2014

Equity 47% 48% 49%

Debt 53% 52% 51%

Duke Energy’s fixed charges coverage ratio, calculated using SEC

guidelines, was 3.2 times for 2015, 3.2 times for 2014, and 3.0 times for 2013.

Restrictive Debt Covenants

Duke Energy’s debt and credit agreements contain various financial and

other covenants. The Master Credit Facility contains a covenant requiring the

debt-to-total capitalization ratio to not exceed 65 percent for each borrower.

Failure to meet those covenants beyond applicable grace periods could result

in accelerated due dates and/or termination of the agreements or sublimits

thereto. As of December 31, 2015, Duke Energy was in compliance with all

covenants related to its debt agreements. In addition, some credit agreements

may allow for acceleration of payments or termination of the agreements due

to nonpayment, or to the acceleration of other significant indebtedness of the

borrower or some of its subsidiaries. None of the debt or credit agreements

contain material adverse change clauses.

Credit Ratings

The Duke Energy Registrants each hold credit ratings by Fitch Ratings,

Inc. (Fitch), Moody’s Investors Service, Inc. (Moody’s) and Standard & Poor’s

Rating Services (S&P). The following table includes Duke Energy and certain

subsidiaries’ credit ratings and ratings outlook as of February 2016.

Fitch Moody’s S&P

Duke Energy Corporation Watch-N Negative Negative

Issuer Credit Rating BBB+ Baa1 A-

Senior Unsecured Debt BBB+ Baa1 BBB+

Commercial Paper F-2 P-2 A-2

Duke Energy Carolinas Stable Stable Negative

Senior Secured Debt AA- Aa2 A

Senior Unsecured Debt A+ A1 A-

Progress Energy Stable Stable Negative

Senior Unsecured Debt BBB Baa2 BBB+

Duke Energy Progress Stable Stable Negative

Issuer Credit Rating A- A2 A-

Senior Secured Debt A+ Aa3 A

Duke Energy Florida Stable Stable Negative

Senior Secured Debt A A1 A

Senior Unsecured Debt A- A3 A-

Duke Energy Ohio Stable Stable Negative

Senior Secured Debt A A2 A

Senior Unsecured Debt A- Baa1 A-

Duke Energy Indiana Positive Stable Negative

Senior Secured Debt A Aa3 A

Senior Unsecured Debt A- A2 A-

Credit ratings are intended to provide credit lenders a framework for

comparing the credit quality of securities and are not a recommendation to buy,

sell or hold. The Duke Energy Registrants’ credit ratings are dependent on the

rating agencies’ assessments of their ability to meet their debt principal and

interest obligations when they come due. If, as a result of market conditions

or other factors, the Duke Energy Registrants are unable to maintain current

balance sheet strength, or if earnings and cash flow outlook materially

deteriorates, credit ratings could be negatively impacted.