Duke Energy 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

PART II

are primarily held to hedge the pension liability. Hedge funds, real estate and

other global securities are held for diversification. Investments within asset

classes are diversified to achieve broad market participation and reduce the

impact of individual managers on investments. In 2013, Duke Energy adopted

a de-risking investment strategy for its pension assets. As the funded status of

the plans increase, over time the targeted allocation to return seeking assets will

be reduced and the targeted allocation to fixed-income assets will be increased

to better manage Duke Energy’s pension liability and reduced funded status

volatility. Effective January 1, 2016, based on the current funded status of the

plans, the asset allocation for the Duke Energy pension plans has been adjusted

to 63 percent fixed-income assets and 37 percent return-seeking assets. Duke

Energy regularly reviews its actual asset allocation and periodically rebalances

its investments to the targeted allocations when considered appropriate.

The assets for Duke Energy’s pension and other post-retirement plans are

maintained in a master trust. Duke Energy also invests other post-retirement

assets in the Duke Energy Corporation Employee Benefits Trust (VEBA I). The

investment objective of VEBA I is to achieve sufficient returns, subject to a

prudent level of portfolio risk, for the purpose of promoting the security of plan

benefits for participants. VEBA I is passively managed.

Duke Energy discounted its future U.S. pension and other post-retirement

obligations using a rate of 4.4 percent as of December 31, 2015. Discount rates

used to measure benefit plan obligations for financial reporting purposes reflect

rates at which pension benefits could be effectively settled. As of December 31,

2015, Duke Energy determined its discount rate for U.S. pension and other

post-retirement obligations using a bond selection-settlement portfolio

approach. This approach develops a discount rate by selecting a portfolio of high

quality corporate bonds that generate sufficient cash flow to match the timing

of projected benefit payments. The selected bond portfolio is derived from a

universe of non-callable corporate bonds rated Aa quality or higher. After the

bond portfolio is selected, a single interest rate is determined that equates the

present value of the plan’s projected benefit payments discounted at this rate

with the market value of the bonds selected.

Future changes in plan asset returns, assumed discount rates and

various other factors related to the participants in Duke Energy’s pension and

post-retirement plans will impact future pension expense and liabilities. Duke

Energy cannot predict with certainty what these factors will be in the future. The

following table presents the approximate effect on Duke Energy’s 2015 pretax

pension expense, pretax other post-retirement expense, pension obligation and

other post-retirement benefit obligation if a 0.25 percent change in rates were

to occur.

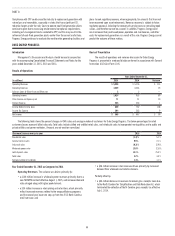

Qualified and Non-

Qualified Pension Plans Other Post-Retirement Plans

(in millions) 0.25% (0.25)% 0.25% (0.25 )%

Effect on 2015 pretax pension and other post-retirement expense

Expected long-term rate of return $ (20) $ 20 $ (1) $ 1

Discount rate (14) 13 (1) 1

Effect on pension and other post-retirement benefit obligation at December 31, 2015

Discount rate (200) 206 (17) 17

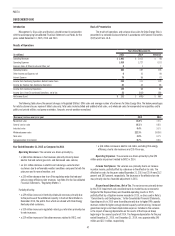

Duke Energy’s U.S. other post-retirement plan uses a health care trend rate covering both pre- and post-age 65 retired plan participants, which is comprised

of a medical care trend rate, which reflects the near- and long-term expectation of increases in medical costs, and a prescription drug trend rate, which reflects the

near and long-term expectation of increases in prescription drug costs. As of December 31, 2015, the health care trend rate was 7.5 percent, trending down to 4.75

percent by 2023. The following table presents the approximate effect on Duke Energy’s 2015 pretax other post-retirement expense and other post-retirement benefit

obligation if a 1 percentage point change in the health care trend rate were to occur.

Other Post-Retirement Plans

(in millions) 1% (1)%

Effect on 2015 other post-retirement expense $ 7 $ (6)

Effect on other post-retirement benefit obligation at December 31, 2015 29 (26)

For further information, see Note 21 to the Consolidated Financial Statements, “Employee Benefit Plans.”