Duke Energy 2015 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

203

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

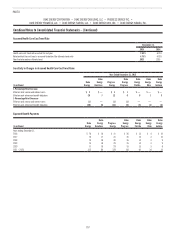

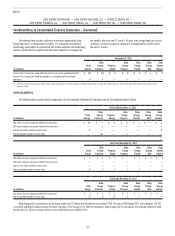

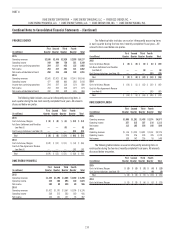

Statutory Rate Reconciliation

The following tables present a reconciliation of income tax expense at the U.S. federal statutory tax rate to the actual tax expense from continuing operations.

Year Ended December 31, 2015

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Income tax expense, computed at the statutory rate of 35 percent $ 1,448 $ 598 $ 555 $ 302 $ 330 $ 81 $ 168

State income tax, net of federal income tax effect 109 46 18 15 33 2 2

Tax differential on foreign earnings (27) — — — — — —

AFUDC equity income (58) (34) (19) (17) (3) (1) (4)

Renewable energy production tax credits (72) — (1) — — — —

Audit adjustment (22) — (23) 1 (24) — —

Tax true-up 2 2 (3) (4) 2 (5) (9)

Other items, net (54) 15 (5) (3) 4 4 6

Income tax expense from continuing operations $ 1,326 $ 627 $ 522 $ 294 $ 342 $ 81 $ 163

Effective tax rate 32.1% 36.7% 32.9% 34.2% 36.3% 35.2% 34.0%

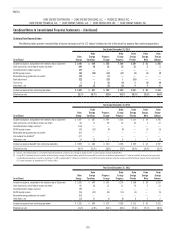

Year Ended December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Income tax expense, computed at the statutory rate of 35 percent $ 1,447 $ 581 $ 497 $ 263 $ 314 $ 39 $ 195

State income tax, net of federal income tax effect 59 17 49 25 34 3 10

Tax differential on foreign earnings(a) (110) — — — — — —

AFUDC equity income (47) (32) (9) (9) — (1) (5)

Renewable energy production tax credits (67) — — — — — —

International tax dividend(b) 373 — — — — — —

Other items, net 14 22 3 6 1 2 (3)

Income tax expense (benefit) from continuing operations $ 1,669 $ 588 $ 540 $ 285 $ 349 $ 43 $ 197

Effective tax rate 40.4% 35.4% 38.0% 37.9% 38.9% 38.9% 35.5%

(a) Includes a $57 million benefit as a result of the merger of two Chilean subsidiaries and a change in income tax rates in various countries primarily relating to Peru.

(b) During 2014, Duke Energy declared a taxable dividend of foreign earnings in the form of notes payable that was expected to result in the repatriation of approximately $2.7 billion of cash held, and expected to be generated,

by International Energy over a period of up to eight years. In 2015, approximately $1.5 billion was remitted. As a result of the decision to repatriate cumulative historical undistributed foreign earnings Duke Energy recorded

U.S. income tax expense of approximately $373 million in 2014.

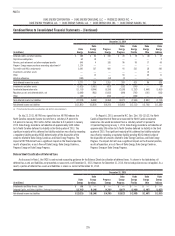

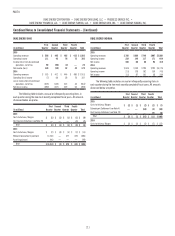

Year Ended December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Income tax expense, computed at the statutory rate of 35 percent $ 1,328 $ 549 $ 361 $ 276 $ 188 $ 39 $ 203

State income tax, net of federal income tax effect 66 56 31 31 20 2 23

Tax differential on foreign earnings (49) — — — — — —

AFUDC equity income (55) (32) (18) (15) (3) — (5)

Renewable energy production tax credits (62) — — — — — —

Other items, net (23) 21 (1) (4) 8 2 2

Income tax expense from continuing operations $ 1,205 $ 594 $ 373 $ 288 $ 213 $ 43 $ 223

Effective tax rate 31.8% 37.8% 36.2% 36.5% 39.6% 39.1% 38.4%