Duke Energy 2015 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

198

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

PLAN ASSETS

Description and Allocations

Duke Energy Master Retirement Trust

Assets for both the qualified pension and other post-retirement benefits

are maintained in the Duke Energy Master Retirement Trust. Approximately 98

percent of the Duke Energy Master Retirement Trust assets were allocated to

qualified pension plans and approximately 2 percent were allocated to other

post-retirement plans, as of December 31, 2015 and 2014. The investment

objective of the Duke Energy Master Retirement Trust is to achieve reasonable

returns, subject to a prudent level of portfolio risk, for the purpose of enhancing

the security of benefits for plan participants.

As of December 31, 2015, Duke Energy assumes pension and other

post-retirement plan assets will generate a long-term rate of return of 6.50

percent. The expected long-term rate of return was developed using a weighted

average calculation of expected returns based primarily on future expected

returns across asset classes considering the use of active asset managers,

where applicable. The asset allocation targets were set after considering the

investment objective and the risk profile. Equity securities are held for their

higher expected return. Debt securities are primarily held to hedge the qualified

pension plan liability. Hedge funds, real estate and other global securities

are held for diversification. Investments within asset classes are diversified

to achieve broad market participation and reduce the impact of individual

managers or investments.

In 2013, Duke Energy adopted a de-risking investment strategy for the

Duke Energy Master Retirement Trust. As the funded status of the pension

plans increase, the targeted allocation to return seeking assets will be reduced

and the targeted allocation to fixed-income assets will be increased to better

manage Duke Energy’s pension liability and reduce funded status volatility. Duke

Energy regularly reviews its actual asset allocation and periodically rebalances

its investments to the targeted allocation when considered appropriate.

The Duke Energy Retirement Master Trust is authorized to engage in the

lending of certain plan assets. Securities lending is an investment management

enhancement that utilizes certain existing securities of the Duke Energy

Retirement Master Trust to earn additional income. Securities lending involves

the loaning of securities to approved parties. In return for the loaned securities,

the Duke Energy Retirement Master Trust receives collateral in the form of cash

and securities as a safeguard against possible default of any borrower on the

return of the loan under terms that permit the Duke Energy Retirement Master

Trust to sell the securities. The Master Trust mitigates credit risk associated with

securities lending arrangements by monitoring the fair value of the securities

loaned, with additional collateral obtained or refunded as necessary. The fair

value of securities on loan was approximately $305 million and $383 million

at December 31, 2015 and 2014, respectively. Cash and securities obtained

as collateral exceeded the fair value of the securities loaned at December 31,

2015 and 2014, respectively. Securities lending income earned by the Master

Trust was immaterial for the years ended December 31, 2015, 2014 and 2013,

respectively.

Qualified pension and other post-retirement benefits for the Subsidiary

Registrants are derived from the Duke Energy Master Retirement Trust, as such,

each are allocated their proportionate share of the assets discussed below.

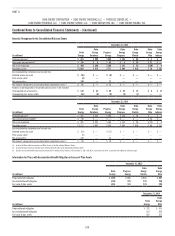

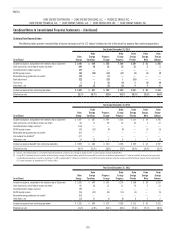

The following table includes the target asset allocations by asset class at December 31, 2015 and the actual asset allocations for the Duke Energy Master

Retirement Trust.

Target

Allocation

Actual Allocation at December 31,

2015 2014

U.S. equity securities 10% 11% 10%

Non-U.S. equity securities 8% 8% 8%

Global equity securities 10% 10% 10%

Global private equity securities 3% 2% 3%

Debt securities 63% 63% 63%

Hedge funds 2% 2% 3%

Real estate and cash 2% 2% 1%

Other global securities 2% 2% 2%

Total 100% 100% 100%

VEBA I

Duke Energy also invests other post-retirement assets in the Duke Energy Corporation Employee Benefits Trust (VEBA I). The investment objective of VEBA I is

to achieve sufficient returns, subject to a prudent level of portfolio risk, for the purpose of promoting the security of plan benefits for participants. VEBA I is passively

managed.

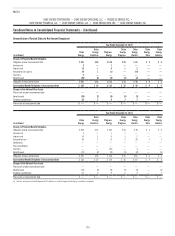

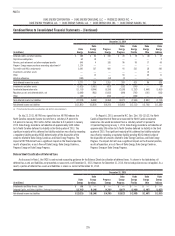

The following table presents target and actual asset allocations for VEBA I at December 31, 2015.

Target

Allocation

Actual Allocation at December 31,

2015 2014

U.S. equity securities 30% 29% 29%

Debt securities 45% 28% 28%

Cash 25% 43% 43%

Total 100% 100% 100%