Duke Energy 2015 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

162

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

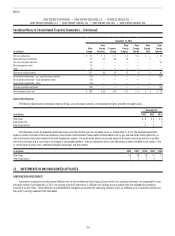

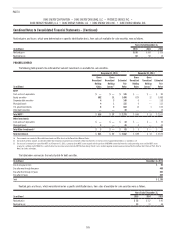

OBJECTIVE CREDIT CONTINGENT FEATURES

Certain derivative contracts contain objective credit contingent features. These features include the requirement to post cash collateral or letters of credit if

specific events occur, such as a credit rating downgrade below investment grade. The following tables show information with respect to derivative contracts that are

in a net liability position and contain objective credit-risk-related payment provisions. Amounts for Duke Energy Indiana were not material.

December 31, 2015

(in millions)

Duke

Energy

Duke Energy

Carolinas

Progress

Energy

Duke Energy

Progress

Duke Energy

Florida

Duke Energy

Ohio

Aggregate fair value of derivatives in a net liability position $ 334 $ 45 $ 290 $ 93 $ 194 $ —

Fair value of collateral already posted 30 — 30 — 30 —

Additional cash collateral or letters of credit in the event credit-risk-related

contingent features were triggered 304 45 260 93 164 —

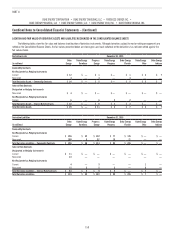

December 31, 2014

(in millions)

Duke

Energy

Duke Energy

Carolinas

Progress

Energy

Duke Energy

Progress

Duke Energy

Florida

Duke Energy

Ohio(a)

Aggregate fair value of derivatives in a net liability position $ 845 $ 19 $ 370 $ 131 $ 239 $ 456

Fair value of collateral already posted 209 — 23 — 23 186

Additional cash collateral or letters of credit in the event credit-risk-related

contingent features were triggered 407 19 347 131 216 41

(a) Duke Energy Ohio includes amounts related to the Disposal Group for the year ended December 31, 2014.

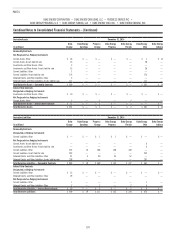

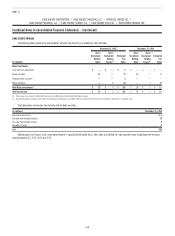

The Duke Energy Registrants have elected to offset cash collateral and fair

values of derivatives. For amounts to be netted, the derivative must be executed

with the same counterparty under the same master netting arrangement.

Amounts disclosed below represent the receivables related to the right to

reclaim cash collateral under master netting arrangements.

December 31, 2015 December 31, 2014

(in millions) Receivables Receivables

Duke Energy

Amounts offset against net derivative

positions

$ 30 $ 145

Amounts not offset against net derivative

positions

— 64

Progress Energy

Amounts offset against net derivative

positions

30 23

Duke Energy Florida

Amounts offset against net derivative

positions

30 23

Duke Energy Ohio

Amounts offset against net derivative

positions

— 122

Amounts not offset against net derivative

positions

— 64

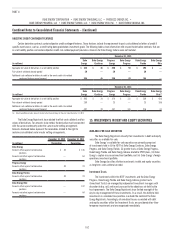

15. INVESTMENTS IN DEBT AND EQUITY SECURITIES

AVAILABLE-FOR-SALE SECURITIES

The Duke Energy Registrants classify their investments in debt and equity

securities as available-for-sale.

Duke Energy’s available-for-sale securities are primarily comprised

of investments held in (i) the NDTF at Duke Energy Carolinas, Duke Energy

Progress and Duke Energy Florida, (ii) grantor trusts at Duke Energy Progress,

Duke Energy Florida and Duke Energy Indiana related to OPEB plans, (iii) Duke

Energy’s captive insurance investment portfolio, and (iv) Duke Energy’s foreign

operations investment portfolio.

Duke Energy classifies all other investments in debt and equity securities

as long term, unless otherwise noted.

Investment Trusts

The investments within the NDTF investments and the Duke Energy

Progress, Duke Energy Florida and Duke Energy Indiana grantor trusts

(Investment Trusts) are managed by independent investment managers with

discretion to buy, sell, and invest pursuant to the objectives set forth by the

trust agreements. The Duke Energy Registrants have limited oversight of the

day-to-day management of these investments. As a result, the ability to hold

investments in unrealized loss positions is outside the control of the Duke

Energy Registrants. Accordingly, all unrealized losses associated with debt

and equity securities within the Investment Trusts are considered other-than-

temporary impairments and are recognized immediately.