Duke Energy 2015 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

East Bend Station

On December 30, 2014, Duke Energy Ohio acquired The Dayton Power

and Light Company’s (DP&L) 31 percent interest in the jointly owned East Bend

Station for approximately $12.4 million. The purchase price, in accordance with

FERC guidelines, was reflected with the net purchase amount as an increase to

property, plant and equipment as of December 31, 2014 and with the DP&L’s

historical original cost as an increase to property, plant and equipment and

accumulated depreciation as of December 31, 2015. On August 20, 2015,

the KPSC approved Duke Energy Kentucky’s application to use the purchase

price as the value of the newly acquired interest in the East Bend Station for

depreciation purposes and ratemaking.

2014 Electric Security Plan (ESP)

In April 2015, the PUCO modified and approved Duke Energy Ohio’s

proposed ESP, with a three-year term and an effective date of June 1, 2015. The

PUCO approved a competitive procurement process for SSO load, a distribution

capital investment rider and a tracking mechanism for incremental distribution

expenses caused by major storms. The PUCO order also approved a placeholder

tariff for a price stabilization rider, but denied Duke Energy Ohio’s specific

request to include Duke Energy Ohio’s entitlement to generation from OVEC in

the rider at this time; however, the order allows Duke Energy Ohio to submit

additional information to request recovery in the future. On May 4, 2015, Duke

Energy Ohio filed an application for rehearing requesting the PUCO to modify

or amend certain aspects of the order. On May 28, 2015, the PUCO granted all

applications for rehearing filed in the case for future consideration. Duke Energy

Ohio cannot predict the outcome of the appeals in this matter.

During May and November 2015, Duke Energy Ohio completed two

competitive bidding processes with results approved by the PUCO to procure a

portion of the supply for its SSO load for the term of the ESP.

2012 Natural Gas Rate Case

On November 13, 2013, the PUCO issued an order approving a settlement

among Duke Energy Ohio, the PUCO Staff and intervening parties (the Gas

Settlement). The Gas Settlement provided for (i) no increase in base rates

for natural gas distribution service and (ii) a return on equity of 9.84 percent.

The Gas Settlement provided for a subsequent hearing on Duke Energy Ohio’s

request for rider recovery of environmental remediation costs associated with

its former MGP sites. The PUCO authorized Duke Energy Ohio to recover $56

million excluding carrying costs, of environmental remediation costs. The MGP

rider became effective in April 2014 for a five-year period. On March 31, 2014,

Duke Energy Ohio filed an application with the PUCO to adjust the MGP rider for

investigation and remediation costs incurred in 2013.

Certain consumer groups appealed the PUCO’s decision authorizing

the MGP rider to the Ohio Supreme Court and asked the court to stay

implementation of the PUCO’s order and collections under the MGP rider

pending their appeal. The Ohio Supreme Court granted the motion to stay

and subsequently required the posting of a bond to effectuate the stay. When

the bond was not posted, the PUCO approved Duke Energy Ohio’s request, in

January 2015, to reinstate collections under the MGP rider and Duke Energy

Ohio resumed billings. Amounts collected prior to the suspension of the rider

were immaterial. On March 31, 2015, Duke Energy Ohio filed an application to

adjust the MGP rider to recover remediation costs incurred in 2014. Duke Energy

Ohio cannot predict the outcome of the appeal of this matter.

Regional Transmission Organization (RTO) Realignment

Duke Energy Ohio, including Duke Energy Kentucky, transferred control of

its transmission assets from MISO to PJM Interconnection, LLC (PJM), effective

December 31, 2011.

On December 22, 2010, the KPSC approved Duke Energy Kentucky’s

request to effect the RTO realignment, subject to a commitment not to seek

double recovery in a future rate case of the transmission expansion fees that

may be charged by MISO and PJM in the same period or overlapping periods.

On May 25, 2011, the PUCO approved a settlement between Duke

Energy Ohio, Ohio Energy Group, the Office of Ohio Consumers’ Counsel and

the PUCO Staff related to Duke Energy Ohio’s recovery of certain costs of the

RTO realignment via a non-bypassable rider. Duke Energy Ohio is allowed to

recover all MISO Transmission Expansion Planning (MTEP) costs, including but

not limited to Multi Value Project (MVP) costs, directly or indirectly charged to

Ohio customers. Duke Energy Ohio also agreed to vigorously defend against any

charges for MVP projects from MISO.

Upon its exit from MISO on December 31, 2011, Duke Energy Ohio

recorded a liability for its exit obligation and share of MTEP costs, excluding

MVP. This liability was recorded within Other in Current liabilities and Other

in Deferred credits and other liabilities on Duke Energy Ohio’s Consolidated

Balance Sheets.

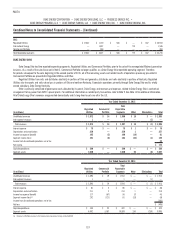

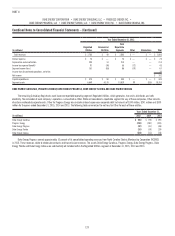

The following table provides a reconciliation of the beginning and ending

balance of Duke Energy Ohio’s recorded obligations related to its withdrawal

from MISO. As of December 31, 2015, $72 million is recorded as a Regulatory

asset on Duke Energy Ohio’s Consolidated Balance Sheets.

(in millions)

December 31,

2014

Provision /

Adjustments

Cash

Reductions

December 31,

2015

Duke Energy Ohio $ 94 $ 3 $ (5) $ 92

MVP. MISO approved 17 MVP proposals prior to Duke Energy Ohio’s exit

from MISO on December 31, 2011. Construction of these projects is expected

to continue through 2020. Costs of these projects, including operating and

maintenance costs, property and income taxes, depreciation and an allowed

return, are allocated and billed to MISO transmission owners.

On December 29, 2011, MISO filed a tariff with the FERC providing for

the allocation of MVP costs to a withdrawing owner based on monthly energy

usage. The FERC set for hearing (i) whether MISO’s proposed cost allocation

methodology to transmission owners who withdrew from MISO prior to

January 1, 2012 is consistent with the tariff at the time of their withdrawal

from MISO and, (ii) if not, what the amount of and methodology for calculating

any MVP cost responsibility should be. In 2012, MISO estimated Duke Energy

Ohio’s MVP obligation over the period from 2012 to 2071 at $2.7 billion, on an

undiscounted basis. On July 16, 2013, a FERC Administrative Law Judge (ALJ)

issued an initial decision. Under this initial decision, Duke Energy Ohio would

be liable for MVP costs. Duke Energy Ohio filed exceptions to the initial decision,

requesting FERC to overturn the ALJ’s decision.

On October 29, 2015, the FERC issued an order reversing the ALJ’s

decision. The FERC ruled the cost allocation methodology is not consistent

with the MISO tariff and that Duke Energy Ohio has no liability for MVP costs

after its withdrawal from MISO. On November 30, 2015, MISO filed with the

FERC a request for rehearing. Duke Energy Ohio cannot predict the outcome of

this matter.