Duke Energy 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

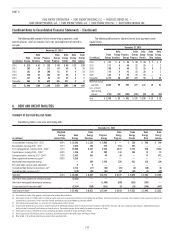

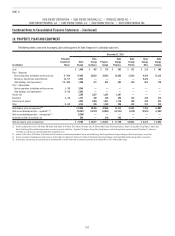

Combined Notes to Consolidated Financial Statements – (Continued)

Money pool receivable balances are reflected within Notes receivable

from affiliated companies on the Subsidiary Registrants’ Consolidated Balance

Sheets. Money pool payable balances are reflected within either Notes payable

to affiliated companies or Long-Term Debt Payable to Affiliated Companies on

the Subsidiary Registrants’ Consolidated Balance Sheets.

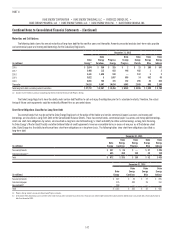

Restrictive Debt Covenants

The Duke Energy Registrants’ debt and credit agreements contain various

financial and other covenants. The Master Credit Facility contains a covenant

requiring the debt-to-total capitalization ratio to not exceed 65 percent for each

borrower. Failure to meet those covenants beyond applicable grace periods

could result in accelerated due dates and/or termination of the agreements.

As of December 31, 2015, each of the Duke Energy Registrants were in

compliance with all covenants related to their debt agreements. In addition,

some credit agreements may allow for acceleration of payments or termination

of the agreements due to nonpayment, or acceleration of other significant

indebtedness of the borrower or some of its subsidiaries. None of the debt or

credit agreements contain material adverse change clauses.

Other Loans

As of December 31, 2015 and 2014, Duke Energy had loans outstanding

of $629 million, including $41 million at Duke Energy Progress and $603 million,

including $44 million at Duke Energy Progress, respectively, against the cash

surrender value of life insurance policies it owns on the lives of its executives.

The amounts outstanding were carried as a reduction of the related cash

surrender value that is included in Other within Investments and Other Assets

on the Consolidated Balance Sheets.

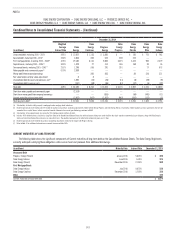

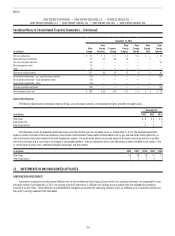

7. GUARANTEES AND INDEMNIFICATIONS

Duke Energy and Progress Energy have various financial and performance

guarantees and indemnifications, which are issued in the normal course of

business. As discussed below, these contracts include performance guarantees,

stand-by letters of credit, debt guarantees, surety bonds and indemnifications.

Duke Energy and Progress Energy enter into these arrangements to facilitate

commercial transactions with third parties by enhancing the value of the

transaction to the third party. At December 31, 2015, Duke Energy and Progress

Energy do not believe conditions are likely for significant performance under

these guarantees. To the extent liabilities are incurred as a result of the activities

covered by the guarantees, such liabilities are included on the accompanying

Consolidated Balance Sheets.

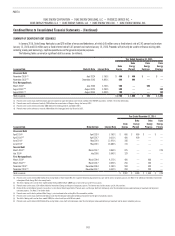

On January 2, 2007, Duke Energy completed the spin-off of its natural gas

businesses to shareholders. Guarantees issued by Duke Energy or its affiliates,

or assigned to Duke Energy prior to the spin-off, remained with Duke Energy

subsequent to the spin-off. Guarantees issued by Spectra Energy Capital,

LLC, formerly known as Duke Capital LLC, (Spectra Capital) or its affiliates

prior to the spin-off remained with Spectra Capital subsequent to the spin-off,

except for guarantees that were later assigned to Duke Energy. Duke Energy

has indemnified Spectra Capital against any losses incurred under certain of

the guarantee obligations that remain with Spectra Capital. At December 31,

2015, the maximum potential amount of future payments associated with these

guarantees was $205 million, the majority of which expires by 2028.

Duke Energy has issued performance guarantees to customers and other

third parties that guarantee the payment and performance of other parties,

including certain non-wholly owned entities, as well as guarantees of debt of

certain non-consolidated entities and less than wholly owned consolidated

entities. If such entities were to default on payments or performance, Duke

Energy would be required under the guarantees to make payments on the

obligations of the less than wholly owned entity. The maximum potential amount

of future payments required under these guarantees as of December 31, 2015,

was $253 million. Of this amount, $15 million relates to guarantees issued

on behalf of less than wholly owned consolidated entities, with the remainder

related to guarantees issued on behalf of third parties and unconsolidated

affiliates of Duke Energy. Of the guarantees noted above, $112 million of the

guarantees expire between 2016 and 2033, with the remaining performance

guarantees having no contractual expiration.

Duke Energy has guaranteed certain issuers of surety bonds, obligating

itself to make payment upon the failure of a wholly owned and former non-

wholly owned entity to honor its obligations to a third party. Under these

arrangements, Duke Energy has payment obligations that are triggered by a

draw by the third party or customer due to the failure of the wholly owned

or former non-wholly owned entity to perform according to the terms of its

underlying contract. At December 31, 2015, Duke Energy had guaranteed

$47 million of outstanding surety bonds, most of which have no set expiration.

Duke Energy uses bank-issued stand-by letters of credit to secure the

performance of wholly owned and non-wholly owned entities to a third party or

customer. Under these arrangements, Duke Energy has payment obligations to

the issuing bank which are triggered by a draw by the third party or customer

due to the failure of the wholly owned or non-wholly owned entity to perform

according to the terms of its underlying contract. At December 31, 2015, Duke

Energy had issued a total of $427 million in letters of credit, which expire

between 2016 and 2020. The unused amount under these letters of credit was

$58 million.

Duke Energy and Progress Energy have issued indemnifications

for certain asset performance, legal, tax and environmental matters to

third parties, including indemnifications made in connection with sales of

businesses. At December 31, 2015, the estimated maximum exposure for these

indemnifications was $97 million, the majority of which expires in 2017. Of this

amount, $7 million has no contractual expiration. For certain matters for which

Progress Energy receives timely notice, indemnity obligations may extend beyond

the notice period. Certain indemnifications related to discontinued operations

have no limitations as to time or maximum potential future payments.