Duke Energy 2015 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

183

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

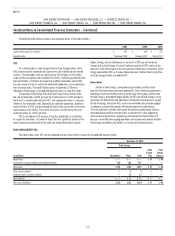

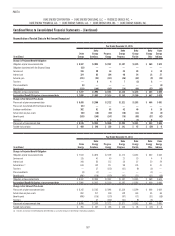

The table below presents the severance liability for past and ongoing severance plans including the plans described above. Amounts for Duke Energy Indiana

and Duke Energy Ohio are not material.

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Balance at December 31, 2014 $ 28 $ 2 $ 18 $ 1 $ 17

Provision/Adjustments 144 80 20 20 —

Cash Reductions (36) (4) (15) (2) (13)

Balance at December 31, 2015 $ 136 $ 78 $ 23 $ 19 $ 4

20. STOCK-BASED COMPENSATION

The Duke Energy Corporation 2015 Long-Term Incentive Plan (the

2015 Plan) provides for the grant of stock-based compensation awards to

employees and outside directors. The 2015 Plan reserves 10 million shares of

common stock for issuance. Duke Energy has historically issued new shares

upon exercising or vesting of share-based awards. However, Duke Energy may

use a combination of new share issuances and open market repurchases for

share-based awards that are exercised or vest in the future. Duke Energy has

not determined with certainty the amount of such new share issuances or open

market repurchases.

The 2015 Plan supersedes the 2010 Long-Term Incentive Plan, as

amended (the 2010 Plan), and the Progress Energy, Inc. 2007 Equity Incentive

Plan (the Progress Plan). No additional grants will be made from the 2010 Plan

and Progress Plan.

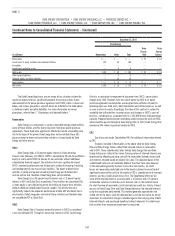

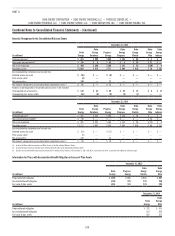

The following table summarizes the total expense recognized by the Duke

Energy Registrants, net of tax, for stock-based compensation.

Years Ended December 31,

(in millions) 2015 2014 2013

Duke Energy $ 38 $ 38 $ 52

Duke Energy Carolinas 14 12 13

Progress Energy 14 14 23

Duke Energy Progress 99 14

Duke Energy Florida 55 9

Duke Energy Ohio 25 4

Duke Energy Indiana 43 4

Duke Energy’s pretax stock-based compensation costs, the tax benefit

associated with stock-based compensation expense, and stock-based

compensation costs capitalized are included in the following table.

Years Ended December 31,

(in millions) 2015 2014 2013

Restricted stock unit awards $ 38 $ 39 $ 49

Performance awards 23 22 34

Stock options —— 2

Pretax stock-based compensation cost $ 61 $ 61 $ 85

Tax benefit associated with stock-based

compensation expense $ 23 $ 23 $ 33

Stock-based compensation costs capitalized 34 3

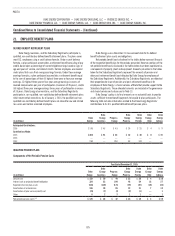

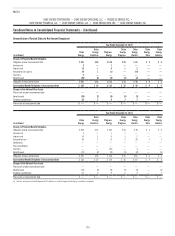

STOCK OPTIONS

Stock options are granted with a maximum option term of 10 years and

with an exercise price not less than the market price of Duke Energy’s common

stock on the grant date. Stock options outstanding at December 31, 2015, were

not exercisable and the aggregate intrinsic value was not material. The following

table summarizes information about stock options outstanding.

Stock Options

(in thousands)

Weighted

Average

Exercise

Price (per

share)

Weighted

Average

Remaining

Life

Outstanding at December 31, 2014 373 $ 64

Exercised (270) 62

Outstanding at December 31, 2015(a) 103 69

7 years,

2 months

(a) Outstanding stock options all vested on January 1, 2016.

The following table summarizes additional information related to stock

options exercised and granted.

Years Ended December 31,

2015 2014 2013

Intrinsic value of options exercised (in millions) $ 5 $ 6 $ 26

Tax benefit related to options exercised (in millions) 22 10

Cash received from options exercised (in millions) 17 25 9

Stock options granted (in thousands)(a) —— 310

(a) Stock options granted in 2013 were expensed immediately.

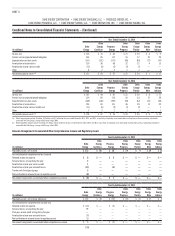

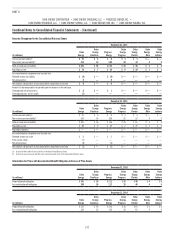

RESTRICTED STOCK UNIT AWARDS

Restricted stock unit awards generally vest over periods from immediate

to three years. Fair value amounts are based on the market price of Duke

Energy’s common stock on the grant date. The following table includes

information related to restricted stock unit awards.

Years Ended December 31,

2015 2014 2013

Shares awarded (in thousands) 524 557 612

Fair value (in millions) $ 41 $ 40 $ 42