Duke Energy 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

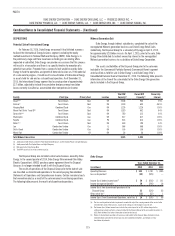

Year Ended December 31, 2015

(in millions)

Regulated

Utilities

International

Energy

Commercial

Portfolio

Total

Reportable

Segments Other Eliminations Total

Unaffiliated Revenues $ 22,024 $ 1,088 $ 301 $ 23,413 $ 46 $ — $ 23,459

Intersegment Revenues 38 — — 38 77 (115) —

Total Revenues $ 22,062 $ 1,088 $ 301 $ 23,451 $ 123 $ (115) $ 23,459

Interest Expense $ 1,097 $ 85 $ 44 $ 1,226 $ 393 $ (6) $ 1,613

Depreciation and amortization 2,814 92 104 3,010 134 — 3,144

Equity in earnings of unconsolidated affiliates (4) 74 (3) 67 2 — 69

Income tax expense (benefit) 1,647 74 (92) 1,629 (303) — 1,326

Segment income (loss)(a)(b)(c)(d) 2,893 225 4 3,122 (322) (4) 2,796

Add back noncontrolling interest component 15

Income from discontinued operations, net of tax(e) 20

Net income $ 2,831

Capital investments expenditures and acquisitions $ 6,974 $ 45 $ 1,131 $ 8,150 $ 213 $ — $ 8,363

Segment Assets 111,562 3,271 4,010 118,843 2,125 188 121,156

(a) Regulated Utilities includes an after-tax charge of $58 million related to the Edwardsport settlement. Refer to Note 4 for further information.

(b) Commercial Portfolio includes state tax expense of $41 million, resulting from changes to state apportionment factors due to the sale of the Disposal Group, that does not qualify for discontinued operations.

Refer to Note 2 for further information related to the sale.

(c) Other includes $60 million of after-tax costs to achieve mergers.

(d) Other includes an after-tax charge of $77 million related to cost savings initiatives. Refer to Note 19 for further information related to the cost savings initiatives.

(e) Includes after-tax impact of $53 million for the settlement agreement reached in a lawsuit related to the Disposal Group. Refer to Note 5 for further information related to the lawsuit.

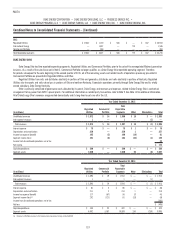

Year Ended December 31, 2014

(in millions)

Regulated

Utilities

International

Energy

Commercial

Portfolio

Total

Reportable

Segments Other Eliminations Total

Unaffiliated Revenues $ 22,228 $ 1,417 $ 255 $ 23,900 $ 25 $ — $ 23,925

Intersegment Revenues 43 — — 43 80 (123) —

Total Revenues $ 22,271 $ 1,417 $ 255 $ 23,943 $ 105 $ (123) $ 23,925

Interest Expense $ 1,093 $ 93 $ 58 $ 1,244 $ 400 $ (22) $ 1,622

Depreciation and amortization 2,759 97 92 2,948 118 — 3,066

Equity in earnings of unconsolidated affiliates (3) 120 10 127 3 — 130

Income tax expense (benefit)(a) 1,628 449 (171) 1,906 (237) — 1,669

Segment income (loss)(b)(c)(d) 2,795 55 (55) 2,795 (334) (10) 2,451

Add back noncontrolling interest component 14

Loss from discontinued operations, net of tax (576)

Net income $ 1,889

Capital investments expenditures and acquisitions $ 4,744 $ 67 $ 555 $ 5,366 $ 162 $ — $ 5,528

Segment Assets 106,574 5,093 6,278 117,945 2,423 189 120,557

(a) International Energy includes a tax adjustment of $373 million related to deferred tax impact resulting from the decision to repatriate all cumulative historical undistributed foreign earnings. See Note 22 for additional

information.

(b) Commercial Portfolio recorded a $94 million pretax impairment charge related to OVEC.

(c) Other includes costs to achieve mergers.

(d) Regulated Utilities includes an increase in the litigation reserve related to the criminal investigation of the Dan River coal ash spill. See Note 5 for additional information.