Duke Energy 2015 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

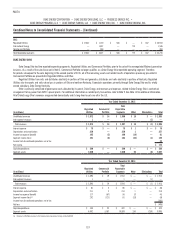

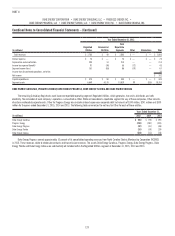

Combined Notes to Consolidated Financial Statements – (Continued)

an order approving the Osprey Plant acquisition. Closing of the acquisition is

contingent upon the expiration of the Hart-Scott-Rodino waiting period and is

expected to occur by the first quarter of 2017, upon the expiration of an existing

Power Purchase Agreement between Calpine and Duke Energy Florida.

FPSC Settlement Agreements

On February 22, 2012, the FPSC approved a settlement agreement (the

2012 Settlement) among Duke Energy Florida, the Florida Office of Public

Counsel (OPC) and other customer advocates. The 2012 Settlement was to

continue through the last billing cycle of December 2016. On October 17, 2013,

the FPSC approved a settlement agreement (the 2013 Settlement) between

Duke Energy Florida, OPC, and other customer advocates. The 2013 Settlement

replaces and supplants the 2012 Settlement and substantially resolves issues

related to (i) Crystal River Unit 3, (ii) Levy, (iii) Crystal River 1 and 2 coal units,

and (iv) future generation needs in Florida. Refer to the remaining sections

below for further discussion of these settlement agreements.

Crystal River Unit 3

On February 5, 2013, Duke Energy Florida announced the retirement of

Crystal River Unit 3. On February 20, 2013, Duke Energy Florida filed with the

NRC a certification of permanent cessation of power operations and permanent

removal of fuel from the reactor vessel. In December 2013, and March 2014,

Duke Energy Florida filed an updated site-specific decommissioning plan with

the NRC and FPSC, respectively. The plan, which was approved by the FPSC in

November 2014, included a decommissioning cost estimate of $1,180 million,

including amounts applicable to joint owners at that time, under the SAFSTOR

option. Duke Energy Florida’s decommissioning study assumes Crystal River

Unit 3 will be in SAFSTOR configuration, requiring limited staffing to monitor

plant conditions, until the eventual dismantling and decontamination activities

to be completed by 2074. This decommissioning approach is currently utilized at

a number of retired domestic nuclear power plants and is one of three accepted

approaches to decommissioning approved by the NRC.

Pursuant to the 2013 Settlement, Duke Energy Florida reclassified all

Crystal River Unit 3 investments, including property, plant and equipment,

nuclear fuel, inventory, and other assets, to regulatory assets. Portions of

the nuclear fuel balances that are under contract for sale were subsequently

moved to Other within Current Assets and Other within Investments and Other

Assets on the Consolidated Balance Sheets. Duke Energy Florida agreed to forgo

recovery of $295 million of regulatory assets and an impairment charge was

recorded in the second quarter of 2013 for this matter. Duke Energy Florida also

accelerated cash recovery of approximately $47 million, net of tax, of the Crystal

River Unit 3 regulatory asset from retail customers during 2014 and 2015,

through its fuel clause.

On May 22, 2015, Duke Energy Florida petitioned the FPSC for approval

to include in base rates the revenue requirement for the projected

$1.298 billion Crystal River Unit 3 regulatory asset as authorized by the 2013

Revised and Restated Stipulation and Settlement Agreement (2013 Agreement).

On September 15, 2015, the FPSC approved Duke Energy Florida’s motion for

approval of a settlement agreement with intervenors to reduce the value of the

projected Crystal River Unit 3 regulatory asset to be recovered to $1.283 billion

as of December 31, 2015. An impairment charge of $15 million was recognized

in the third quarter of 2015 to adjust the regulatory asset balance.

In June 2015, the governor of Florida signed legislation to allow utilities to

securitize certain retired nuclear generation assets, with approval of the FPSC.

On November 19, 2015, the FPSC issued a financing order approving Duke

Energy Florida’s request to securitize its unrecovered regulatory asset related

to Crystal River Unit 3 through a debt issuance at a wholly owned special

purpose entity. Securitization would replace the base rate recovery methodology

authorized by the 2013 Agreement and result in a lower rate impact to

customers with an approximately 20 year recovery period. On February 9,

2016, Duke Energy Florida filed a registration statement for the proposed initial

public offering of the bonds. Use of the registration statement for purposes of

the offering is subject to review and declaration of its effectiveness by the SEC.

Duke Energy Florida expects to issue securitization bonds in the first half of

2016.

In December 2014, the FPSC approved Duke Energy Florida’s decision to

construct an independent spent fuel storage installation (ISFSI) and approved

Duke Energy Florida’s request to defer amortization of the ISFSI pending

resolution of its litigation against the federal government as a result of the

Department of Energy’s breach of its obligation to accept spent nuclear fuel. The

return rate will be based on the currently approved AFUDC rate with a return

on equity of 7.35 percent, or 70 percent of the currently approved 10.5 percent.

The return rate is subject to change if the return on equity changes in the future.

Through December 31, 2015 Duke Energy Florida has deferred approximately

$60 million for recovery associated with building the ISFSI.

The regulatory asset associated with the original Crystal River Unit 3

power uprate project will continue to be recovered through the NCRC over an

estimated seven-year period that began in 2013 with a remaining uncollected

balance at December 31, 2015 of $169 million.

Customer Rate Matters

Pursuant to the 2013 Settlement, Duke Energy Florida will maintain base

rates at the current level through the last billing period of 2018, subject to

the return on equity range of 9.5 percent to 11.5 percent, with exceptions for

base rate increases for the recovery of the Crystal River Unit 3 regulatory asset

beginning no later than 2017, unless the regulatory asset is securitized as

discussed above, and base rate increases for new generation through 2018, per

the provisions of the 2013 Settlement. Duke Energy Florida is not required to file

a depreciation study, fossil dismantlement study or nuclear decommissioning

study until the earlier of the next rate case filing or March 31, 2019. The

2012 Settlement also provided for a $150 million increase in base revenue

effective with the first billing cycle of January 2013. If Duke Energy Florida’s

retail base rate earnings fall below the return on equity range, as reported on

a FPSC-adjusted or pro forma basis on a monthly earnings surveillance report,

it may petition the FPSC to amend its base rates during the term of the 2013

Settlement.

Duke Energy Florida agreed to refund $388 million to retail customers

through its fuel clause, as required by the 2012 Settlement. At December

31, 2015, $70 million remains to be refunded and is included in Regulatory

liabilities within Current Liabilities on the Consolidated Balance Sheets.

Levy Nuclear Project

On July 28, 2008, Duke Energy Florida applied to the NRC for a COL

for two Westinghouse AP1000 reactors at Levy. In 2008, the FPSC granted

Duke Energy Florida’s petition for an affirmative Determination of Need and

related orders requesting cost recovery under Florida’s nuclear cost-recovery

rule, together with the associated facilities, including transmission lines and

substation facilities. Design changes have been identified in the Westinghouse

AP1000 certified design that must be addressed before the NRC can complete

its review of the Levy COL application. These design changes set the schedule

for completion of the NRC COL application review and issuance of the Levy COL.

Based on the current review schedule, the Levy COL is currently expected by

late 2016.