Duke Energy 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

PART II

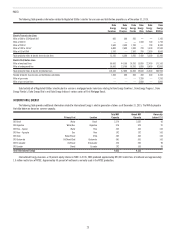

Pursuant to the Merger Agreement, upon the closing of the merger, each

share of Piedmont common stock issued and outstanding immediately prior to

the closing will be converted automatically into the right to receive $60 in cash

per share. In addition, Duke Energy will assume Piedmont’s existing debt, which

was approximately $1.9 billion at October 31, 2015, the end of Piedmont’s

most recent fiscal year. Duke Energy expects to finance the transaction with a

combination of debt, between $500 million and $750 million of newly issued

equity and other cash sources.

In connection with the Merger Agreement with Piedmont, Duke Energy

entered into a $4.9 billion senior unsecured bridge financing facility (Bridge

Facility) with Barclays Capital, Inc. (Barclays). The Bridge Facility, if drawn

upon, may be used to (i) fund the cash consideration for the transaction and (ii)

pay certain fees and expenses in connection with the transaction. In November

2015, Barclays syndicated its commitment under the Bridge Facility to a broader

group of lenders. Duke Energy intends to finance the transaction with proceeds

raised through the issuance of debt, equity and other sources as noted above

and, therefore, does not expect to draw upon the Bridge Facility.

The Federal Trade Commission (FTC) has granted early termination

of the 30-day waiting period under the federal Hart-Scott-Rodino Antitrust

Improvements Act of 1976. On January 22, 2016, shareholders of Piedmont

Natural Gas approved the company’s acquisition by Duke Energy. On January

15, 2016, Duke Energy filed for approval of the transaction and associated

financing requests with the NCUC. On January 29, 2016, the NCUC approved

the financing requests. On January 15, 2016, Duke Energy and Piedmont filed a

joint request with the Tennessee Regulatory Authority for approval of a change in

control of Piedmont that will result from Duke Energy’s acquisition of Piedmont.

In that request, Duke Energy and Piedmont requested that the Authority approve

the change in control on or before April 30, 2016. Subject to receipt of required

regulatory approvals and meeting closing conditions, Duke Energy and Piedmont

target a closing by the end of 2016.

On December 11, 2015, Duke Energy Kentucky filed a declaratory request

with the KPSC seeking a finding that the transaction does not constitute a

change in control of Duke Energy Kentucky requiring KPSC approval. Duke

Energy also presented the transaction for information before the PSCSC on

January 13, 2016.

The Merger Agreement contains certain termination rights for both Duke

Energy and Piedmont, and provides that, upon termination of the Merger

Agreement under specified circumstances, Duke Energy would be required

to pay a termination fee of $250 million to Piedmont and Piedmont would be

required to pay Duke Energy a termination fee of $125 million.

See Note 4 to the Consolidated Financial Statements, Regulatory

Matters,” for additional information regarding Duke Energy and Piedmont’s joint

investment in Atlantic Coast Pipeline, LLC.

Midwest Generation Exit

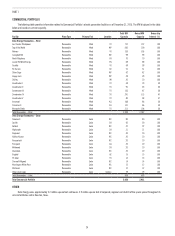

Duke Energy, through indirect subsidiaries, completed the sale of the

nonregulated Midwest generation business and Duke Energy Retail Sales LLC

(collectively, the Disposal Group) to a subsidiary of Dynegy on April 2, 2015, for

approximately $2.8 billion in cash. Refer to Note 2 to the Consolidated Financial

Statements, “Acquisitions and Dispositions,” for additional information on this

transaction.

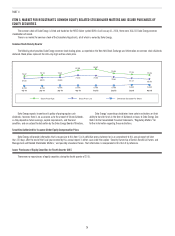

Accelerated Stock Repurchase Program

On April 6, 2015, Duke Energy entered into agreements with each of

Goldman, Sachs & Co. and JPMorgan Chase Bank, National Association

(the Dealers) to repurchase a total of $1.5 billion of Duke Energy common

stock under an accelerated stock repurchase program (the ASR). Duke

Energy made payments of $750 million to each of the Dealers and was

delivered 16.6 million shares, with a total fair value of $1.275 billion,

which represented approximately 85 percent of the total number of shares

of Duke Energy common stock expected to be repurchased under the ASR.

The $225 million unsettled portion met the criteria to be accounted for

as a forward contract indexed to Duke Energy’s stock and qualified as an

equity instrument. The company recorded the $1.5 billion payment as a

reduction to common stock as of April 6, 2015. In June 2015, the Dealers

delivered 3.2 million additional shares to Duke Energy to complete the ASR.

Approximately 19.8 million shares, in total, were delivered to Duke Energy

and retired under the ASR at an average price of $75.75 per share. The

final number of shares repurchased was based upon the average of the

daily volume weighted average stock prices of Duke Energy’s common stock

during the term of the program, less a discount.

For additional information on the details of this transaction, see

Note 18 to the Consolidated Financial Statements, “Common Stock.”

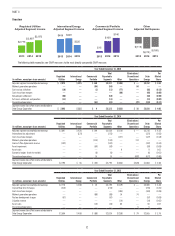

Financial Results

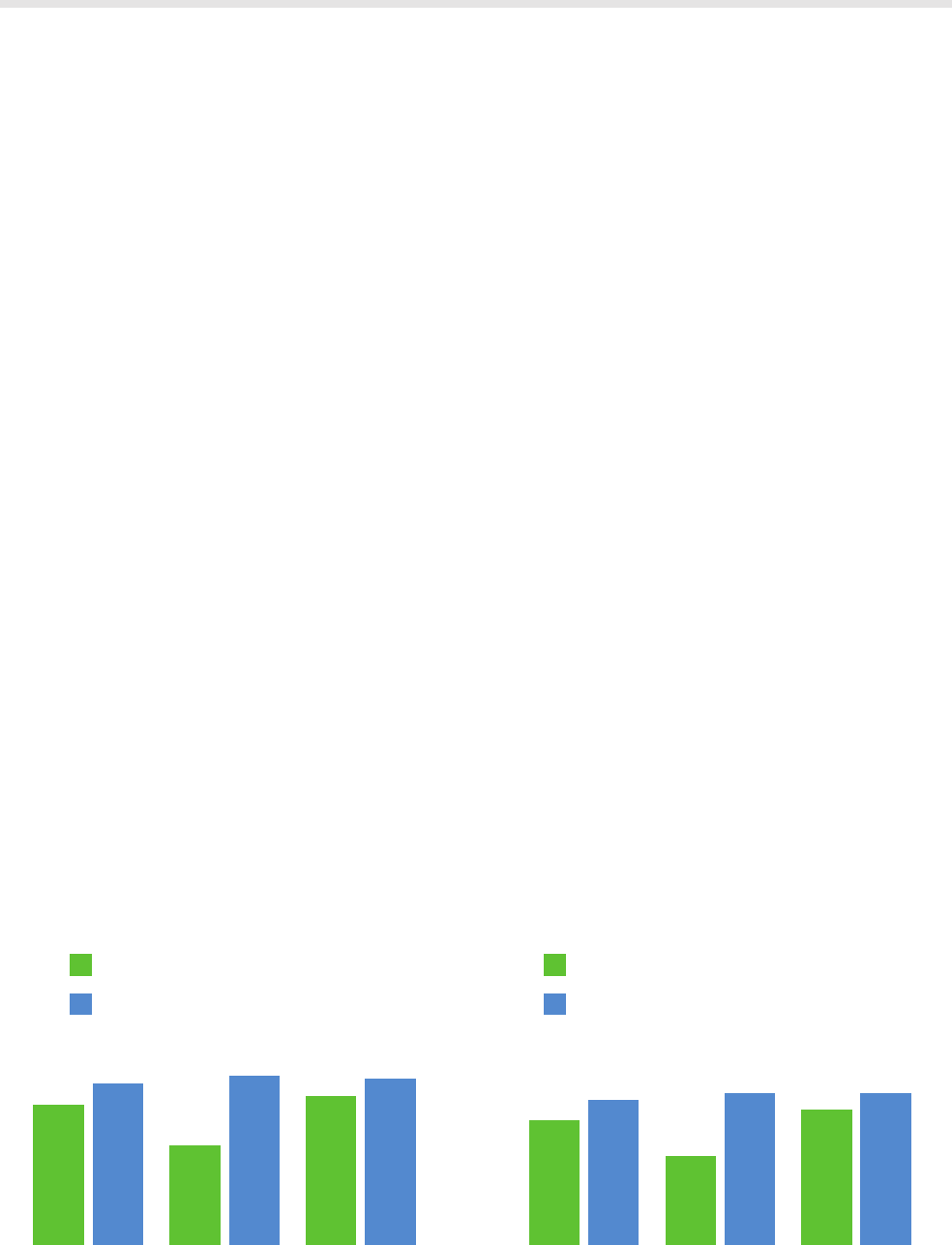

2013

$2,665

$3,080

$1,883

$3,218

$2,816

$3,152

$4.54

$3.76

$4.36

$2.66

$4.55

$4.05

2014

Net Income Attributable to Duke Energy Corporation Net Income Attributable to Duke Energy Corporation common

stockholders per diluted share

Adjusted Earnings (a) Adjusted Diluted Earnings Per Share (a)

2015 2013 2014 2015

Annual Earnings (in millions) Annual Earnings Per Diluted Share

(a) See Results of Operations below for Duke Energy’s definition of adjusted earnings and adjusted diluted earnings per share as well as a reconciliation of this non-GAAP financial measure to net income attributable to Duke

Energy and net income attributable to Duke Energy per diluted share.