Duke Energy 2015 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

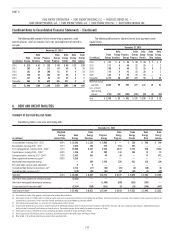

The table below presents recorded reserves based on management’s best

estimate of probable loss for legal matters, excluding asbestos-related reserves

and the exit obligation discussed above related to the termination of an EPC

contract. Reserves are classified on the Consolidated Balance Sheets in Other

within Deferred Credits and Other Liabilities and Accounts payable and Other

within Current Liabilities. The reasonably possible range of loss in excess of

recorded reserves is not material, other than as described above.

December 31,

(in millions) 2015 2014

Reserves for Legal Matters

Duke Energy $166 $ 323

Duke Energy Carolinas 11 72

Progress Energy 54 93

Duke Energy Progress 637

Duke Energy Florida 31 36

Duke Energy Ohio 80 —

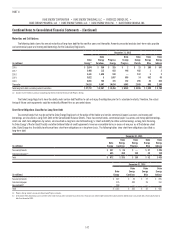

OTHER COMMITMENTS AND CONTINGENCIES

General

As part of their normal business, the Duke Energy Registrants are party

to various financial guarantees, performance guarantees and other contractual

commitments to extend guarantees of credit and other assistance to various

subsidiaries, investees and other third parties. These guarantees involve

elements of performance and credit risk, which are not fully recognized on the

Consolidated Balance Sheets and have unlimited maximum potential payments.

However, the Duke Energy Registrants do not believe these guarantees will have

a material effect on their results of operations, cash flows or financial position.

Purchase Obligations

Purchased Power

Duke Energy Progress and Duke Energy Florida have ongoing purchased

power contracts, including renewable energy contracts, with other utilities,

wholesale marketers, co-generators, and qualified facilities. These purchased

power contracts generally provide for capacity and energy payments. In addition,

Duke Energy Progress and Duke Energy Florida have various contracts to secure

transmission rights.

The following table presents executory purchased power contracts with terms exceeding one year, excluding contracts classified as leases.

Minimum Purchase Amount at December 31, 2015

(in millions)

Contract

Expiration 2016 2017 2018 2019 2020 Thereafter Total

Duke Energy Progress(a) 2019-2031 $ 54 $ 60 $ 61 $ 62 $ 49 $ 363 $ 649

Duke Energy Florida(b) 2021-2043 305 345 360 377 394 1,591 3,372

Duke Energy Ohio(c)(d) 2017-2018 236 195 59 — — — 490

(a) Contracts represent between 15 percent and 100 percent of net plant output.

(b) Contracts represent between 80 percent and 100 percent of net plant output.

(c) Contracts represent between 1 percent and 11 percent of net plant output.

(d) Excludes purchase power agreement with OVEC. See Note 17 for additional information.

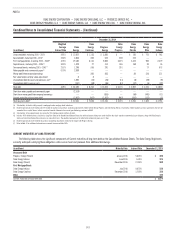

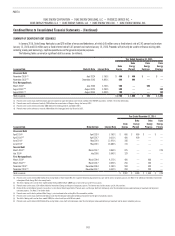

Operating and Capital Lease Commitments

The Duke Energy Registrants lease office buildings, railcars, vehicles, computer equipment and other property and equipment with various terms and expiration

dates. Additionally, Duke Energy Progress has a capital lease related to firm gas pipeline transportation capacity. Duke Energy Progress and Duke Energy Florida have

entered into certain purchased power agreements, which are classified as leases. Consolidated capitalized lease obligations are classified as Long-Term Debt or Other

within Current Liabilities on the Consolidated Balance Sheets. Amortization of assets recorded under capital leases is included in Depreciation and amortization and

Fuel used in electric generation – regulated on the Consolidated Statements of Operations.

The following table presents rental expense for operating leases. These amounts are included in Operation, maintenance and other on the Consolidated

Statements of Operations.

Years Ended December 31,

(in millions) 2015 2014 2013

Duke Energy $318 $355 $321

Duke Energy Carolinas 41 41 39

Progress Energy 230 257 225

Duke Energy Progress 149 161 153

Duke Energy Florida 81 96 72

Duke Energy Ohio 13 17 14

Duke Energy Indiana 20 21 22