Duke Energy 2015 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

of fuel source). The rule establishes requirements regarding landfill design,

structural integrity design and assessment criteria for surface impoundments,

groundwater monitoring and protection procedures and other operational and

reporting procedures to ensure the safe disposal and management of CCR. In

addition to the requirements of the federal CCR regulation, CCR landfills and

surface impoundments will continue to be independently regulated by most states.

As a result of the EPA rule, Duke Energy Carolinas, Progress Energy, Duke Energy

Progress, Duke Energy Ohio and Duke Energy Indiana recorded additional asset

retirement obligation amounts during 2015.

Coal Ash Liability

The ARO amount recorded on the Consolidated Balance Sheets is based

upon estimated closure costs for impacted ash impoundments. The amount

recorded represents the discounted cash flows for estimated closure costs

based upon either specific closure plans or the probability weightings of the

potential closure methods as evaluated on a site-by-site basis. Actual costs

to be incurred will be dependent upon factors that vary from site to site. The

most significant factors are the method and time frame of closure at the

individual sites. Closure methods considered include removing the water from

the basins, consolidating material as necessary, and capping the ash with a

synthetic barrier, excavating and relocating the ash to a lined structural fill or

lined landfill, or recycling the ash for concrete or some other beneficial use.

The ultimate method and timetable for closure will be in compliance with

standards set by federal and state regulations. The ARO amount will be adjusted

as additional information is gained through the closure process, including

acceptance and approval of compliance approaches which may change

management assumptions, and may result in a material change to the balance.

Asset retirement costs associated with the asset retirement obligations

for operating plants and retired plants are included in Net property, plant and

equipment, and Regulatory assets, respectively, on the Consolidated Balance

Sheets. See Note 4 for additional information on Regulatory assets related to

AROs.

Cost recovery for future expenditures will be pursued through the normal

ratemaking process with federal and state utility commissions, which permit

recovery of necessary and prudently incurred costs associated with Duke

Energy’s regulated operations.

Nuclear Decommissioning Liability

Asset retirement obligations related to nuclear decommissioning are

based on site-specific cost studies. The NCUC, PSCSC, and FPSC require

updated cost estimates for decommissioning nuclear plants every five years.

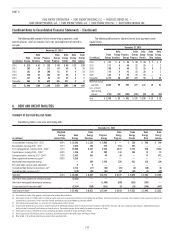

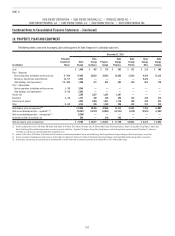

The following table summarizes information about the most recent site-specific nuclear decommissioning cost studies. Decommissioning costs in the table

below are presented in dollars of the year of the cost study and include costs to decommission plant components not subject to radioactive contamination.

(in millions)

Annual Funding

Requirement(a)

Decommissioning

Costs(a)(b)

Year of Cost

Study

Duke Energy $ 14 $ 8,130 2013 and 2014

Duke Energy Carolinas — 3,420 2013

Duke Energy Progress 14 3,550 2014

Duke Energy Florida — 1,160 2013

(a) Amounts for Progress Energy equal the sum of Duke Energy Progress and Duke Energy Florida.

(b) Amounts include the Subsidiary Registrant’s ownership interest in jointly owned reactors. Other joint owners are responsible for decommissioning costs related to their interest in the reactors.

Duke Energy Progress’ site-specific nuclear decommissioning cost studies were filed with the NCUC and PSCSC in 2015. New funding studies were completed

and filed with the NCUC and PSCSC in 2015 as well. Accordingly, in January 2016 Duke Energy Progress received approval from the PSCSC to reduce the annual

funding requirement. The NCUC will decide on the appropriate funding level in 2016. Duke Energy Progress will complete and file new funding studies with the

FERC in 2016.

Nuclear Decommissioning Trust Funds (NDTF)

Duke Energy Carolinas, Duke Energy Progress and Duke Energy Florida each maintain Nuclear Decommissioning Trust Funds (NDTF) that are intended to pay

for the decommissioning costs of the respective nuclear power plants. The NDTF investments are managed and invested in accordance with applicable requirements

of various regulatory bodies including the NRC, FERC, NCUC, PSCSC, FPSC and the Internal Revenue Service. Use of the NTDF investments is restricted to nuclear

decommissioning activities including license termination, spent fuel and site restoration. The license termination and spent fuel obligations relate to contaminated

decommissioning and are recorded as AROs. The site restoration obligation relates to non-contaminated decommissioning and is recorded to cost of removal within

Regulatory liabilities on the Consolidated Balance Sheets.

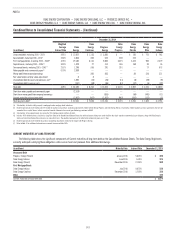

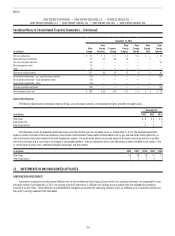

The following table presents the fair value of NDTF assets legally restricted for purposes of settling asset retirement obligations associated with nuclear

decommissioning.

December 31,

(in millions) 2015 2014

Duke Energy $ 4,670 $ 5,182

Duke Energy Carolinas 2,686 2,678

Duke Energy Progress(a) 1,984 1,701

Duke Energy Florida(a)(b) —803

(a) Amounts for Progress Energy equal the sum of Duke Energy Progress and Duke Energy Florida.

(b) Duke Energy Florida is actively decommissioning Crystal River Unit 3 and was granted an exemption from the NRC which allows for unrestricted use of the NDTF. Therefore, the entire balance of Duke Energy Florida’s NDTF

may be applied toward license termination, spent fuel and site restoration costs incurred to decommission Crystal River Unit 3.