Duke Energy 2015 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

213

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Duke Energy will provide information that is responsive to this Item 10 in its definitive proxy statement or in an amendment to this Annual Report not later than

120 days after the end of the fiscal year covered by this Annual Report. That information is incorporated in this Item 10 by reference.

ITEM 11. EXECUTIVE COMPENSATION

Duke Energy will provide information that is responsive to this Item 11 in its definitive proxy statement or in an amendment to this Annual Report not later than

120 days after the end of the fiscal year covered by this Annual Report. That information is incorporated in this Item 11 by reference.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Duke Energy will provide information that is responsive to this Item 12 in its definitive proxy statement or in an amendment to this Annual Report not later than

120 days after the end of the fiscal year covered by this Annual Report. That information is incorporated in this Item 12 by reference.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Duke Energy will provide information that is responsive to this Item 13 in its definitive proxy statement or in an amendment to this Annual Report not later than

120 days after the end of the fiscal year covered by this Annual Report. That information is incorporated in this Item 13 by reference.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

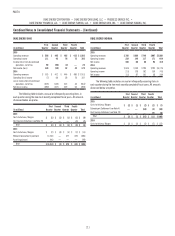

Deloitte & Touche LLP, and the member firms of Deloitte Touche Tohmatsu and their respective affiliates (collectively, Deloitte) provided professional services to

the Duke Energy Registrants. The following tables present the Deloitte fees for services rendered to the Duke Energy Registrants during 2015 and 2014.

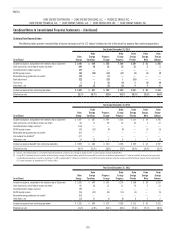

Year Ended December 31, 2015

Duke Duke Duke Duke Duke

Duke Energy Progress Energy Energy Energy Energy

(in millions) Energy Carolinas Energy Progress Florida Ohio Indiana

Types of Fees

Audit Fees(a) $12.5 $4.6 $5.1 $2.9 $2.2 $0.8 $1.3

Audit-Related Fees(b) 2.7 — — — — 1.2 —

Tax Fees(c) 0.2 0.1 — — — — —

Total Fees $15.4 $4.7 $5.1 $2.9 $2.2 $2.0 $1.3

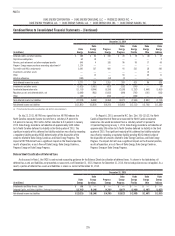

Year Ended December 31, 2014

Duke Duke Duke Duke Duke

Duke Energy Progress Energy Energy Energy Energy

(in millions) Energy Carolinas Energy Progress Florida Ohio Indiana

Types of Fees

Audit Fees(a) $ 12.0 $4.2 $4.6 $2.6 $2.0 $1.2 $1.2

Audit-Related Fees(b) 4.2 0.1 0.1 0.1 — 2.6 —

Tax Fees(c) 0.7 0.3 0.3 0.2 0.1 0.1 0.1

Total Fees $ 16.9 $4.6 $5.0 $2.9 $2.1 $3.9 $1.3

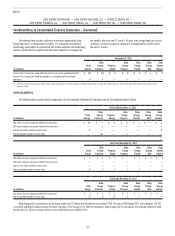

(a) Audit Fees are fees billed or expected to be billed for professional services for the audit of the Duke Energy Registrants’ financial statements included in the annual report on Form 10-K and the review of financial statements

included in quarterly reports on Form 10-Q, for services that are normally provided by Deloitte in connection with statutory, regulatory or other filings or engagements, or for any other service performed by Deloitte to comply

with generally accepted auditing standards.

(b) Audit-Related Fees are fees for assurance and related services that are reasonably related to the performance of an audit or review of financial statements, including assistance with acquisitions and divestitures and internal

control reviews.

(c) Tax Fees are fees for tax return assistance and preparation, tax examination assistance, and professional services related to tax planning and tax strategy.

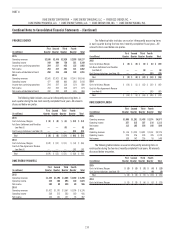

To safeguard the continued independence of the independent auditor, the Audit Committee of the Board of Directors (Audit Committee) of Duke Energy adopted

a policy that all services provided by the independent auditor require preapproval by the Audit Committee. Pursuant to the policy, certain audit services, audit-related

services, tax services and other services have been specifically preapproved up to fee limits. In the event the cost of any of these services may exceed the fee limits,

the Audit Committee must preapprove the service. All services performed in 2015 and 2014 by the independent accountant were approved by the Audit Committee

pursuant to their preapproval policy.