Duke Energy 2015 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

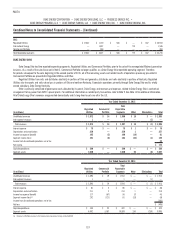

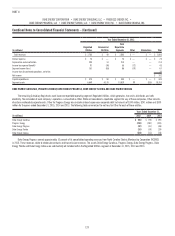

Combined Notes to Consolidated Financial Statements – (Continued)

On January 28, 2014, Duke Energy Florida terminated the Levy

engineering, procurement and construction agreement (EPC). Duke Energy

Florida may be required to pay for work performed under the EPC and to bring

existing work to an orderly conclusion, including but not limited to costs to

demobilize and cancel certain equipment and material orders placed. Duke

Energy Florida recorded an exit obligation of $25 million in first quarter 2014 for

the termination of the EPC. This liability was recorded within Other in Deferred

Credits and Other Liabilities with an offset primarily to Regulatory assets on

the Consolidated Balance Sheets. Duke Energy Florida is allowed to recover

reasonable and prudent EPC cancellation costs from its retail customers.

The 2012 Settlement provided that Duke Energy Florida include the

allocated wholesale cost of Levy as a retail regulatory asset and include this

asset as a component of rate base and amortization expense for regulatory

reporting. In accordance with the 2013 Settlement, Duke Energy Florida ceased

amortization of the wholesale allocation of Levy investments against retail rates.

In the second quarter of 2013, Duke Energy Florida recorded a pretax charge of

$65 million to write off the wholesale portion of Levy investments. This amount

is included in Impairment charges on Duke Energy Florida’s Statements of

Operations and Comprehensive Income.

On October 27, 2014, the FPSC approved Duke Energy Florida rates for

2015 for Levy as filed and consistent with those established in the 2013 Revised

and Restated Settlement Agreement. Recovery of the remaining retail portion

of the project costs may occur over five years from 2013 through 2017. Duke

Energy Florida has an ongoing responsibility to demonstrate prudency related

to the wind down of the Levy investment and the potential for salvage of Levy

assets. As of December 31, 2015, Duke Energy Florida has a net uncollected

investment in Levy of approximately $183 million, including AFUDC. Of this

amount, $105 million related to land and the COL is included in Net, property,

plant and equipment and will be recovered through base rates and $78 million

is included in Regulatory assets within Regulatory Assets and Deferred Debits on

the Consolidated Balance Sheets and will be recovered through the NCRC.

On April 16, 2015, the FPSC approved Duke Energy Florida’s petition to

cease collection of the Levy Nuclear Project fixed charge beginning with the first

billing cycle in May 2015. On August 18, 2015, the FPSC approved leaving the

Levy Nuclear Project portion of the Nuclear Cost Recovery Clause charge at zero

dollars for 2016 and 2017, consistent with the 2013 Settlement. Duke Energy

Florida will submit by May 2017 a true-up of Levy Nuclear Project costs or

credits to be recovered no earlier than January 2018. To the extent costs become

known after May 2017, Duke Energy Florida will petition for recovery at that time.

Crystal River 1 and 2 Coal Units

Duke Energy Florida has evaluated Crystal River 1 and 2 coal units for

retirement in order to comply with certain environmental regulations. Based on

this evaluation, those units will likely be retired by 2018. Once those units are

retired Duke Energy Florida will continue recovery of existing annual depreciation

expense through the end of 2020. Beginning in 2021, Duke Energy Florida will

be allowed to recover any remaining net book value of the assets from retail

customers through the Capacity Cost Recovery Clause. In April 2014, the FPSC

approved Duke Energy Florida’s petition to allow for the recovery of prudently

incurred costs to comply with the Mercury and Air Toxics Standard through the

Environmental Cost Recovery Clause.

Cost of Removal Reserve

The 2012 Settlement and the 2013 Settlement provide Duke Energy

Florida the discretion to reduce cost of removal amortization expense for a

certain portion of the cost of removal reserve until the earlier of its applicable

cost of removal reserve reaches zero or the expiration of the 2013 Settlement.

Duke Energy Florida could not reduce amortization expense if the reduction

would cause it to exceed the appropriate high point of the return on equity

range. Duke Energy Florida recognized a reduction in amortization expense of

$114 million for the year ended December 31, 2013. Duke Energy Florida had

no cost of removal reserves eligible for amortization to income remaining after

December 31, 2013.

Duke Energy Ohio

Accelerated Natural Gas Service Line Replacement Rider

On January 20, 2015, Duke Energy Ohio filed an application for approval

of an accelerated natural gas service line replacement program (ASRP). The

ASRP is modeled after the accelerated main replacement program (AMRP),

which concluded on December 31, 2015. Under the ASRP, Duke Energy Ohio

proposes to replace certain natural gas service lines on an accelerated basis.

The program is proposed to last 10 years. Through the ASRP, Duke Energy Ohio

also proposes to complete preliminary survey and investigation work related

to natural gas service lines that are customer-owned and for which it does

not have valid records and, further, to relocate interior natural gas meters to

suitable exterior locations where such relocation can be accomplished. Duke

Energy Ohio projects total capital and operations and maintenance expenditures

under the ASRP to approximate $320 million. The filing also seeks approval of

Rider ASRP, the rider through which expenditures would be recovered. Similar to

the Rider AMRP methodology, Duke Energy Ohio proposes to update Rider ASRP

on an annual basis. Duke Energy Ohio’s application is pending before the PUCO

and it is uncertain when an order will be issued.

Intervenors oppose the ASRP, primarily because they believe the program

is neither required nor necessary under federal pipeline regulation. The hearing

concluded on November 19, 2015 and initial and reply briefs were filed, with

briefing complete on December 23, 2015.

Duke Energy Ohio cannot predict the outcome of this matter.

Energy Efficiency Cost Recovery

On March 28, 2014, Duke Energy Ohio filed an application for recovery

of program costs, lost distribution revenue and performance incentives related

to its energy efficiency and peak demand reduction programs. These programs

are undertaken to comply with environmental mandates set forth in Ohio law.

After a comment period, the PUCO approved Duke Energy Ohio’s application, but

found that Duke Energy Ohio was not permitted to use banked energy savings

from previous years in order to calculate the amount of allowed incentive. This

conclusion represented a change to the cost recovery mechanism that had

been agreed to by intervenors and approved by the PUCO in previous cases.

As a result of the PUCO’s decision, Duke Energy Ohio reversed $23 million in

revenues deemed to be refundable for the period between January 2013 and

April 2015 in second quarter 2015. The PUCO granted Duke Energy Ohio’s

application for rehearing on July 8, 2015. Substantive ruling on the application

for rehearing is pending. The PUCO granted all applications for rehearing for

future consideration. On January 6, 2016, Duke Energy Ohio and PUCO Staff

entered into a stipulation, pending PUCO approval, resolving the issues related

to, among other things, performance incentives and the PUCO Staff audit of

2013 costs. Based on this stipulation, in December 2015, Duke Energy Ohio re-

established approximately $20 million of the revenues that had been reversed

in the second quarter. A hearing on the stipulation is scheduled for March 10,

2016. Duke Energy Ohio cannot predict the outcome of this matter.