Duke Energy 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

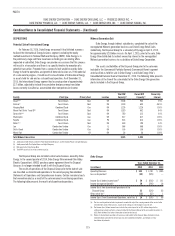

Duke Energy Ohio

Years Ended December 31,

(in millions) 2015 2014 2013

Operating Revenues $ 412 $ 1,299 $ 1,503

Loss on disposition(a) (52) (959) —

Income (loss) before income taxes(b) $ 44 $ (863) $ 67

Income tax expense (benefit) 21 (300) 32

Income (Loss) From Discontinued Operations,

net of tax $ 23 $ (563) $ 35

(a) The Loss on disposition includes impairments recorded to adjust the carrying amount of the assets to the

estimated fair value of the business, based on the selling price to Dynegy less cost to sell.

(b) The Income (loss) before income taxes includes the pretax impact of an $81 million charge for the

settlement agreement reached in a lawsuit related to the Disposal Group for the year ended December 31,

2015, respectively. Refer to Note 5 for further information related to the lawsuit.

Commercial Portfolio has a revolving credit agreement (RCA) which

was used to support the operations of the nonregulated Midwest generation

business. Interest expense associated with the RCA was allocated to

discontinued operations. No other interest expense related to corporate level

debt was allocated to discontinued operations.

Duke Energy Ohio had a power purchase agreement with the Disposal

Group for a portion of its standard service offer (SSO) supply requirement.

The agreement and the SSO expired in May 2015. Duke Energy received

reimbursement for transition services provided to Dynegy through December

2015. The continuing cash flows were not considered direct cash flows or

material. Duke Energy or Duke Energy Ohio did not significantly influence the

operations of the Disposal Group during the transition service period.

See Notes 4 and 5 for a discussion of contingencies related to the

Disposal Group that are retained by Duke Energy Ohio subsequent to the sale.

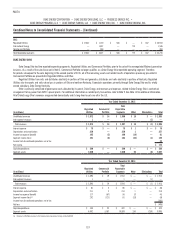

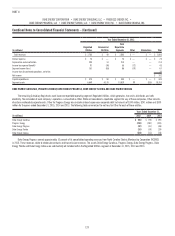

3. BUSINESS SEGMENTS

Duke Energy evaluates segment performance based on segment income.

Segment income is defined as income from continuing operations net of income

attributable to noncontrolling interests. Segment income, as discussed below,

includes intercompany revenues and expenses that are eliminated in the

Consolidated Financial Statements. Certain governance costs are allocated

to each segment. In addition, direct interest expense and income taxes are

included in segment income.

Operating segments are determined based on information used by the

chief operating decision maker in deciding how to allocate resources and

evaluate the performance.

Products and services are sold between affiliate companies and

reportable segments of Duke Energy at cost. Segment assets as presented in the

tables that follow exclude all intercompany assets.

DUKE ENERGY

Duke Energy has the following reportable operating segments: Regulated

Utilities, International Energy and Commercial Portfolio.

Regulated Utilities conducts electric and natural gas operations that are

substantially all regulated and, accordingly, qualify for regulatory accounting

treatment. These operations are primarily conducted through the Subsidiary

Registrants and are subject to the rules and regulations of the FERC, NRC,

NCUC, PSCSC, FPSC, PUCO, IURC and KPSC.

International Energy principally operates and manages power generation

facilities and engages in sales and marketing of electric power, natural gas

and natural gas liquids outside the U.S. Its activities principally target power

generation in Latin America. Additionally, International Energy owns a 25

percent interest in NMC, a large regional producer of methyl tertiary butyl ether

(MTBE) located in Saudi Arabia. The investment in NMC is accounted for under

the equity method of accounting. On February 4, 2016, Duke Energy announced

it had initiated a process to divest its International Energy business segment,

excluding the investment in NMC. See Note 2 for further information.

Commercial Portfolio builds, develops and operates wind and solar

renewable generation and energy transmission projects throughout the U.S.

The segment was renamed as a result of the sale of the Disposal Group, as

discussed in Note 2. For periods subsequent to the sale, beginning in the second

quarter of 2015, certain immaterial results of operations and related assets

previously presented in the Commercial Portfolio segment are presented in

Regulated Utilities and Other.

The remainder of Duke Energy’s operations is presented as Other, which

is primarily comprised of unallocated corporate interest expense, unallocated

corporate costs, contributions to the Duke Energy Foundation and the operations

of Duke Energy’s wholly owned captive insurance subsidiary, Bison Insurance

Company Limited (Bison). On December 31, 2013, Duke Energy sold its interest

in DukeNet Communications Holdings, LLC (DukeNet) to Time Warner Cable, Inc.