Duke Energy 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

PART II

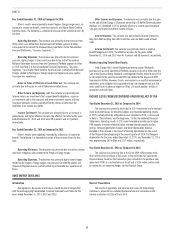

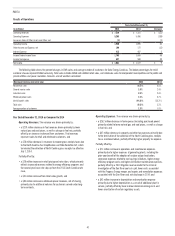

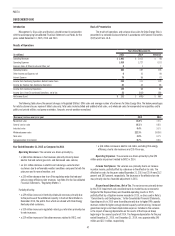

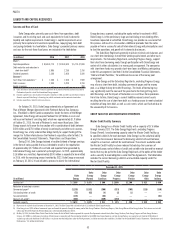

Year Ended December 31, 2015 as Compared to 2014

Operating Revenues. The variance was driven primarily by:

• a $265 million decrease in fuel revenues primarily due to a decrease in

fuel rates as a result of lower fuel and purchased power costs.

Operating Expenses. The variance was driven primarily by:

• a $277 million decrease in fuel used in electric generation and

purchased power primarily due to lower fuel prices; and

• a $67 million decrease in property and other taxes, primarily as a result

of lower sales and use tax. In 2014, an approximate $40 million other

tax reserve was recorded, a portion of which was reversed in 2015

upon settlement of the matter.

Partially offset by:

• an $88 million impairment charge related to the 2015 Edwardsport

IGCC settlements. See Note 4 to the Consolidated Financial Statements,

“Regulatory Matters,” for additional information.

Other Income and Expense, net. The variance was primarily due to lower

AFUDC equity due to Cayuga scrubbers placed into service in July 2015 and a

lower rate compared to the prior year, partially offset by favorable interest income.

Income Tax Expense. The variance was primarily due to a decrease in

pretax income and in the effective tax rate. The effective tax rates for the years

ended December 31, 2015 and 2014 were 34.0 percent and 35.5 percent,

respectively. The decrease in the effective tax rate was primarily due to a

favorable adjustment in 2015.

Matters Impacting Future Results

Duke Energy Indiana is evaluating converting Wabash River Unit 6 to

a natural gas-fired unit or retiring the unit earlier than its current estimated

useful life. If Duke Energy Indiana elects early retirement of the unit, recovery

of remaining book values and associated carrying costs totaling approximately

$40 million could be subject to future regulatory approvals and therefore cannot

be assured.

On April 17, 2015, the EPA published in the Federal Register a rule to

regulate the disposal of CCR from electric utilities as solid waste. Duke Energy

Indiana has interpreted the rule to identify the coal ash basin sites impacted

and has assessed the amounts of coal ash subject to the rule and a method of

compliance. Duke Energy Indiana’s interpretation of the requirements of the CCR

rule is subject to potential legal challenges and further regulatory approvals,

which could result in additional ash basin closure requirements, higher costs of

compliance and greater asset retirement obligations. An order from regulatory

authorities disallowing recovery of costs related to closure of ash basins could

have an adverse impact on Duke Energy Indiana’s financial position, results of

operations and cash flows.

In September 2015, Duke Energy Indiana entered into a settlement

agreement with multiple parties that will resolve all disputes, claims and issues

from the IURC proceedings regarding the Edwardsport IGCC generating facility.

In January 2016, additional parties joined a revised settlement. Pursuant to

the terms of the agreement, Duke Energy Indiana recognized an impairment

and related charges of $93 million. Additionally, the settlement agreement

stipulates the recovery of the remaining regulatory asset over an eight-year

period and confirms the conclusion that the in-service date for accounting and

ratemaking purposes will remain June 7, 2013. The settlement agreement will

also impose a cost cap for recoverable operations and maintenance retail costs

of $73 million in 2016 and $77 million in 2017 as well as a cost cap for ongoing

capital expenditures through 2017. As part of the settlement, Duke Energy

Indiana committed to cease burning coal at Gallagher Station Unit 2 and 4 by

the end of 2022. The settlement is subject to IURC approval and, if approved,

would resolve and close a number of outstanding issues pending before the

IURC related to post commercial operating performance and recovery of ongoing

operating and capital costs at Edwardsport. If the settlement is not approved,

outstanding issues before the IURC related to Edwardsport would resume, the

ultimate resolution of which could have an adverse impact on Duke Energy

Indiana’s financial position, results of operations and cash flows. In addition,

the inability to manage operating and capital costs under caps imposed under

the settlement could have an adverse impact on Duke Energy Indiana’s financial

position, results of operations and cash flows. See Note 4 to the Consolidated

Financial Statements, “Regulatory Matters,” for additional information.

On October 23, 2015, the EPA published in the Federal Register the

CPP rule for regulating CO2 emissions from existing fossil fuel-fired EGUs. The

CPP establishes CO2 emission rates and mass cap goals that apply to fossil

fuel-fired generation. Under the CPP, states are required to develop and submit

a final compliance plan, or an initial plan with an extension request, to the EPA

by September 6, 2016, or no later than September 6, 2018, with an approved

extension. These state plans are subject to EPA approval, with a federal plan

applied to states that fail to submit a plan to the EPA or if a state plan is

not approved. Legal challenges to the CPP have been filed by stakeholders

and motions to stay the requirements of the rule pending the outcome of the

litigation have been filed. The U.S. Supreme Court granted a Motion to Stay in

February 2016, effectively blocking enforcement of the rule until legal challenges

are resolved. Final resolution of these legal challenges could take several years.

Compliance with CPP could cause the industry to replace coal generation with

natural gas and renewables, especially in states that have significant CO2

reduction targets under the rule. Costs to operate coal-fired generation plants

continue to grow due to increasing environmental compliance requirements,

including ash management costs unrelated to CPP, and this may result in the

retirement of coal-fired generation plants earlier than the current useful lives.

Duke Energy Indiana continues to evaluate the need to retire generating facilities

and plans to seek regulatory recovery, where appropriate, for amounts that have

not been recovered upon asset retirements. However, recovery is subject to

future regulatory approval, including the recovery of carrying costs on remaining

book values, and therefore cannot be assured. In addition, Duke Energy Indiana

could incur increased fuel, purchased power, operation and maintenance, and

other costs for replacement generation as a result of this rule. Duke Energy

Indiana cannot predict the outcome of these matters.

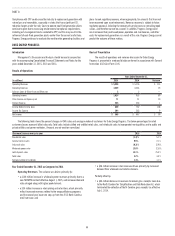

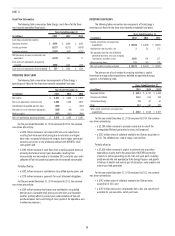

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Preparation of financial statements requires the application of accounting

policies, judgments, assumptions and estimates that can significantly affect the

reported results of operations and the amounts of assets and liabilities reported

in the financial statements. Judgments made include the likelihood of success

of particular projects, possible legal and regulatory challenges, earnings

assumptions on pension and other benefit fund investments and anticipated

recovery of costs, especially through regulated operations.

Management discusses these policies, estimates and assumptions with

senior members of management on a regular basis and provides periodic

updates on management decisions to the Audit Committee of the Board of

Directors. Management believes the areas described below require significant

judgment in the application of accounting policy or in making estimates and

assumptions that are inherently uncertain and that may change in subsequent

periods.

For further information, see Note 1 to the Consolidated Financial

Statements, “Summary of Significant Accounting Policies.”