Duke Energy 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

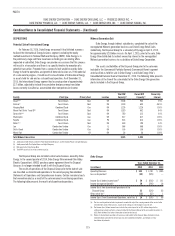

Combined Notes to Consolidated Financial Statements – (Continued)

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Regulatory Assets

Asset retirement obligations – coal ash $ 1,992 $ 840 $1,152 $ 1,152 $ — $ — $ —

Asset retirement obligations – nuclear and other 1,025 67 730 432 298 — —

Accrued pension and OPEB 2,015 412 812 354 458 132 217

Retired generation facilities 1,659 58 1,545 152 1,393 — 56

Debt fair value adjustment 1,305 — — — — — —

Net regulatory asset related to income taxes 1,144 614 354 141 213 64 111

Hedge costs and other deferrals 628 103 490 217 273 7 28

DSM/EE 330 106 203 193 10 21 —

Grid Modernization 76 — — — — 76 —

Vacation accrual 213 86 46 46 — 6 12

Deferred fuel and purchased power 246 50 182 138 44 9 5

Nuclear deferral 296 141 155 43 112 — —

Post-in-service carrying costs and deferred operating expenses 494 124 121 28 93 21 228

Gasification services agreement buyout 55 — — — — — 55

Transmission expansion obligation 70 — — — — 74 —

MGP 115 — — — — 115 —

Other 494 263 109 66 42 36 66

Total regulatory assets 12,157 2,864 5,899 2,962 2,936 561 778

Less: current portion 1,115 399 491 287 203 49 93

Total noncurrent regulatory assets $11,042 $2,465 $5,408 $ 2,675 $2,733 $ 512 $685

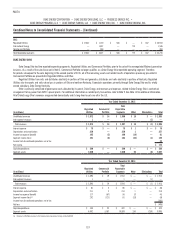

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Regulatory Liabilities

Costs of removal $ 5,221 $2,420 $ 1,975 $1,692 $ 283 $ 222 $ 613

Amounts to be refunded to customers 166 — 70 — 70 — 96

Storm reserve 150 25 125 — 125 — —

Accrued pension and OPEB 379 76 121 61 60 19 91

Deferred fuel and purchased power 37 6 23 23 — — 8

Other 444 217 171 127 44 10 42

Total regulatory liabilities 6,397 2,744 2,485 1,903 582 251 850

Less: current portion 204 34 106 71 35 10 54

Total noncurrent regulatory liabilities $ 6,193 $2,710 $ 2,379 $1,832 $ 547 $ 241 $ 796

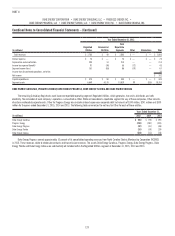

Descriptions of regulatory assets and liabilities, summarized in the tables

above, as well as their recovery and amortization periods follow. Items are

excluded from rate base unless otherwise noted.

Asset retirement obligations – coal ash. Represents regulatory assets

including deferred depreciation and accretion related to the legal obligation

to close ash basins. The costs are deferred until recovery treatment has been

determined. The recovery period for these costs has yet to be established. Duke

Energy Carolinas, Duke Energy Progress and Duke Energy Ohio earn a debt

return on their expenditures. See Notes 1 and 9 for additional information.

Asset retirement obligations – nuclear and other. Represents

regulatory assets, including deferred depreciation and accretion, related to

legal obligations associated with the future retirement of property, plant and

equipment, excluding amounts related to coal ash. The Asset retirement

obligations relate primarily to decommissioning nuclear power facilities. The

amounts also include certain deferred gains on NDTF investments. The recovery

period for costs related to nuclear facilities runs through the decommissioning

period of each nuclear unit, the latest of which is currently estimated to be

2086. See Notes 1 and 9 for additional information.

Accrued pension and OPEB. Accrued pension and OPEB represent

regulatory assets and liabilities related to each of the Duke Energy Registrants’

respective shares of unrecognized actuarial gains and losses and unrecognized

prior service cost and credit attributable to Duke Energy’s pension plans and

OPEB plans. The regulatory asset or liability is amortized with the recognition

of actuarial gains and losses and prior service cost and credit to net periodic

benefit costs for pension and OPEB plans. See Note 21 for additional detail.