Duke Energy 2015 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

157

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

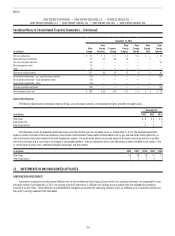

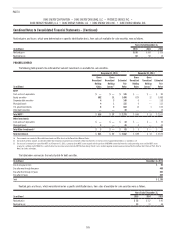

COMMODITY PRICE RISK

The Duke Energy Registrants are exposed to the impact of changes in the

prices of electricity, coal and natural gas. Exposure to commodity price risk is

influenced by a number of factors including the term of contracts, the liquidity of

markets and delivery locations.

Regulated public utilities may have cost-based rate regulations and

various other cost recovery mechanisms that result in a limited exposure to

market volatility of commodity fuel prices. Financial derivative contracts, where

approved by the respective state regulatory commissions, can be used to

manage the risk of price volatility. At December 31, 2015, all of Duke Energy’s

open commodity derivative instruments were undesignated because they are

accounted for under regulatory accounting. Mark-to-market gains or losses on

contracts that use regulatory accounting are deferred as regulatory liabilities or

regulatory assets, respectively. Undesignated contracts expire as late as 2048.

The Subsidiary Registrants utilize cost-tracking mechanisms, commonly

referred to as fuel adjustment clauses. These clauses allow for the recovery of

fuel and fuel-related costs, including settlements of undesignated derivatives

for fuel commodities, and portions of purchased power costs through surcharges

on customer rates. The difference between the costs incurred and the surcharge

revenues is recorded as an adjustment to Fuel used in electric generation and

purchased power – regulated or as Operating Revenues: Regulated electric

on the Consolidated Statements of Operations with an offsetting impact on

regulatory assets or liabilities. Therefore, due to the regulatory accounting

followed by the Subsidiary Registrants for undesignated derivatives, realized

and unrealized gains and losses on undesignated commodity derivatives do not

have an immediate impact on reported net income.

Mark-to-market gains and losses related to the nonregulated Midwest

generation business were recorded in discontinued operations and open

positions at April 2, 2014, were included in the sale of the Disposal Group.

Refer to Note 2 for further information on the sale of the Disposal Group. Gains

and losses on undesignated derivative contracts for nonregulated continuing

operations are not material.

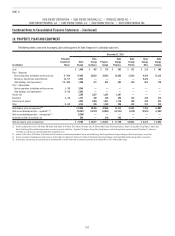

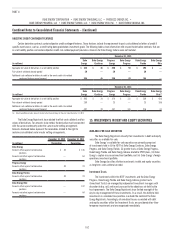

Volumes

The tables below show information relating to volumes of outstanding

commodity derivatives. Amounts disclosed represent the absolute value of

notional volumes of commodity contracts excluding NPNS. The Duke Energy

Registrants have netted contractual amounts where offsetting purchase and

sale contracts exist with identical delivery locations and times of delivery. Where

all commodity positions are perfectly offset, no quantities are shown.

December 31, 2015

Duke

Energy

Duke Energy

Carolinas

Progress

Energy

Duke Energy

Progress

Duke Energy

Florida

Duke Energy

Ohio

Duke Energy

Indiana

Electricity (gigawatt-hours) 70 — — — — 34 36

Natural gas (millions of decatherms) 398 66 332 117 215 — —

December 31, 2014

Duke

Energy

Duke Energy

Carolinas

Progress

Energy

Duke Energy

Progress

Duke Energy

Florida

Duke Energy

Ohio

Duke Energy

Indiana

Electricity (gigawatt-hours)(a)(b) 25,370 — — — — 19,141 —

Natural gas (millions of decatherms)(a) 676 35 328 116 212 313 —

(a) Duke Energy Ohio includes amounts related to the Disposal Group. Refer to Note 2 for further information on the sale.

(b) Amounts at Duke Energy Ohio include intercompany positions that eliminate at Duke Energy.