Duke Energy 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

For Duke Energy, the revised accounting guidance is effective for interim

and annual periods beginning January 1, 2018, by recording a cumulative effect

to the balance sheet as of January 1, 2018. This guidance is expected to have

minimal impact on Duke Energy’s Statement of Comprehensive Income as

changes in the fair value of most of Duke Energy’s available-for-sale equity

securities are deferred as regulatory assets or liabilities.

2. ACQUISITIONS AND DISPOSITIONS

ACQUISITIONS

The Duke Energy Registrants consolidate assets and liabilities from

acquisitions as of the purchase date, and include earnings from acquisitions in

consolidated earnings after the purchase date.

Acquisition of Piedmont Natural Gas

On October 24, 2015, Duke Energy entered into an Agreement and

Plan of Merger (Merger Agreement) with Piedmont Natural Gas Company,

Inc. (Piedmont), a North Carolina corporation. Under the terms of the Merger

Agreement, Duke Energy will acquire Piedmont for $4.9 billion in cash. Upon

closing, Piedmont will become a wholly owned subsidiary of Duke Energy.

Pursuant to the Merger Agreement, upon the closing of the merger,

each share of Piedmont common stock issued and outstanding immediately

prior to the closing will be converted automatically into the right to receive

$60 in cash per share. In addition, Duke Energy will assume Piedmont’s

existing debt, which was approximately $1.9 billion at October 31, 2015, the

end of Piedmont’s most recent fiscal year. Duke Energy expects to finance

the transaction with a combination of debt, equity issuances and other cash

sources. As of December 31, 2015, Duke Energy entered into $900 million of

forward starting interest rate swaps to lock in components of interest rates

for the expected financing. The change in the fair value of the swaps from

inception to December 31, 2015, was not material. For additional information

on the forward-starting swaps, see Note 14.

In connection with the Merger Agreement with Piedmont, Duke Energy

entered into a $4.9 billion senior unsecured bridge financing facility (Bridge

Facility) with Barclays Capital, Inc. (Barclays). The Bridge Facility, if drawn

upon, may be used to (i) fund the cash consideration for the transaction

and (ii) pay certain fees and expenses in connection with the transaction.

In November 2015, Barclays syndicated its commitment under the Bridge

Facility to a broader group of lenders. Duke Energy does not expect to draw

upon the Bridge Facility.

The Federal Trade Commission (FTC) has granted early termination

of the 30-day waiting period under the federal Hart-Scott-Rodino Antitrust

Improvements Act of 1976. On January 22, 2016, shareholders of Piedmont

Natural Gas approved the company’s acquisition by Duke Energy. On

January 15, 2016, Duke Energy filed for approval of the transaction and

associated financing requests with the NCUC. On January 29, 2016, the

NCUC approved the financing requests. On January 15, 2016, Duke Energy

and Piedmont filed a joint request with the Tennessee Regulatory Authority for

approval of a change in control of Piedmont that will result from Duke Energy’s

acquisition of Piedmont. In that request, Duke Energy and Piedmont requested

that the Authority approve the change in control on or before April 30, 2016.

Subject to receipt of required regulatory approvals and meeting closing

conditions, Duke Energy and Piedmont target a closing by the end of 2016.

On December 11, 2015, Duke Energy Kentucky filed a declaratory

request with the KPSC seeking a finding that the transaction does not

constitute a change in control of Duke Energy Kentucky requiring KPSC

approval. Duke Energy also presented the transaction for information before

the PSCSC on January 13, 2016.

The Merger Agreement contains certain termination rights for both Duke

Energy and Piedmont, and provides that, upon termination of the Merger

Agreement under specified circumstances, Duke Energy would be required

to pay a termination fee of $250 million to Piedmont and Piedmont would be

required to pay Duke Energy a termination fee of $125 million.

See Note 4 for additional information regarding Duke Energy and

Piedmont’s joint investment in Atlantic Coast Pipeline, LLC (ACP).

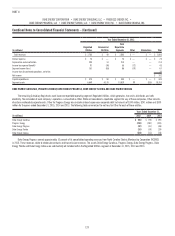

Purchase of NCEMPA’s Generation

On July 31, 2015, Duke Energy Progress completed the purchase of North

Carolina Eastern Municipal Power Agency’s (NCEMPA) ownership interests in

certain generating assets, fuel and spare parts inventory jointly owned with

and operated by Duke Energy Progress for approximately $1.25 billion. This

purchase was accounted for as an asset acquisition. The purchase resulted in

the acquisition of a total of approximately 700 megawatts (MW) of generating

capacity at Brunswick Nuclear Plant, Shearon Harris Nuclear Plant, Mayo Steam

Plant and Roxboro Steam Plant. In connection with this transaction, Duke Energy

Progress and NCEMPA entered into a 30-year wholesale power agreement,

whereby Duke Energy Progress will sell power to NCEMPA to continue to meet

the needs of NCEMPA customers.

The purchase price exceeds the historical carrying value of the acquired

assets by $350 million, which was recognized as an acquisition adjustment,

recorded in property, plant and equipment. Duke Energy Progress received FERC

approval for inclusion of the acquisition adjustment in wholesale power formula

rates on December 9, 2014. On July 8, 2015, the NCUC adopted a new rule

that enables a rider mechanism for recovery of the costs to acquire, operate

and maintain interests in the assets purchased as allocated to Duke Energy

Progress’ North Carolina retail operations, including the acquisition adjustment.

Pursuant to the NCUC’s approval, Duke Energy Progress implemented a rider

to recover costs associated with the NCEMPA asset acquisition effective

December 1, 2015. Duke Energy Progress also received an order from the

PSCSC to defer the recovery of the South Carolina retail allocated costs of the

asset purchased until the Company’s next general rate case.

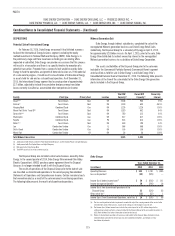

Assets Acquired

The ownership interests in generating assets acquired are subject to rate-

setting authority of the FERC, NCUC and PSCSC and accordingly, the assets are

recorded at historical cost. The assets acquired are presented in the following

table.

(in millions)

Inventory $ 56

Net property, plant and equipment 845

Total assets 901

Acquisition adjustment, recorded within property, plant and equipment 350

Total purchase price $ 1,251

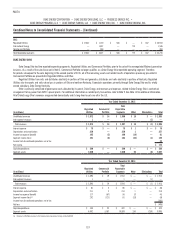

In connection with the acquisition, Duke Energy Progress acquired

NCEMPA’s nuclear decommissioning trust fund assets of $287 million and

assumed asset retirement obligations of $204 million associated with NCEMPA’s

interest in the generation assets. The nuclear decommissioning trust fund and

the asset retirement obligation are subject to regulatory accounting treatment.