Duke Energy 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

PART II

SEGMENT RESULTS

The remaining information presented in this discussion of results of operations is on a GAAP basis.

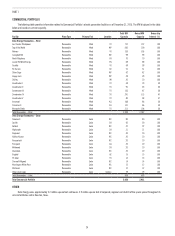

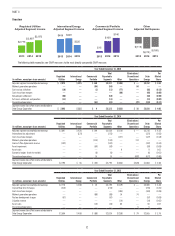

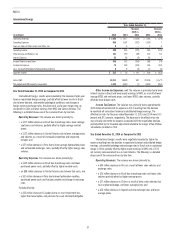

Regulated Utilities

(in millions)

Years Ended December 31,

2015 2014

Variance

2015 vs.

2014 2013

Variance

2014 vs.

2013

Operating Revenues $ 22,062 $ 22,271 $ (209) $ 20,910 $ 1,361

Operating Expenses 16,698 17,026 (328) 16,126 900

Gains on Sales of Other Assets and Other, net 11 4 7 7 (3)

Operating Income 5,375 5,249 126 4,791 458

Other Income and Expense, net 262 267 (5) 221 46

Interest Expense 1,097 1,093 4 986 107

Income Before Income Taxes 4,540 4,423 117 4,026 397

Income Tax Expense 1,647 1,628 19 1,522 106

Segment Income $ 2,893 $ 2,795 $ 98 $ 2,504 $ 291

Duke Energy Carolinas Gigawatt-Hours (GWh) sales 87,375 87,645 (270) 85,790 1,855

Duke Energy Progress GWh sales 64,881 62,871 2,010 60,204 2,667

Duke Energy Florida GWh sales 40,053 38,703 1,350 37,974 729

Duke Energy Ohio GWh sales 25,439 24,735 704 24,557 178

Duke Energy Indiana GWh sales 33,518 33,433 85 33,715 (282)

Total Regulated Utilities GWh sales 251,266 247,387 3,879 242,240 5,147

Net proportional MW capacity in operation 50,170 49,600 570 49,607 (7)

Year Ended December 31, 2015 as Compared to 2014

Regulated Utilities’ results increased due to an increase in wholesale

power margins, growth in retail sales, and increased retail pricing primarily

due to rate riders in most jurisdictions, including increased revenues related

to energy efficiency programs, and higher base rates primarily due to phasing

of 2013 rate cases. These drivers were partially offset by impairment expense

associated with the 2015 Edwardsport IGCC settlement, higher operations and

maintenance expenses, and increased depreciation and amortization expense.

The following is a detailed discussion of the variance drivers by line item.

Operating Revenues. The variance was driven primarily by:

• a $339 million decrease in fuel revenues driven primarily by overall

lower fuel rates for electric retail customers. Fuel revenues represent

sales to retail and wholesale customers; and

• a $131 million decrease in revenues to recover gross receipts taxes

due to the North Carolina Tax Simplification and Rate Reduction Act,

which terminated the collection of the North Carolina gross receipts tax

effective July 1, 2014.

Partially offset by:

• a $175 million increase in wholesale power revenues, primarily due to

additional volumes and capacity charges for customers served under

long-term contracts, including the NCEMPA wholesale contract that

became effective August 1, 2015; and

• a $79 million increase from retail sales growth (net of fuel revenue)

reflecting increased demand.

Operating Expenses. The variance was driven primarily by:

• a $422 million decrease in fuel expense (including purchased power

and natural gas purchases for resale) primarily due to (i) lower natural

gas and coal prices, (ii) lower volumes of coal and oil used in electric

generation and (iii) lower gas prices and volumes to full-service retail

gas customers, partially offset by (iv) higher volumes of natural gas

used in electric generation; and

• a $116 million decrease in property and other taxes primarily due to

the termination of the collection of the North Carolina gross receipts

tax as mentioned above, and the partial reversal of a sales tax reserve

recorded in 2014 at Duke Energy Indiana, partially offset by higher

property taxes across multiple jurisdictions and a favorable 2014 Ohio

gas excise tax settlement that did not recur in 2015.

Partially offset by:

• an $88 million impairment charge related to the 2015 Edwardsport

IGCC settlement. See Note 4 to the Consolidated Financial Statements,

“Regulatory Matters,” for additional information;

• a $56 million increase in operations and maintenance expense

primarily due to planned nuclear spending and the prior-year benefit of

the adoption of nuclear outage levelization, higher costs for customer

programs and distribution projects, and higher maintenance costs at

fossil generation stations primarily due to increased ownership interest

in assets acquired from NCEMPA, partially offset by a 2014 litigation

reserve related to the investigation of the Dan River coal ash spill (see

Note 5 to the Consolidated Financial Statements, “Commitments and

Contingencies,” for additional information), and lower storm restoration

costs; and

• a $55 million increase in depreciation and amortization expense

primarily due to increased plant in service.