Duke Energy 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

PART II

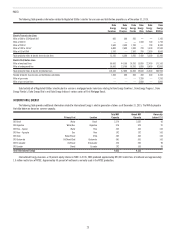

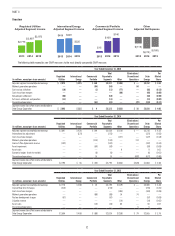

Adjusted earnings decreased from 2014 to 2015 primarily due to lower

earnings at International Energy as a result of unfavorable hydrology and

changes in foreign currency exchange rates, partially offset by improved

earnings at Regulated Utilities from improved retail pricing and wholesale

margins net of higher operations and maintenance expense.

Adjusted earnings increased from 2013 to 2014 primarily due to the

impact of revised rates and favorable weather, partially offset by higher

depreciation and amortization expense.

See “Results of Operations” below for a detailed discussion of the

consolidated results of operations, as well as a detailed discussion of financial

results for each of Duke Energy’s reportable business segments, as well as

Other.

2015 Areas of Focus and Accomplishments

In 2015, Duke Energy advanced a number of important strategic

initiatives to transform the energy future with a focus on customers, employees,

operations and growth. Duke Energy announced the acquisition of Piedmont,

completed the purchase of North Carolina Eastern Municipal Power Agency’s

(NCEMPA) generation assets, completed the sale of the nonregulated Midwest

Generation business and executed on the coal ash strategy to continue moving

toward ash basin closures. Duke Energy also accomplished industry-leading

safety and environmental performance and increased the growth rate of the

dividend, a significant component of the investor value proposition.

Acquisition of Piedmont Natural Gas. In 2015, Duke Energy entered

into a Merger Agreement with Piedmont, under which Duke Energy will

acquire Piedmont for $4.9 billion in cash. This acquisition reflects the growing

importance of natural gas to the future of the energy infrastructure within the

company’s service territory, and throughout the U.S., and establishes a platform

for future growth in natural gas infrastructure.

Purchase of NCEMPA’s Generation. In 2015, Duke Energy completed

the acquisition of NCEMPA’s ownership interest in some of Duke Energy

Progress’s existing nuclear and coal generation for a total amount of

approximately $1.25 billion. Duke Energy and NCEMPA signed a long-term

wholesale contract to provide power to NCEMPA’s customers previously served

by the generation assets purchased by Duke Energy.

Sale of the Midwest Generation Business. In 2015, Duke Energy

completed the sale of the Disposal Group to Dynegy for approximately $2.8

billion. This decision supports Duke Energy’s strategy to focus investments

on businesses with more predictable and less volatile earnings. The proceeds

from the sale were used, in part, to recapitalize Duke Energy through a stock

repurchase program and deferrals of the issuance of long-term debt.

Operational Excellence of the Nuclear Fleet. Duke Energy’s nuclear

fleet set a company record for total electricity production and demonstrated a

combined capacity factor at approximately 94 percent, the 17th consecutive

year above 90 percent on this plant reliability measure.

Coal Ash Management. On April 17, 2015, the EPA published the RCRA

in the Federal Register, establishing rules to regulate the disposal of CCR from

electric utilities as solid waste. The RCRA, and the Coal Ash Act, as amended,

finalized the legal framework related to coal ash management practices and

ash basin closure. With final rules in place, Duke Energy has made significant

progress toward closure of coal ash basins and has recommended excavation of

24 basins in the Carolinas. In addition, Duke Energy has performed comprehensive

groundwater studies at each North Carolina basin and provided that information

to the North Carolina Department of Environmental Quality (NCDEQ), which was

used by NCDEQ to risk-rank each North Carolina basin. These draft risk rankings

provide additional direction for the closure of each basin.

Also in 2015, Duke Energy began closure activities on the four sites

specified as high risk by the Coal Ash Act and at the W.S. Lee site in South

Carolina. At each site, excavation has commenced, with coal ash moving off-site

for use in structural fill or to lined landfills.

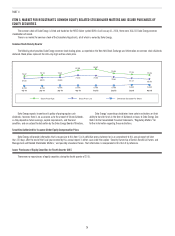

Deliver Merger Benefits. Duke Energy continues to focus on realizing

benefits of the merger with Progress Energy. Duke Energy is on track to achieve the

$687 million of guaranteed savings for customers in the Carolinas over five years.

After 31/2 years, Duke Energy Carolinas and Duke Energy Progress have generated

approximately 90 percent of the guaranteed fuel and joint dispatch savings.

Grow the Dividend. In 2015, Duke Energy increased the growth rate of the

dividend to an annual rate of approximately 4 percent.

Duke Energy Objectives – 2016 and Beyond

Duke Energy will continue to deliver exceptional value to our customers,

be an integral part of the communities in which we do business, and provide

attractive returns to our investors. Duke Energy is committed to lead the way

to cleaner, smarter energy solutions that customers value through a strategy

focused on:

• Transformation of the customer experience to meet the changing

customer expectations through enhanced convenience, control and

choice in energy supply and usage.

• Modernization of the power grid to improve reliability and flexibility in

support of increased distributed energy sources.

• Generation of cleaner energy through an increased amount of natural

gas, renewables generation and the continued safe and reliable

operation of nuclear plants.

• Operational excellence through engagement with employees and being

one of the best safety performers in the industry.

• Stakeholder engagement to ensure the regulatory rules in the states in

which we operate benefit all customers.

Primary objectives toward the implementation of this strategy include:

Complete the Acquisition of Piedmont. As discussed above, Duke

Energy will continue to pursue the remaining required regulatory approvals to

achieve completion of the Piedmont acquisition in 2016. This acquisition will

establish a broader gas infrastructure platform within Duke Energy.

Duke Energy expects to finance the acquisition through a combination of

debt, newly issued equity and other cash sources.

Potential Sale of the Latin American Generation Business. On

February 18, 2016, Duke Energy announced it had initiated a process to divest

the International Energy business segment, excluding the equity investment

in NMC. The process remains in a preliminary stage and there have been no

binding or non-binding offers requested or submitted. There is no specific

timeline for execution of a potential transaction. The sale is expected to be

dilutive to Duke Energy but would improve Duke Energy’s risk profile and

enhance its ability to generate more consistent earnings and cash flows over

time. Proceeds from a successful sale would be used to fund the operations and

growth of its domestic business.