Duke Energy 2015 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

security to meet their obligations under the Plea Agreements. Payments under

the Plea Agreements will be borne by shareholders and are not tax deductible.

Duke Energy Corporation has agreed to issue a guarantee of all payments

and performance due from DEBS, Duke Energy Carolinas and Duke Energy

Progress, including but not limited to payments for fines, restitution, community

service, mitigation and the funding of, and obligations under, the environmental

compliance plans. As a result of the Plea Agreements, Duke Energy Carolinas

and Duke Energy Progress recognized charges of $72 million and $30 million,

respectively, in Operation, maintenance and other on the Consolidated

Statements of Operations and Comprehensive Income during 2014. Payment of

the amounts relating to fines and restitution were made between May and July

2015. The Plea Agreements do not cover pending civil claims related to the Dan

River coal ash release and operations at other North Carolina coal plants.

On May 14, 2015, Duke Energy reached an Interim Administrative

Agreement with the U.S. Environmental Protection Agency Office of Suspension

and Debarment that avoids debarment of DEBS, Duke Energy Carolinas or Duke

Energy Progress with respect to all active generating facilities. The Interim

Administrative Agreement imposes a number of requirements relating to

environmental and ethical compliance, subject to the oversight of an independent

monitor.

Potential Groundwater Contamination Claims

Beginning in May 2015, a number of residents living in the vicinity of the

North Carolina facilities with ash basins received letters from NCDEQ advising

them not to drink water from the private wells on their land tested by NCDEQ

as the samples were found to have certain substances at levels higher than the

criteria set by the North Carolina Department of Health and Human Services

(DHHS). The criteria, in some cases, are considerably more stringent than federal

drinking water standards established to protect human health and welfare.

The Coal Ash Act requires additional groundwater monitoring and assessments

for each of the 14 coal-fired plants in North Carolina, including sampling of

private water supply wells. The data gathered through these Comprehensive

Site Assessments (CSAs) will be used by NCDEQ to determine whether the

water quality of these private water supply wells has been adversely impacted

by the ash basins. Duke Energy has submitted CSAs documenting the results of

extensive groundwater monitoring around coal ash basins at all 14 of the plants

with coal ash basins. Generally, the data gathered through the installation of

new monitoring wells and soil and water samples across the state have been

consistent with historical data provided to state regulators over many years.

The DHHS and NCDEQ sent follow-up letters on October 15, 2015, to residents

near coal ash basins who have had their wells tested, stating that private well

samplings at a considerable distance from coal ash impoundments, as well

as some municipal water supplies, contain similar levels of vanadium and

hexavalent chromium which leads investigators to believe these constituents

are naturally occurring. It is not possible to estimate the maximum exposure of

loss, if any, that may occur in connection with claims which might be made by

these residents.

Duke Energy Carolinas

New Source Review

In 1999-2000, the U.S. Department of Justice (DOJ) on behalf of the EPA

filed a number of complaints and notices of violation against multiple utilities,

including Duke Energy Carolinas, for alleged violations of the New Source Review

(NSR) provisions of the Clean Air Act (CAA). The government alleges the utilities

violated the CAA when undertaking certain maintenance and repair projects at

certain coal plants without (i) obtaining NSR permits and (ii) installing the best

available emission controls for sulfur dioxide, nitrogen oxide and particulate

matter. The complaints sought the installation of pollution control technology on

generating units that allegedly violated the CAA, and unspecified civil penalties in

amounts of up to $37,500 per day for each violation.

In 2000, the government sued Duke Energy Carolinas in the U.S. District

Court in Greensboro, North Carolina, claiming NSR violations for 29 projects

performed at 25 of Duke Energy Carolinas’ coal-fired units. Duke Energy

Carolinas asserted there were no CAA violations because the applicable

regulations do not require NSR permitting in cases where the projects undertaken

are routine or otherwise do not result in an increase in emissions. In 2011, the

parties filed a stipulation agreeing to dismiss with prejudice all but 13 claims at

13 generating units, 11 of which have since been retired. On October 20, 2015,

the Court approved and entered a consent decree to resolve this matter. Under

the consent decree, Duke Energy Carolinas will retire by the end of 2024, the

remaining units at the Allen plant that are part of the litigation as well as a

third unit that is not part of the litigation. Prior to closure, Duke Energy Carolinas

will comply with new, lower emissions limits at the Allen units named in the

litigation. Additionally, Duke Energy Carolinas will spend approximately $4 million

on environmental projects and donations and pay a civil penalty of $975,000.

This matter is now closed.

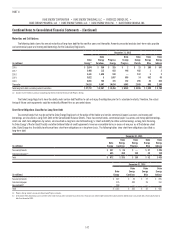

Asbestos-related Injuries and Damages Claims

Duke Energy Carolinas has experienced numerous claims for

indemnification and medical cost reimbursement related to asbestos exposure.

These claims relate to damages for bodily injuries alleged to have arisen from

exposure to or use of asbestos in connection with construction and maintenance

activities conducted on its electric generation plants prior to 1985. As of

December 31, 2015, there were 156 asserted claims for non-malignant cases

with the cumulative relief sought of up to $37 million, and 70 asserted claims for

malignant cases with the cumulative relief sought of up to $11 million. Based on

Duke Energy Carolinas’ experience, it is expected that the ultimate resolution of

most of these claims likely will be less than the amount claimed.

Duke Energy Carolinas has recognized asbestos-related reserves of $536

million and $575 million at December 31, 2015 and 2014, respectively. These

reserves are classified in Other within Deferred Credits and Other Liabilities

and Other within Current Liabilities on the Consolidated Balance Sheets. These

reserves are based upon the minimum amount of the range of loss for current

and future asbestos claims through 2033, are recorded on an undiscounted basis

and incorporate anticipated inflation. In light of the uncertainties inherent in a

longer-term forecast, management does not believe they can reasonably estimate

the indemnity and medical costs that might be incurred after 2033 related to

such potential claims. It is possible Duke Energy Carolinas may incur asbestos

liabilities in excess of the recorded reserves.

Duke Energy Carolinas has third-party insurance to cover certain losses

related to asbestos-related injuries and damages above an aggregate self-

insured retention. Duke Energy Carolinas’ cumulative payments began to exceed

the self-insurance retention in 2008. Future payments up to the policy limit will

be reimbursed by the third-party insurance carrier. The insurance policy limit

for potential future insurance recoveries indemnification and medical cost claim

payments is $847 million in excess of the self-insured retention. Receivables for

insurance recoveries were $599 million and $616 million at December 31, 2015

and 2014, respectively. These amounts are classified in Other within Investments

and Other Assets and Receivables on the Consolidated Balance Sheets. Duke

Energy Carolinas is not aware of any uncertainties regarding the legal sufficiency

of insurance claims. Duke Energy Carolinas believes the insurance recovery

asset is probable of recovery as the insurance carrier continues to have a strong

financial strength rating.