Duke Energy 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

6

ITEM 1. BUSINESS

DUKE ENERGY

General

Duke Energy Corporation (collectively with its subsidiaries, Duke Energy)

is an energy company headquartered in Charlotte, North Carolina, subject to

regulation by the Federal Energy Regulatory Commission (FERC). Duke Energy

operates in the United States (U.S.) and Latin America primarily through

its direct and indirect subsidiaries. Duke Energy’s subsidiaries include its

subsidiary registrants (collectively referred to as the Subsidiary Registrants);

Duke Energy Carolinas, LLC (Duke Energy Carolinas); Progress Energy, Inc.

(Progress Energy); Duke Energy Progress, LLC (formerly Duke Energy Progress,

Inc.) (Duke Energy Progress); Duke Energy Florida, LLC (formerly Duke Energy

Florida, Inc.) (Duke Energy Florida); Duke Energy Ohio, Inc. (Duke Energy Ohio);

and Duke Energy Indiana, LLC (formerly Duke Energy Indiana, Inc.) (Duke Energy

Indiana). When discussing Duke Energy’s consolidated financial information, it

necessarily includes the results of its Subsidiary Registrants, which along with

Duke Energy, are collectively referred to as the Duke Energy Registrants.

Duke Energy has entered into an Agreement and Plan of Merger (Merger

Agreement) with Piedmont Natural Gas Company, Inc. (Piedmont), a North

Carolina corporation. Piedmont is an energy services company primarily

engaged in the distribution of natural gas to residential, commercial, industrial

and power generation customers in portions of North Carolina, South Carolina

and Tennessee. Under terms of the Merger Agreement, Duke Energy will acquire

Piedmont for $4.9 billion in cash and Piedmont will become a wholly owned

subsidiary of Duke Energy. Piedmont’s common stock will be delisted from the

New York Stock Exchange (NYSE). Duke Energy and Piedmont target to close the

transaction by the end of 2016 subject to meeting various conditions, including

receipt of required regulatory approvals. For additional information see Note 2 to

the Consolidated Financial Statements, “Acquisitions and Dispositions.”

Duke Energy completed the sale of the nonregulated Midwest generation

business and Duke Energy Retail Sales, LLC (collectively, the Disposal Group)

to Dynegy Inc. (Dynegy) on April 2, 2015, for approximately $2.8 billion in

cash. The Disposal Group primarily included Duke Energy Ohio’s coal-fired

and gas-fired generation assets located in the Midwest region of the United

States and dispatched into the PJM wholesale market. The Disposal Group also

included a retail sales subsidiary of Duke Energy, that served retail electric and

gas customers in Ohio with energy and other energy services at competitive

rates. For additional information see Note 2 to the Consolidated Financial

Statements, “Acquisitions and Dispositions.”

The Duke Energy Registrants electronically file reports with the Securities

and Exchange Commission (SEC), including annual reports on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K, proxies and

amendments to such reports.

The public may read and copy any materials the Duke Energy Registrants

file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE,

Washington, DC 20549. The public may obtain information on the operation of

the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC

also maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically with

the SEC at http://www.sec.gov. Additionally, information about the Duke Energy

Registrants, including reports filed with the SEC, is available through Duke

Energy’s website at http://www.duke-energy.com. Such reports are accessible

at no charge and are made available as soon as reasonably practicable after

such material is filed with or furnished to the SEC.

Business Segments

Duke Energy conducts its operations in three business segments;

Regulated Utilities, International Energy and Commercial Portfolio (formerly

Commercial Power). The remainder of Duke Energy’s operations are presented

as Other. Duke Energy’s chief operating decision maker regularly reviews

financial information about each of these business segments in deciding how to

allocate resources and evaluate the performance of the business. For additional

information on each of these business segments, including financial and

geographic information, see Note 3 to the Consolidated Financial Statements,

“Business Segments.”

The following sections describe the business and operations of each of

Duke Energy’s reportable business segments, as well as Other.

REGULATED UTILITIES

Regulated Utilities conducts operations primarily through Duke Energy

Carolinas, Duke Energy Progress, Duke Energy Florida, Duke Energy Indiana,

and Duke Energy Ohio. These electric and gas operations are subject to the

rules and regulations of the FERC, the North Carolina Utilities Commission

(NCUC), the Public Service Commission of South Carolina (PSCSC), the

Florida Public Service Commission (FPSC), the Indiana Utility Regulatory

Commission (IURC), the Public Utilities Commission of Ohio (PUCO), and the

Kentucky Public Service Commission (KPSC).

Regulated Utilities serves 7.4 million retail electric customers in six

states in the Southeast and Midwest regions of the U.S. Its service area covers

approximately 95,000 square miles with an estimated population of 24 million

people. Regulated Utilities serves 525,000 retail natural gas customers in

southwestern Ohio and northern Kentucky. Electricity is also sold wholesale to

incorporated municipalities, electric cooperative utilities and other load-serving

entities.

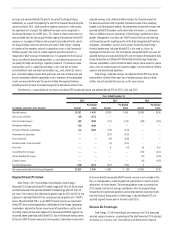

The following table represents the distribution of billed sales by customer class for the year ended December 31, 2015.

Duke

Energy

Carolinas(a)

Duke

Energy

Progress(a)

Duke

Energy

Florida(b)

Duke

Energy

Ohio(c)

Duke

Energy

Indiana(d)

Residential 32% 28% 50% 34% 27%

General service 33% 24% 38% 37% 25%

Industrial 25% 16% 8% 24% 31%

Total retail sales 90% 68% 96% 95% 83%

Wholesale and other sales 10% 32% 4% 5% 17%

Total sales 100% 100% 100% 100% 100%

(a) Primary general service sectors include health care, education, financial services, information technology and military buildings. Primary industrial sectors include textiles, chemicals, rubber and plastics, paper, food and

beverage, and auto manufacturing.

(b) Primary general service sectors include tourism, health care and government facilities and schools. Primary industrial sectors include phosphate rock mining and processing and citrus and other food processing.

(c) Primary general service sectors include health care, education, real estate and rental leasing, financial and insurance services, water/wastewater services, and wholesale trade services. Primary industrial sectors include

primary metals, chemicals, food and beverage, and transportation.

(d) Primary general service sectors include retail, financial, health care and education services. Primary industrial sectors include metals, transportation, building materials, food and beverage, and chemicals.