Duke Energy 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

PART II

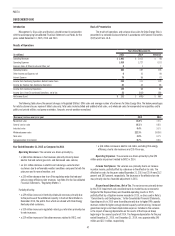

Cash Flow Information

The following table summarizes Duke Energy’s cash flows for the three

most recently completed fiscal years.

Years Ended December 31,

(in millions) 2015 2014 2013

Cash flows provided by (used in):

Operating activities $ 6,676 $ 6,586 $ 6,382

Investing activities (5,277) (5,373) (4,978)

Financing activities (2,578) (678) (1,327)

Net (decrease) increase in cash and cash

equivalents (1,179) 535 77

Cash and cash equivalents at beginning

of period 2,036 1,501 1,424

Cash and cash equivalents at end of period $ 857 $ 2,036 $ 1,501

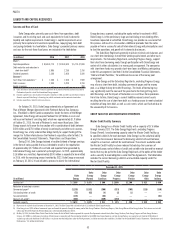

OPERATING CASH FLOWS

The following table summarizes key components of Duke Energy’s

operating cash flows for the three most recently completed fiscal year.

Years Ended December 31,

(in millions) 2015 2014 2013

Net income $ 2,831 $ 1,889 $ 2,676

Non-cash adjustments to net income 4,800 5,366 4,876

Contributions to qualified pension plans (302) — (250)

Payments for asset retirement obligations (346) (68) (12)

Working capital (307) (601) (908)

Net cash provided by operating activities $ 6,676 $ 6,586 $ 6,382

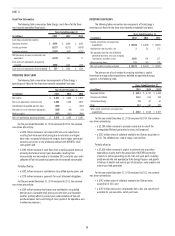

For the year ended December 31, 2015 compared to 2014, the variance

was driven primarily by:

• a $376 million increase in net income after non-cash adjustments

resulting from increased retail pricing due to rate riders and higher

base rates, increased wholesale net margins due to higher contracted

amounts and prices, a new wholesale contract with NCEMPA, retail

sales growth and

• a $294 million increase in cash flows from a working capital decrease

primarily due to lower current year receivables resulting from

unseasonably warmer weather in December 2015 and prior year under

collection of fuel and purchased power due to increased consumption.

Partially offset by:

• a $302 million increase in contributions to qualified pension plans and

• a $278 million increase in payments for asset retirement obligations.

For the year ended December 31, 2014 compared to 2013, the variance

was driven primarily by:

• a $204 million increase due to prior year contributions to qualified

pension plans, favorable retail pricing and rate riders and favorable

weather, partially offset by current year under collection of fuel and

purchased power costs and timing of cash payments for operations and

maintenance expenses.

INVESTING CASH FLOWS

The following table summarizes key components of Duke Energy’s

investing cash flows for the three most recently completed fiscal years.

Years Ended December 31,

(in millions) 2015 2014 2013

Capital, investment and acquisition

expenditures $ (8,363) $ (5,528) $ (5,607)

Available for sale securities, net 323 173

Net proceeds from the sale of Midwest

generation business and sales of equity

investments and other assets 2,968 179 277

Other investing items 115 (47) 179

Net cash used in investing activities $ (5,277) $ (5,373) $ (4,978)

The primary use of cash related to investing activities is capital,

investment and acquisition expenditures, detailed by reportable business

segment in the following table.

Years Ended December 31,

(in millions) 2015 2014 2013

Regulated Utilities $ 6,974 $ 4,744 $ 5,049

Commercial Portfolio 1,131 555 268

International Energy 45 67 67

Other 213 162 223

Total capital, investment and acquisition

expenditures $ 8,363 $ 5,528 $ 5,607

For the year ended December 31, 2015 compared to 2014, the variance

was driven primarily by:

• a $2,789 million increase in proceeds mainly due to sale of the

nonregulated Midwest generation business to Dynegy and

• a $202 million return of collateral related to the Chilean acquisition in

2013. The collateral was used to repay a secured loan.

Partially offset by:

• a $2,835 million increase in capital, investment and acquisition

expenditures mainly due to the acquisition of NCEMPA ownership

interests in certain generating assets, fuel and spare parts inventory

jointly owned with and operated by Duke Energy Progress and growth

initiatives in electric and natural gas infrastructure, solar projects and

natural-gas fired generation.

For the year ended December 31, 2014 compared to 2013, the variance

was driven primarily by:

• a $192 million return of collateral related to the Chilean hydro

acquisition in 2013 and

• a $150 million decrease in net proceeds from sales and maturities of

available for sale securities, net of purchases.