Duke Energy 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

PART II

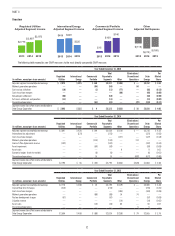

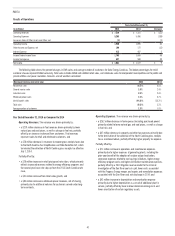

Growth Initiatives. Duke Energy will continue to pursue regulatory, state

and federal approval of the growth projects announced in 2015 and in earlier

periods. These projects will support long-term adjusted earnings growth and

support Duke Energy’s ability to continue providing its customers affordable,

reliable energy from an increasingly diverse generation portfolio.

Growth in the Regulated Utilities business is expected to be supported

by retail and wholesale load growth and significant investments. Duke Energy

expects to invest between $4 billion and $5 billion annually in the Regulated

Utilities business growth projects. Many of these projects will be recovered

through riders such as transmission and distribution expenditures in Indiana

and Ohio, as well as energy efficiency riders in the Carolinas.

The Commercial Portfolio renewables business is a significant component

of the Duke Energy growth strategy. Renewable projects enable Duke Energy

to respond to customer interest in clean energy resources while increasing

diversity in the generation portfolio. The portfolio of wind and solar is expected

to continue growing as between $1 billion and $2 billion of capital is expected to

be deployed over the next three years. Additionally, investments in the Atlantic

Coast Pipeline add approximately $1 billion of capital spending through 2017.

Duke Energy announced new growth initiatives in 2015, which include:

• Duke Energy Progress proposed an approximate $1 billion investment

in the Western Carolinas Modernization Project. The project will retire

and replace the existing coal units with two natural gas combined-cycle

280 MW fired generation projects, a utility scale solar power plant and

aggressive energy efficiency and demand-side management adoption

in the region.

• Commercial Portfolio acquired a 7.5 percent ownership interest in Sabal

Trail Transmission, LLC pipeline for a total estimated investment of

approximately $225 million upon completion of the project.

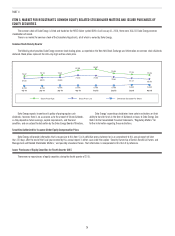

Cost Management. Duke Energy has a demonstrated track record of

driving efficiencies and productivity into the business. Duke Energy committed

to efficiencies following the merger with Progress Energy and is on track to meet

those commitments. Additionally, there is potential for more productivity and

efficiency gains leading to a target of 2016 operations and maintenance costs at

or below 2015 levels.

Continue the Coal Ash Management Strategy. Duke Energy will

continue the company’s compliance strategy with the Coal Ash Act and RCRA.

Duke Energy will update ash management plans to comply with the appropriate

regulations and expand excavation and other compliance work at additional

sites once plans and permits are approved.

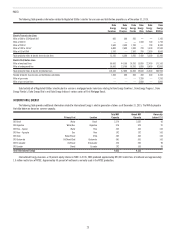

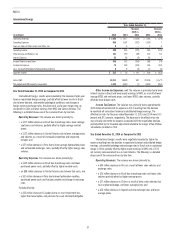

Results of Operations

In this section, Duke Energy provides analysis and discussion of earnings

and factors affecting earnings on both a GAAP and non-GAAP basis.

Management evaluates financial performance in part based on the

non-GAAP financial measures, adjusted earnings and adjusted diluted EPS.

These items are measured as income from continuing operations net of

income (loss) attributable to noncontrolling interests, adjusted for the dollar

and per share impact of mark-to-market impacts of economic hedges in

the Commercial Portfolio segment and special items including the operating

results of the Disposal Group classified as discontinued operations for

GAAP purposes. Special items represent certain charges and credits, which

management believes will not be recurring on a regular basis, although it is

reasonably possible such charges and credits could recur. Operating results

of the Disposal Group sold to Dynegy are reported as discontinued operations,

including a portion of the mark-to-market adjustments associated with

derivative contracts. Management believes that including the operating results

of the Disposal Group reported as discontinued operations better reflects its

financial performance and therefore has included these results in adjusted

earnings and adjusted diluted EPS prior to the sale of the Disposal Group.

Additionally, as a result of completing the sale of the Disposal Group during the

second quarter of 2015, state income tax expense increased as state income

tax apportionments changed. The additional tax expense was recognized in

Continuing Operations on a GAAP basis. This impact to state income taxes has

been excluded from the Commercial Portfolio segment for adjusted diluted EPS

purposes as management believes these impacts are incidental to the sale of

the Disposal Group. Derivative contracts are used in Duke Energy’s hedging

of a portion of the economic value of its generation assets in the Commercial

Portfolio segment. The mark-to-market impact of derivative contracts is

recognized in GAAP earnings immediately and, if associated with the Disposal

Group, classified as discontinued operations, as such derivative contracts do

not qualify for hedge accounting or regulatory treatment. The economic value

of generation assets is subject to fluctuations in fair value due to market

price volatility of input and output commodities (e.g., coal, electricity, natural

gas). Economic hedging involves both purchases and sales of those input and

output commodities related to generation assets. Operations of the generation

assets are accounted for under the accrual method. Management believes

excluding impacts of mark-to-market changes of the derivative contracts from

adjusted earnings until settlement better matches the financial impacts of

the derivative contract with the portion of economic value of the underlying

hedged asset. Management believes the presentation of adjusted earnings and

adjusted diluted EPS provides useful information to investors, as it provides

them an additional relevant comparison of Duke Energy’s performance across

periods. Management uses these non-GAAP financial measures for planning

and forecasting and for reporting results to the Duke Energy Board of Directors

(Board of Directors), employees, shareholders, analysts and investors

concerning Duke Energy’s financial performance. Adjusted diluted EPS is also

used as a basis for employee incentive bonuses. The most directly comparable

GAAP measures for adjusted earnings and adjusted diluted EPS are Net Income

Attributable to Duke Energy Corporation and Diluted EPS Attributable to Duke

Energy Corporation common shareholders, which include the dollar and per-

share impact of special items, mark-to-market impacts of economic hedges in

the Commercial Portfolio segment and discontinued operations.

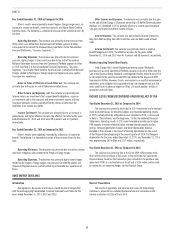

Management evaluates segment performance based on segment income.

Segment income is defined as income from continuing operations net of income

attributable to noncontrolling interests. Segment income, as discussed below,

includes intercompany revenues and expenses that are eliminated in the

Consolidated Financial Statements. Management also uses adjusted segment

income as a measure of historical and anticipated future segment performance.

Adjusted segment income is a non-GAAP financial measure, as it is based upon

segment income adjusted for the mark-to-market impacts of economic hedges

in the Commercial Portfolio segment and special items, including the operating

results of the Disposal Group classified as discontinued operations for GAAP

purposes. Management believes the presentation of adjusted segment income

as presented provides useful information to investors, as it provides them with

an additional relevant comparison of a segment’s performance across periods.

The most directly comparable GAAP measure for adjusted segment income is

segment income, which represents segment income from continuing operations,

including any special items and the mark-to-market impacts of economic

hedges in the Commercial Portfolio segment.

Duke Energy’s adjusted earnings, adjusted diluted EPS, and adjusted

segment income may not be comparable to similarly titled measures of another

company because other entities may not calculate the measures in the same

manner.

See Note 3 to the Consolidated Financial Statements, “Business

Segments,” for a discussion of Duke Energy’s segment structure.