Duke Energy 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

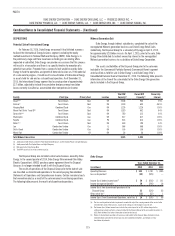

Combined Notes to Consolidated Financial Statements – (Continued)

Retired generation facilities. Duke Energy Florida earns a full return

on a portion of the regulatory asset related to the retired nuclear plant currently

recovered in the nuclear cost recovery clause (NCRC), with the remaining

portion earning a reduced return. Duke Energy Carolinas earns a return on the

outstanding retail balance with recovery periods ranging from five to 10 years.

Duke Energy Progress earns a return on the outstanding balance with recovery

over a period of 10 years for retail purposes and over the longer of 10 years or

the previously estimated planned retirement date for wholesale purposes. Duke

Energy Indiana earns a return on the outstanding balances and the costs are

included in rate base.

Debt fair value adjustment. Purchase accounting adjustment recorded

to state the carrying value of Progress Energy at fair value in connection with the

2012 merger. Amount is amortized over the life of the related debt.

Net regulatory asset related to income taxes. Regulatory assets

principally associated with the depreciation and recovery of AFUDC equity.

Amounts have no impact on rate base as regulatory assets are offset by

deferred tax liabilities. The recovery period is over the life of the associated

assets. Amounts for Duke Energy, Duke Energy Carolinas, Progress Energy and

Duke Energy Progress include regulatory liabilities related to the change in the

North Carolina corporate tax rate discussed in Note 22.

Nuclear asset securitizable balance, net. Represents the balance

associated with Crystal River Unit 3 retirement approved for recovery by the

FPSC on September 15, 2015, and the deferred operating expenses expected to

be securitized in 2016 upon issuance of the associated bonds. The regulatory

asset balance is net of the AFUDC equity portion of the $1.283 billion amount

approved by the FPSC. The regulatory asset balance approved for recovery by

the FPSC will earn a reduced return until the expected bond issuance, after

which it will earn a return in rates to recover the interest costs of the associated

debt. Once bonds are issued, the balance will be recovered over approximately

20 years. This regulatory asset is not included in rate base.

Hedge costs and other deferrals. Amounts relate to unrealized gains

and losses on derivatives recorded as a regulatory asset or liability, respectively,

until the contracts are settled. The recovery period varies for these costs and

currently extends to 2048.

DSM/EE. The recovery period varies for these costs, with some currently

unknown. Duke Energy Carolinas, Duke Energy Progress and Duke Energy Florida

are required to pay interest on the outstanding liability balance. Duke Energy

Carolinas, Duke Energy Progress and Duke Energy Florida collect a return on

DSM/EE investments.

Grid Modernization. Represents deferred depreciation and operating

expenses as well as carrying costs on the portion of capital expenditures placed

in service but not yet reflected in retail rates as plant in service. Recovery period

is generally one year for depreciation and operating expenses. Recovery for

post-in-service carrying costs is over the life of the assets. Duke Energy Ohio is

earning a return on these costs.

Vacation accrual. Generally recovered within one year.

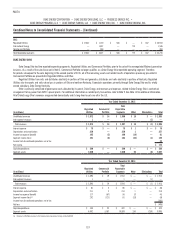

Deferred fuel and purchased power. Represents certain energy

related costs that are recoverable or refundable as approved by the applicable

regulatory body. Duke Energy Florida amount includes capacity costs. Duke

Energy Florida earns a return on the retail portion of under-recovered costs.

Duke Energy Ohio earns a return on under-recovered costs. Duke Energy Florida

and Duke Energy Ohio pay interest on over-recovered costs. Duke Energy

Carolinas and Duke Energy Progress amounts include certain purchased power

costs in both North Carolina and South Carolina and costs of distributed energy

resource programs in South Carolina. Duke Energy Carolinas and Duke Energy

Progress pay interest on over-recovered costs in North Carolina. Recovery period

is generally over one year. Duke Energy Indiana recovery period is quarterly.

Nuclear deferral. Includes (i) amounts related to levelizing nuclear plant

outage costs at Duke Energy Carolinas in North Carolina and South Carolina,

and Duke Energy Progress in North Carolina, which allows for the recognition of

nuclear outage expenses over the refueling cycle rather than when the outage

occurs, resulting in the deferral of operations and maintenance costs associated

with refueling and (ii) certain deferred preconstruction and carrying costs at

Duke Energy Florida as approved by the FPSC primarily associated with Levy,

with a final true-up to be filed by May 2017.

Post-in-service carrying costs and deferred operating expenses.

Represents deferred depreciation and operating expenses as well as carrying

costs on the portion of capital expenditures placed in service but not yet

reflected in retail rates as plant in service. Duke Energy Carolinas, Duke Energy

Progress, Duke Energy Ohio and Duke Energy Indiana earn a return on the

outstanding balance. Duke Energy Florida earns a return at a reduced rate. For

Duke Energy Ohio and Duke Energy Indiana, some amounts are included in rate

base. Recovery is over various lives, and the latest recovery period is 2082.

Gasification services agreement buyout. The IURC authorized Duke

Energy Indiana to recover costs incurred to buyout a gasification services

agreement, including carrying costs through 2018.

Transmission expansion obligation. Represents transmission

expansion obligations related to Duke Energy Ohio’s withdrawal from

Midcontinent Independent System Operator, Inc. (MISO).

MGP. Represents remediation costs for former MGP sites. In November

2013, the PUCO approved recovery of costs incurred through 2019. Duke Energy

Ohio does not earn a return on these costs.

NCEMPA deferrals. Represents retail allocated cost deferrals and

returns associated with the additional ownership interest in assets acquired

from NCEMPA discussed in Note 2. The North Carolina retail allocated costs are

generally being recovered, over a period of time between three years and the

remaining life of the assets purchased, through a rider that became effective on

December 1, 2015. The South Carolina retail allocated costs are being deferred

until Duke Energy Progress’ next general rate case, earning a return pursuant to

an order received from the PSCSC.

East Bend deferrals. Represents both deferred operating expenses and

deferred depreciation as well as carrying costs on the portion of East Bend

that was acquired from Dayton Power and Light and that had been previously

operated as a jointly owned facility. Recovery will not commence until the

settlement of the next rate case in Kentucky. Duke Energy Ohio is earning a

return on these deferred costs.

Costs of removal. Represents funds received from customers to cover the

future removal of property, plant and equipment from retired or abandoned sites

as property is retired. Also includes certain deferred gains on NDTF investments.

Amounts to be refunded to customers. Represents required rate

reductions to retail customers by the applicable regulatory body. The period of

refund for Duke Energy Indiana is through 2017.

Storm reserve. Duke Energy Carolinas and Duke Energy Florida are

allowed to petition the PSCSC and FPSC, respectively, to seek recovery of named

storms. Funds are used to offset future incurred costs.

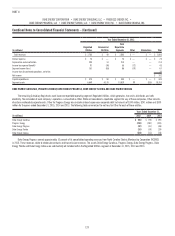

RESTRICTIONS ON THE ABILITY OF CERTAIN SUBSIDIARIES TO MAKE

DIVIDENDS, ADVANCES AND LOANS TO DUKE ENERGY

As a condition to the approval of merger transactions, the NCUC,

PSCSC, PUCO, KPSC and IURC imposed conditions on the ability of Duke

Energy Carolinas, Duke Energy Progress, Duke Energy Ohio, Duke Energy

Kentucky and Duke Energy Indiana to transfer funds to Duke Energy

through loans or advances, as well as restricted amounts available to pay

dividends to Duke Energy. Certain subsidiaries may transfer funds to Duke