Duke Energy 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

PART II

The inputs and methodologies used to determine the fair value of

contracts are validated by an internal group separate from Duke Energy’s deal

origination function. While Duke Energy uses common industry practices to

develop its valuation techniques, changes in its pricing methodologies or the

underlying assumptions could result in significantly different fair values and

income recognition.

Hedging Strategies

Duke Energy closely monitors risks associated with commodity price

changes on its future operations and, where appropriate, uses various

commodity instruments such as electricity, coal and natural gas forward

contracts to mitigate the effect of such fluctuations on operations. Duke

Energy’s primary use of energy commodity derivatives is to hedge the generation

portfolio against exposure to the prices of power and fuel.

The majority of instruments used to manage Duke Energy’s commodity

price exposure are either not designated as hedges or do not qualify for hedge

accounting. These instruments are referred to as undesignated contracts.

Mark-to-market changes for undesignated contracts entered into by regulated

businesses are reflected as regulatory assets or liabilities on the Consolidated

Balance Sheets. Undesignated contracts entered into by unregulated businesses

are marked-to-market each period, with changes in the fair value of the

derivative instruments reflected in earnings.

Duke Energy may also enter into other contracts that qualify for the normal

purchase/normal sale (NPNS) exception. When a contract meets the criteria to

qualify as an NPNS, Duke Energy applies such exception. Income recognition and

realization related to NPNS contracts generally coincide with the physical delivery

of the commodity. For contracts qualifying for the NPNS exception, no recognition of

the contract’s fair value in the Consolidated Financial Statements is required until

settlement of the contract as long as the transaction remains probable of occurring.

Generation Portfolio Risks

Duke Energy is primarily exposed to market price fluctuations of wholesale

power, natural gas, and coal prices in the Regulated Utilities segment. The

Duke Energy Registrants optimize the value of their generation portfolios, which

include generation assets, fuel, and emission allowances. Modeled forecasts of

future generation output and fuel requirements are based on forward power and

fuel markets. The component pieces of the portfolio are bought and sold based

on models and forecasts of generation in order to manage the economic value of

the portfolio in accordance with the strategies of the business units.

For the Regulated Utilities segment, the generation portfolio not utilized

to serve retail operations or committed load is subject to commodity price

fluctuations. However, the impact on the Consolidated Statements of Operations

is partially offset by mechanisms in these regulated jurisdictions that result in

the sharing of net profits from these activities with retail customers.

International Energy generally hedges their expected generation using

long-term bilateral power sales contracts when favorable market conditions

exist and are subject to wholesale commodity price risks for electricity not sold

under such contracts. International Energy dispatches electricity not sold under

long-term bilateral contracts into unregulated markets and receives wholesale

energy margins and capacity revenues from national system operators.

Interest Rate Risk

Duke Energy is exposed to risk resulting from changes in interest rates as

a result of its issuance of variable and fixed-rate debt and commercial paper.

Duke Energy manages interest rate exposure by limiting variable-rate exposures

to a percentage of total debt and by monitoring the effects of market changes

in interest rates. Duke Energy also enters into financial derivative instruments,

which may include instruments such as, but not limited to, interest rate swaps,

swaptions and U.S. Treasury lock agreements to manage and mitigate interest

rate risk exposure. See Notes 1, 6, 14, and 16 to the Consolidated Financial

Statements, “Summary of Significant Accounting Policies,” “Debt and Credit

Facilities,” “Derivatives and Hedging,” and “Fair Value Measurements.”

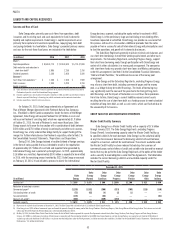

At December 31, 2015, Duke Energy had $727 million notional amount

of floating-to-fixed swaps outstanding, $500 million notional amount of

fixed-to-floating swaps outstanding and $1,300 million forward-starting swaps

outstanding. In the first quarter of 2016, Duke Energy entered into an additional

$500 million notional amount of forward-starting swaps. Duke Energy had

$7.9 billion of unhedged long- and short-term floating interest rate exposure at

December 31, 2015. The impact of a 100 basis point change in interest rates on

pretax income is approximately $79 million at December 31, 2015. This amount

was estimated by considering the impact of the hypothetical interest rates on

variable-rate securities outstanding, adjusted for interest rate hedges as of

December 31, 2015.

See Notes 2 and 14, “Acquisitions and Dispositions” and Derivatives and

Hedging,” respectively, to the Consolidated Financial Statements for additional

information about the forward-starting interest rate swaps related to the

Piedmont acquisition.

Credit Risk

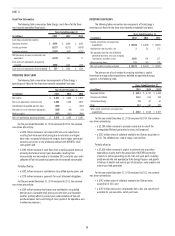

Credit risk represents the loss that the Duke Energy Registrants would

incur if a counterparty fails to perform under its contractual obligations. Where

exposed to credit risk, the Duke Energy Registrants analyze the counterparty’s

financial condition prior to entering into an agreement and monitor exposure

on an ongoing basis. The Duke Energy Registrants establish credit limits where

appropriate in the context of contractual arrangements and monitor such limits.

To reduce credit exposure, the Duke Energy Registrants seek to include

netting provisions with counterparties which permit the offset of receivables and

payables with such counterparties. The Duke Energy Registrants also frequently

use master agreements with credit support annexes to further mitigate certain

credit exposures. The master agreements provide for a counterparty to post

cash or letters of credit to the exposed party for exposure in excess of an

established threshold. The threshold amount represents a negotiated unsecured

credit limit for each party to the agreement, determined in accordance with the

Duke Energy Registrants’ internal corporate credit practices and standards.

Collateral agreements generally also provide that the inability to post collateral

is sufficient cause to terminate contracts and liquidate all positions.

The Duke Energy Registrants also obtain cash or letters of credit from

certain counterparties to provide credit support outside of collateral agreements,

where appropriate, based on a financial analysis of the counterparty and the

regulatory or contractual terms and conditions applicable to each transaction.

See Note 14 to the Consolidated Financial Statements, “Derivatives and

Hedging,” for additional information regarding credit risk related to derivative

instruments.

The Duke Energy Registrants’ principal counterparties for its electric and

gas businesses are regional transmission organizations, distribution companies,

municipalities, electric cooperatives and utilities located throughout the U.S. and

Latin America. The Duke Energy Registrants have concentrations of receivables

from such entities throughout these regions. These concentrations of receivables

may affect the Duke Energy Registrants’ overall credit risk in that risk factors

can negatively impact the credit quality of the entire sector.

The Duke Energy Registrants are also subject to credit risk from

transactions with their suppliers that involve prepayments in conjunction

with outsourcing arrangements, major construction projects and certain

commodity purchases. The Duke Energy Registrants’ credit exposure to such

suppliers may take the form of increased costs or project delays in the event of

non-performance. The Duke Energy Registrants’ frequently require guarantees or

letters of credit from suppliers to mitigate this credit risk.

Credit risk associated with the Duke Energy Registrants’ service to

residential, commercial and industrial customers is generally limited to

outstanding accounts receivable. The Duke Energy Registrants mitigate this

credit risk by requiring customers to provide a cash deposit, letter of credit

or surety bond until a satisfactory payment history is established, subject to

the rules and regulations in effect in each retail jurisdiction, at which time the