Duke Energy 2015 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

205

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

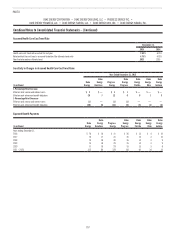

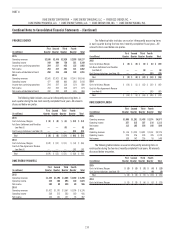

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Deferred credits and other liabilities $ 188 $ 53 $ 108 $ 28 $ 78 $ (8) $ 12

Capital lease obligations 63 10 — — — — 2

Pension, post-retirement and other employee benefits 546 4 188 96 93 17 43

Progress Energy merger purchase accounting adjustments(a) 1,124 — — — — — —

Tax credits and NOL carryforwards 3,540 157 980 91 252 38 260

Investments and other assets — — — — — 14 —

Other — 12 — 55 — 35 11

Valuation allowance (184) — (13) (1) — — —

Total deferred income tax assets 5,277 236 1,263 269 423 96 328

Investments and other assets (1,625) (1,051) (427) (232) (245) — (4)

Accelerated depreciation rates (11,715) (4,046) (3,284) (2,030) (1,252) (1,660) (1,603)

Regulatory assets and deferred debits, net (3,694) (953) (1,602) (809) (792) (141) (106)

Other (44) — (151) — (246) — —

Total deferred income tax liabilities (17,078) (6,050) (5,464) (3,071) (2,535) (1,801) (1,713)

Net deferred income tax liabilities $(11,801) $(5,814) $(4,201) $(2,802) $(2,112) $(1,705) $(1,385)

(a) Primarily related to capital lease obligations and debt fair value adjustments.

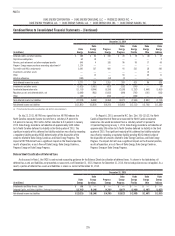

On July 23, 2013, HB 998 was signed into law. HB 998 reduces the

North Carolina corporate income tax rate from a statutory 6.9 percent to

6.0 percent in January 2014 with a further reduction to 5.0 percent in January

2015. Duke Energy recorded a net reduction of approximately $145 million

to its North Carolina deferred tax liability in the third quarter of 2013. The

significant majority of this deferred tax liability reduction was offset by recording

a regulatory liability pending NCUC determination of the disposition of the

amounts related to Duke Energy Carolinas and Duke Energy Progress. The

impact of HB 998 did not have a significant impact on the financial position,

results of operation, or cash flows of Duke Energy, Duke Energy Carolinas,

Progress Energy or Duke Energy Progress.

On August 6, 2015, pursuant to N.C. Gen. Stat. 105-130.3C, the North

Carolina Department of Revenue announced the North Carolina corporate

income tax rate would be reduced from a statutory rate of 5.0 percent to

4.0 percent beginning January 1, 2016. Duke Energy recorded a net reduction of

approximately $95 million to its North Carolina deferred tax liability in the third

quarter of 2015. The significant majority of this deferred tax liability reduction

was offset by recording a regulatory liability pending NCUC determination of

the disposition of amounts related to Duke Energy Carolinas and Duke Energy

Progress. The impact did not have a significant impact on the financial position,

results of operation, or cash flows of Duke Energy, Duke Energy Carolinas,

Progress Energy or Duke Energy Progress.

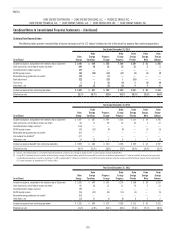

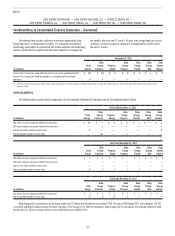

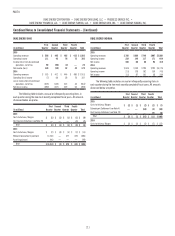

Balance Sheet Classification of Deferred Taxes

As discussed in Note 1, the FASB issued revised accounting guidance for the Balance Sheet classification of deferred taxes. As shown in the table below, all

deferred tax assets and liabilities are presented as noncurrent as of December 31, 2015. However, for December 31, 2014, the revised guidance was not applied. As a

result, a portion of deferred tax assets and liabilities is shown as current at December 31, 2014.

December 31, 2015

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Investments and Other Assets: Other $ 80 $ — $ — $ — $ — $ — $ —

Deferred Credits and Other Liabilities: Deferred income taxes (12,705) (6,146) (4,790) (3,027) (2,460) (1,407) (1,657)

Net deferred income tax liabilities $(12,625) $(6,146) $(4,790) $(3,027) $(2,460) $(1,407) $(1,657)