Duke Energy 2015 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

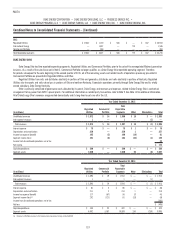

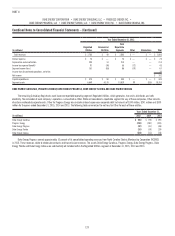

Combined Notes to Consolidated Financial Statements – (Continued)

FERC Transmission Return on Equity and MTEP Cost Settlement

On October 14, 2011, Duke Energy Ohio and Duke Energy Kentucky

submitted with the FERC proposed modifications to the PJM Interconnection

Open Access Transmission Tariff pertaining to recovery of the transmission

revenue requirement as PJM transmission owners. The filing was made in

connection with Duke Energy Ohio’s and Duke Energy Kentucky’s move from

MISO to PJM effective December 31, 2011. On April 24, 2012, the FERC issued

an order accepting the proposed filing effective January 1, 2012, except that the

order denied a request to recover certain costs associated with the move from

MISO to PJM without prejudice to the right to submit another filing seeking such

recovery and including certain additional evidence, and set the rate of return

on equity of 12.38 percent for settlement and hearing. On April 16, 2015, the

FERC approved a settlement agreement between Duke Energy Ohio, Duke Energy

Kentucky and six PJM transmission customers with load in the Duke Energy

Ohio and Duke Energy Kentucky zone. The principal terms of the settlement

agreement are that, effective upon the date of FERC approval, (i) the return on

equity for wholesale transmission service is reduced to 11.38 percent, (ii) the

settling parties agreed not to seek a change in the return on equity that would

be effective prior to June 1, 2017, and (iii) Duke Energy Ohio and Duke Energy

Kentucky will recover 30 percent of the wholesale portion of costs arising from

their obligation to pay any portion of the costs of projects included in any MTEP

that was approved prior to the date of Duke Energy Ohio’s and Duke Energy

Kentucky’s integration into PJM.

Duke Energy Indiana

Edwardsport Integrated Gasification Combined Cycle (IGCC) Plant

On November 20, 2007, the IURC granted Duke Energy Indiana a CPCN

for the construction of the Edwardsport IGCC Plant. The Citizens Action Coalition

of Indiana, Inc., Sierra Club, Inc., Save the Valley, Inc., and Valley Watch, Inc.

(collectively, the Joint Intervenors) were intervenors in several matters related

to the Edwardsport IGCC Plant. The Edwardsport IGCC Plant was placed in

commercial operation in June 2013. Costs for the Edwardsport IGCC Plant

are recovered from retail electric customers via a tracking mechanism, the

IGCC rider.

The ninth semi-annual IGCC rider order was appealed by the Joint

Intervenors. On September 8, 2014, the Indiana Court of Appeals remanded

the IURC order in the ninth IGCC rider proceeding back to the IURC for further

findings. On February 25, 2015, the IURC issued a new order upholding its prior

decision and provided additional detailed findings. Joint Intervenors appealed

this remand order to the Indiana Court of Appeals. On September 23, 2015, the

Indiana Court of Appeals affirmed the IURC remand decision on one of the key

financial issues. The Indiana Court of Appeals found that there was sufficient

evidence for the IURC to find that the three-month delay in construction for this

time period was not unreasonable and therefore the costs of such delay should

be borne by Duke Energy Indiana customers. The Indiana Court of Appeals found

that the IURC did not support its findings regarding the ratemaking impact of

the tax in-service declaration and reversed and remanded this issue back to the

IURC, with direction to hold further proceedings and issue additional findings

on the issue. On December 10, 2015, the Indiana Court of Appeals denied a

request for rehearing by Joint Intervenors, and the decision was not further

appealed. The proceeding will be remanded to the IURC for further proceedings

and additional findings on the tax in-service issue.

The 10th semi-annual IGCC rider order was also appealed by the Joint

Intervenors. On August 21, 2014, the Indiana Court of Appeals affirmed the

IURC order in the 10th IGCC rider proceeding and on October 29, 2014, denied

the Joint Intervenors’ request for rehearing. The Joint Intervenors requested the

Indiana Supreme Court to review the decision, which was denied on April 23,

2015, concluding the appeal.

Duke Energy Indiana has filed the 14th and 15th semi-annual IGCC rider

proceedings. The 11th through 15th semi-annual IGCC riders and a subdocket

to Duke Energy Indiana’s fuel adjustment clause are currently in various stages

of approval by the IURC in the filing process. Issues in these filings include

the determination whether the IGCC plant was properly declared in service for

ratemaking purposes in June 2013 and a review of the operational performance

of the plant. On September 17, 2015, Duke Energy Indiana, the Office of Utility

Consumer Counselor, the Industrial Group and Nucor Steel Indiana reached a

settlement agreement to resolve these pending issues. On January 15, 2016,

The Citizens Action Coalition of Indiana, Inc., Sierra Club, Save the Valley and

Valley Watch joined the settlement. The proposed settlement will result in

customers not being billed for previously incurred operating costs of

$87.5 million and for additional Duke Energy Indiana payments and

commitments of $5.5 million for attorneys’ fees and amounts to fund consumer

programs. Attorneys’ fees and expenses for the new settling parties will be

addressed in a separate proceeding. Duke Energy Indiana recorded $87.5

million within Impairment charges and $5.5 million within Other Income and

Expenses, net in the Consolidated Statements of Operations and Comprehensive

Income for the 12 months ended December 31, 2015. Duke Energy Indiana

also recorded an $80.3 million reduction of Regulatory assets within Regulatory

Assets and Deferred Debits, an additional $7.2 million of Other within Deferred

Credits and Other Liabilities and $5.5 million of Accounts payable within

Current Liabilities on the Consolidated Balance Sheets at December 31, 2015.

Additionally, under the proposed settlement, the operating and maintenance

expenses and ongoing maintenance capital at the plant are subject to certain

caps during the years of 2016 and 2017. The revised settlement includes a

commitment to either retire or stop burning coal by December 31, 2022, at

the Gallagher Station. Pursuant to the settlement, the in-service date used for

accounting and ratemaking will remain as June 2013. Remaining deferred costs

will be recovered over eight years and not earn a carrying cost. The settlement

is subject to IURC approval which is expected in the first half of 2016. As of

December 31, 2015, deferred costs related to the project are approximately

$128 million. Future IGCC riders will be filed annually, rather than every six

months, with the next filing scheduled for first quarter 2017.

Duke Energy Indiana cannot predict the outcome of the settlement of

these matters or future IGCC rider proceedings.

FERC Transmission Return on Equity Complaint

Customer groups have filed with the FERC complaints against MISO and

its transmission-owning members, including Duke Energy Indiana, alleging,

among other things, that the current base rate of return on equity earned by

MISO transmission owners of 12.38 percent is unjust and unreasonable. The

latest complaint, filed on February 12, 2015, claims the base rate of return

on equity should be reduced to 8.67 percent and requests a consolidation of

complaints. The motion to consolidate complaints was denied. On January 5,

2015, the FERC issued an order accepting the MISO transmission owners 0.50

percent adder to the base rate of return on equity based on participation in an

RTO subject to it being applied to a return on equity that is shown to be just

and reasonable in the pending return on equity complaint. A hearing in the base

return on equity proceeding was held in August 2015. On December 22, 2015,

the presiding FERC ALJ issued an Initial Decision in which he set the base rate

of return on equity at 10.32 percent. The Initial Decision will be reviewed by

the FERC. Duke Energy Indiana currently believes these matters will have an

immaterial impact on its results of operations, cash flows and financial position.