Duke Energy 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

PART II

Compliance with CPP could cause the industry to replace coal generation with

natural gas and renewables, especially in states that have significant CO2

reduction targets under the rule. Costs to operate coal-fired generation plants

continue to grow due to increasing environmental compliance requirements,

including ash management costs unrelated to CPP, and this may result in the

retirement of coal-fired generation plants earlier than the current useful lives.

Progress Energy continues to evaluate the need to retire generating facilities and

plans to seek regulatory recovery, where appropriate, for amounts that have not

been recovered upon asset retirements. However, recovery is subject to future

regulatory approval, including the recovery of carrying costs on remaining book

values, and therefore cannot be assured. In addition, Progress Energy could

incur increased fuel, purchased power, operation and maintenance, and other

costs for replacement generation as a result of this rule. Progress Energy cannot

predict the outcome of these matters.

DUKE ENERGY PROGRESS

Introduction

Management’s Discussion and Analysis should be read in conjunction

with the accompanying Consolidated Financial Statements and Notes for the

years ended December 31, 2015, 2014 and 2013.

Basis of Presentation

The results of operations and variance discussion for Duke Energy

Progress is presented in a reduced disclosure format in accordance with General

Instruction (I)(2)(a) of Form 10-K.

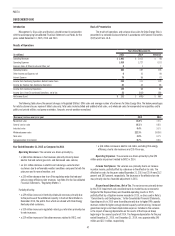

Results of Operations

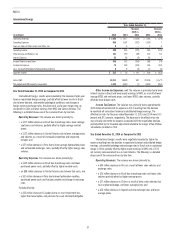

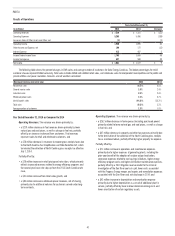

Years Ended December 31,

(in millions) 2015 2014 Variance

Operating Revenues $ 5,290 $ 5,176 $ 114

Operating Expenses 4,269 4,244 25

Gains on Sales of Other Asset and Other, net 33 —

Operating Income 1,024 935 89

Other Income and Expense, net 71 51 20

Interest Expense 235 234 1

Income Before Income Taxes 860 752 108

Income Tax Expense 294 285 9

Net Income $ 566 $ 467 $ 99

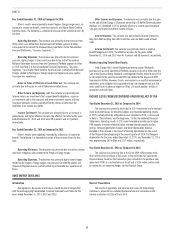

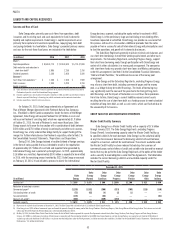

The following table shows the percent changes in GWh sales and average number of customers for Duke Energy Progress. The below percentages for retail

customer classes represent billed sales only. Total sales includes billed and unbilled retail sales, and wholesale sales to incorporated municipalities and to public and

private utilities and power marketers. Amounts are not weather normalized.

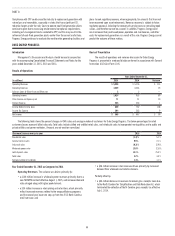

(Decrease) increase over prior year 2015 2014

Residential sales (1.4)% 5.1%

General service sales 0.9% 2.1%

Industrial sales (0.3)% (2.9)%

Wholesale power sales 13.0% (2.3)%

Joint dispatch sales 14.1% 75.3%

Total sales 3.2% 4.4%

Average number of customers 1.4% 1.1%

Year Ended December 31, 2015 as Compared to 2014

Operating Revenues. The variance was driven primarily by:

• a $100 million increase in wholesale power revenues primarily due to a

new NCEMPA contract effective August 1, 2015, and increased demand

rates charged along with higher peak demand;

• a $34 million increase in retail pricing and rate riders, which primarily

reflect increased revenues related to the energy efficiency programs

and the second year base rate step-up from the 2013 North Carolina

retail rate case; and

• a $26 million increase in fuel revenues driven primarily by increased

demand from wholesale and retail customers.

Partially offset by:

• a $44 million decrease in revenues to recover gross receipts taxes due

to the North Carolina Tax Simplification and Rate Reduction Act, which

terminated the collection of North Carolina gross receipts tax effective

July 1, 2014.