Duke Energy 2015 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

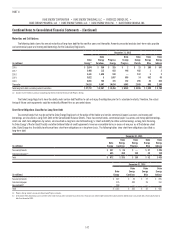

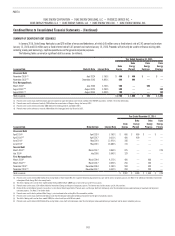

Combined Notes to Consolidated Financial Statements – (Continued)

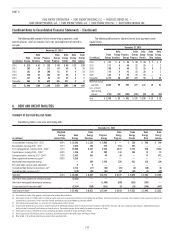

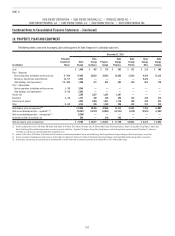

The following table includes the liabilities recognized for the guarantees discussed above. These amounts are primarily recorded in Other within Deferred Credits

and other Liabilities on the Consolidated Balance Sheets. As current estimates change, additional losses related to guarantees and indemnifications to third parties,

which could be material, may be recorded by the Duke Energy Registrants in the future.

December 31,

2015 2014

Duke Energy $21 $28

Progress Energy 713

Duke Energy Florida 77

8. JOINT OWNERSHIP OF GENERATING AND TRANSMISSION FACILITIES

The Duke Energy Registrants maintain ownership interests in certain jointly owned generating and transmission facilities. The Duke Energy Registrants are

entitled to a share of the generating capacity and output of each unit equal to their respective ownership interests, except as otherwise noted below. The Duke

Energy Registrants pay their ownership share of additional construction costs, fuel inventory purchases and operating expenses, except in certain instances where

agreements have been executed to limit certain joint owners’ maximum exposure to the additional costs. The Duke Energy Registrants share of revenues and operating

costs of the jointly owned facilities is included within the corresponding line in the Consolidated Statements of Operations. Each participant in the jointly owned

facilities must provide its own financing, except in certain instances where agreements have been executed to limit certain joint owners’ maximum exposure to the

additional costs.

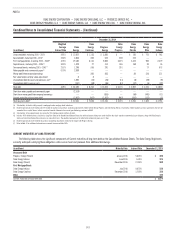

The following table presents the Duke Energy Registrants’ interest of jointly owned plant or facilities and amounts included on the Consolidated Balance Sheets.

All facilities are operated by the Duke Energy Registrants and are included in the Regulated Utilities segment unless otherwise noted.

December 31, 2015

Ownership

Interest

Property, Plant

and Equipment

Accumulated

Depreciation

Construction Work

in Progress

Duke Energy Carolinas

Catawba Nuclear Station (units 1 and 2)(a) 19.25% $ 926 $ 567 $ 9

Duke Energy Florida

Intercession City Plant (unit 11) (b) 24 15 —

Duke Energy Ohio

Transmission facilities(c) Various 85 50 1

Duke Energy Indiana

Gibson Station (unit 5)(d) 50.05% 329 151 5

Vermillion(e) 62.5% 153 108 —

Transmission and local facilities(d) Various 4,094 1,688 —

International Energy

Brazil – Canoas I and II(f) 47.2% 160 57 —

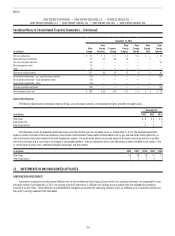

(a) Jointly owned with North Carolina Municipal Power Agency Number One, NCEMC and Piedmont Municipal Power Agency.

(b) Jointly owned with Georgia Power Company (GPC). GPC has exclusive rights to the output of the unit during the months of June through September and pays all fuel and water costs during this period. Duke Energy Florida pays

all fuel and water costs during the remaining months. Other costs are allocated 66.67 percent to Duke Energy Florida and the remainder to GPC.

(c) Jointly owned with America Electric Power Generation Resources and The Dayton Power and Light Company.

(d) Jointly owned with Wabash Valley Power Association, Inc. (WVPA) and Indiana Municipal Power Agency.

(e) Jointly owned with WVPA.

(f) Jointly owned with Companhia Brasileira de Aluminio and included in the International segment.

On July 31, 2015, Duke Energy Progress completed the purchase of NCEMPA’s ownership interests in jointly owned facilities. See Note 2 for additional

information.

Duke Energy Florida owns 98.3 percent interest in the retired Crystal River Unit 3 nuclear plant and is in the process of obtaining the remaining 1.7 percent

interest from Seminole Electric Cooperative. On October 30, 2015, Duke Energy Florida completed the purchase of 6.52 percent ownership interest in Crystal River

Unit 3 from the Florida Municipal Joint Owners (FMJO) and settled other disputes for $55 million. All costs associated with Crystal River Unit 3 are included within

Regulatory assets on the Consolidated Balance Sheets of Duke Energy, Progress Energy and Duke Energy Florida. See Note 4 for additional information.