Duke Energy 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

PART II

Piedmont Bridge Facility

In connection with the Merger Agreement with Piedmont, Duke Energy

entered into a $4.9 billion Bridge Facility with Barclays. The Bridge Facility, if

drawn upon, may be used to (i) fund the cash consideration for the transaction

and (ii) pay certain fees and expenses in connection with the transaction. In

November 2015, Barclays syndicated its commitment under the Bridge Facility

to a broader group of lenders. Duke Energy intends to finance the transaction

with proceeds raised through the issuance of debt, equity and other sources as

noted above and, therefore, does not expect to draw upon the Bridge Facility.

Short-Term Loan Facility

On February 22, 2016, Duke Energy entered into a six-month term loan

facility (Term Loan) with commitments totaling $1 billion to provide additional

flexibility in managing short-term liquidity. The Term Loan can be drawn upon in

a single borrowing of up to $1 billion, which must occur no later than 45 calendar

days following February 22, 2016. As of February 24, 2016, no amounts have

been drawn under the Term Loan. Amounts drawn under this facility, if any, will be

due on August 19, 2016. The terms and conditions of this Term Loan are generally

consistent with those governing the Master Credit Facility discussed above.

Shelf Registration

In September 2013, Duke Energy filed a registration statement (Form S-3)

with the SEC. Under this Form S-3, which is uncapped, the Duke Energy

Registrants, excluding Progress Energy may issue debt and other securities

in the future at amounts, prices and with terms to be determined at the time

of future offerings. The registration statement also allows for the issuance of

common stock by Duke Energy.

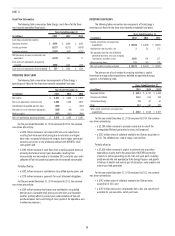

CAPITAL EXPENDITURES

Duke Energy continues to focus on reducing risk and positioning its

business for future success and will invest principally in its strongest business

sectors. Based on this goal, the majority of Duke Energy’s total projected capital

expenditures are allocated to the Regulated Utilities segment. Duke Energy’s

projected capital and investment expenditures for the next three fiscal years are

included in the table below.

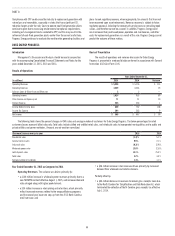

(in millions) 2016 2017 2018

New generation $ 1,275 $ 925 $ 825

Environmental 350 425 200

Nuclear fuel 525 425 425

Major nuclear 175 200 75

Customer additions 500 575 575

Grid modernization and other transmission and

distribution projects 1,300 1,475 1,575

Maintenance 2,700 2,325 2,200

Total Regulated Utilities 6,825 6,350 5,875

Commercial Portfolio, International Energy and Other 1,775 950 900

Total committed expenditures 8,600 7,300 6,775

Discretionary expenditures 175 1,200 1,025

Total projected capital and investment expenditures $ 8,775 $ 8,500 $ 7,800

DEBT MATURITIES

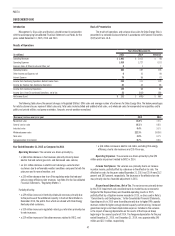

The following table shows the significant components of Current

maturities of Long-Term Debt on the Consolidated Balance Sheets. The Duke

Energy Registrants currently anticipate satisfying these obligations with cash on

hand and proceeds from additional borrowings.

(in millions) Maturity Date Interest Rate December 31, 2015

Unsecured Debt

Progress Energy (Parent) January 2016 5.625% $ 300

Duke Energy Indiana June 2016 6.05% 325

Duke Energy (Parent) November 2016 2.150% 500

First Mortgage Bonds

Duke Energy Indiana July 2016 0.670% 150

Duke Energy Carolinas December 2016 1.750% 350

Other 449

Current maturities of

long-term debt $ 2,074

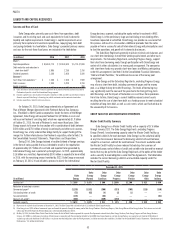

DIVIDEND PAYMENTS

In 2015, Duke Energy paid quarterly cash dividends for the 90th

consecutive year and expects to continue its policy of paying regular cash

dividends in the future. There is no assurance as to the amount of future

dividends because they depend on future earnings, capital requirements,

financial condition and are subject to the discretion of the Board of Directors.

Through 2020, the dividend payout ratio is expected to be between 70

and 75 percent, based upon adjusted diluted EPS. Over the past several years,

Duke Energy’s dividend has grown at approximately 2 percent annually, slower

than overall adjusted earnings growth. In 2015, Duke Energy increased the

dividend payout to grow the dividend at approximately 4 percent annually, better

matching expected future earnings growth.

Dividend and Other Funding Restrictions of Duke Energy Subsidiaries

As discussed in Note 4 to the Consolidated Financial Statements,

“Regulatory Matters,” Duke Energy’s wholly owned public utility operating

companies have restrictions on the amount of funds that can be transferred

to Duke Energy through dividends, advances or loans as a result of conditions

imposed by various regulators in conjunction with merger transactions. Duke

Energy Progress and Duke Energy Florida also have restrictions imposed by

their first mortgage bond indentures and Articles of Incorporation which in

certain circumstances limit their ability to make cash dividends or distributions

on common stock. Additionally, certain other Duke Energy subsidiaries have

other restrictions, such as minimum working capital and tangible net worth

requirements pursuant to debt and other agreements that limit the amount

of funds that can be transferred to Duke Energy. At December 31, 2015, the

amount of restricted net assets of wholly owned subsidiaries of Duke Energy

that may not be distributed to Duke Energy in the form of a loan or dividend

is less than 25 percent of Duke Energy’s net assets. Duke Energy does

not have any legal or other restrictions on paying common stock dividends

to shareholders out of its consolidated equity accounts. Although these

restrictions cap the amount of funding the various operating subsidiaries can

provide to Duke Energy, management does not believe these restrictions will

have a significant impact on Duke Energy’s ability to access cash to meet its

payment of dividends on common stock and other future funding obligations.