Duke Energy 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

Energy Corporation Holding Company (the parent) by obtaining approval

of the respective state regulatory commissions. These conditions imposed

restrictions on the ability of the public utility subsidiaries to pay cash

dividends as discussed below.

Duke Energy Progress and Duke Energy Florida also have restrictions

imposed by their first mortgage bond indentures and Articles of Incorporation

which, in certain circumstances, limit their ability to make cash dividends

or distributions on common stock. Amounts restricted as a result of these

provisions were not material at December 31, 2015.

Additionally, certain other subsidiaries of Duke Energy have restrictions

on their ability to dividend, loan or advance funds to Duke Energy due to

specific legal or regulatory restrictions, including, but not limited to, minimum

working capital and tangible net worth requirements.

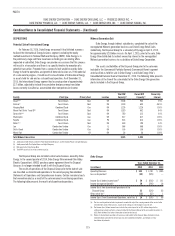

Duke Energy Carolinas

Duke Energy Carolinas must limit cumulative distributions subsequent to

mergers to (i) the amount of retained earnings on the day prior to the closing of

the mergers, plus (ii) any future earnings recorded.

Duke Energy Progress

Duke Energy Progress must limit cumulative distributions subsequent

to the merger between Duke Energy and Progress Energy to (i) the amount of

retained earnings on the day prior to the closing of the merger, plus (ii) any

future earnings recorded.

Duke Energy Ohio

Duke Energy Ohio will not declare and pay dividends out of capital or

unearned surplus without the prior authorization of the PUCO. Duke Energy Ohio

received FERC and PUCO approval to pay dividends from its equity accounts

that are reflective of the amount that it would have in its retained earnings

account had push-down accounting for the Cinergy Corp. (Cinergy) merger not

been applied to Duke Energy Ohio’s balance sheet. The conditions include a

commitment from Duke Energy Ohio that equity, adjusted to remove the impacts

of push-down accounting, will not fall below 30 percent of total capital.

Duke Energy Kentucky is required to pay dividends solely out of retained

earnings and to maintain a minimum of 35 percent equity in its capital

structure.

Duke Energy Indiana

Duke Energy Indiana must limit cumulative distributions subsequent

to the merger between Duke Energy and Cinergy to (i) the amount of retained

earnings on the day prior to the closing of the merger, plus (ii) any future

earnings recorded. In addition, Duke Energy Indiana will not declare and pay

dividends out of capital or unearned surplus without prior authorization of the

IURC.

The restrictions discussed above were less than 25 percent of Duke

Energy’s net assets at December 31, 2015.

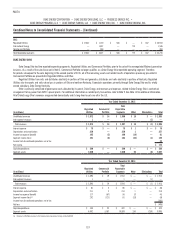

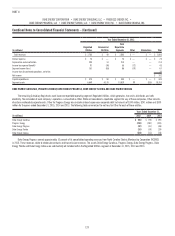

RATE RELATED INFORMATION

The NCUC, PSCSC, FPSC, IURC, PUCO and KPSC approve rates for

retail electric and natural gas services within their states. The FERC approves

rates for electric sales to wholesale customers served under cost-based rates

(excluding Ohio and Indiana), as well as sales of transmission service.

Duke Energy Carolinas

FERC Transmission Return on Equity Complaint

On January 7, 2016, a customer group filed a complaint with the FERC

that the rate of return on equity of 10.2 percent in Duke Energy Carolinas’

transmission formula rates is excessive and should be reduced to no higher

than 8.49 percent, effective upon the complaint date. The customer group

requests consolidation with a similar complaint filed against Duke Energy

Progress on the same day. Duke Energy Carolinas cannot predict the outcome of

this matter.

William States Lee Combined Cycle Facility

On April 9, 2014, the PSCSC granted Duke Energy Carolinas and NCEMC

a Certificate of Environmental Compatibility and Public Convenience and

Necessity (CECPCN) for the construction and operation of a 750 MW combined-

cycle natural gas-fired generating plant at Duke Energy Carolinas’ existing

William States Lee Generating Station in Anderson, South Carolina. Duke Energy

Carolinas began construction in July 2015 and estimates a cost to build of

$600 million for its share of the facility, including AFUDC. The project is expected

to be commercially available in late 2017. NCEMC will own approximately

13 percent of the project. On July 3, 2014, the South Carolina Coastal

Conservation League and Southern Alliance for Clean Energy jointly filed a

Notice of Appeal with the Court of Appeals of South Carolina seeking the court’s

review of the PSCSC’s decision, claiming the PSCSC did not properly consider

a request related to a proposed solar facility prior to granting approval of the

CECPCN. The Court of Appeals affirmed the PSCSC’s decision on February 10,

2016. On February 23, 2016, the South Carolina Coastal Conservation League

and Southern Alliance for Clean Energy filed a petition for rehearing with the

Court of Appeals.

William States Lee III Nuclear Station

In December 2007, Duke Energy Carolinas applied to the NRC for a COL

for two Westinghouse AP1000 (advanced passive) reactors for the proposed

William States Lee III Nuclear Station (Lee Nuclear Station) at a site in Cherokee

County, South Carolina. Submitting the COL application did not commit Duke

Energy Carolinas to build nuclear units. Through several separate orders,

the NCUC and PSCSC concurred with the prudency of Duke Energy Carolinas

incurring certain project development and pre-construction costs, although

recovery of costs is not guaranteed. Duke Energy Carolinas has incurred

approximately $471 million, including AFUDC through December 31, 2015.

This amount is included in Net property, plant and equipment on Duke Energy

Carolinas’ Consolidated Balance Sheets.

Design changes have been identified in the Westinghouse AP1000

certified design that must be addressed before NRC can complete its review of

the Lee Nuclear Station COL application. These design changes set the schedule

for completion of the NRC COL application review and issuance of the Lee COL.

Receipt of the Lee Nuclear Station COL is currently expected by late 2016.

Duke Energy Progress

FERC Transmission Return on Equity Complaint

On January 7, 2016, a customer group filed a complaint with the FERC

that the rate of return on equity of 10.8 percent in Duke Energy Progress’

transmission formula rates is excessive and should be reduced to no higher

than 8.49 percent, effective upon the complaint date. The customer group