Duke Energy 2015 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes To Consolidated Financial Statements – (Continued)

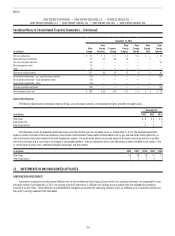

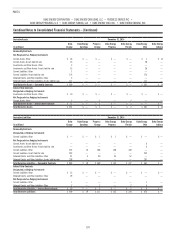

14. DERIVATIVES AND HEDGING

The Duke Energy Registrants use commodity and interest rate contracts

to manage commodity price risk and interest rate risk. The primary use of

commodity derivatives is to hedge the generation portfolio against changes in

the prices of electricity and natural gas. Interest rate swaps are used to manage

interest rate risk associated with borrowings.

All derivative instruments not identified as normal purchase/normal sale

(NPNS) are recorded at fair value as assets or liabilities on the Consolidated

Balance Sheets. Cash collateral related to derivative instruments executed

under master netting arrangements is offset against the collateralized

derivatives on the Consolidated Balance Sheets. The cash impacts of settled

derivatives are recorded as operating activities on the Consolidated Statements

of Cash Flows.

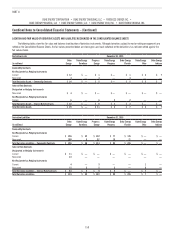

INTEREST RATE RISK

The Duke Energy Registrants are exposed to changes in interest rates

as a result of their issuance or anticipated issuance of variable-rate and

fixed-rate debt and commercial paper. Interest rate risk is managed by limiting

variable-rate exposures to a percentage of total debt and by monitoring

changes in interest rates. To manage risk associated with changes in interest

rates, the Duke Energy Registrants may enter into interest rate swaps, U.S.

Treasury lock agreements and other financial contracts. In anticipation of

certain fixed-rate debt issuances, a series of forward-starting interest rate

swaps may be executed to lock in components of current market interest rates.

These instruments are later terminated prior to or upon the issuance of the

corresponding debt.

Cash Flow Hedges

For a derivative designated as hedging the exposure to variable cash

flows of a future transaction, referred to as a cash flow hedge, the effective

portion of the derivative’s gain or loss is initially reported as a component of

other comprehensive income and subsequently reclassified into earnings once

the future transaction effects earnings. Amounts for interest rate contracts are

reclassified to earnings as interest expense over the term of the related

debt. Gains and losses reclassified out of AOCI for the years ended

December 31, 2015 and 2014 were not material. Duke Energy’s interest rate

derivatives designated as hedges include interest rate swaps used to hedge

existing debt within the International Energy and Renewables’ businesses.

Undesignated Contracts

Undesignated contracts include contracts not designated as a hedge

because they are accounted for under regulatory accounting and contracts that

do not qualify for hedge accounting.

Duke Energy’s interest rate swaps for its Regulated Utilities operations

employ regulatory accounting. With regulatory accounting, the mark-to-market

gains or losses on the swaps are deferred as regulatory liabilities or regulatory

assets, respectively. Regulatory assets and liabilities are amortized consistent

with the treatment of the related costs in the ratemaking process. The accrual of

interest on the swaps is recorded as Interest Expense.

Interest rate contracts issued in 2015 that use regulatory accounting

include $400 million notional amount of forward-starting interest rate swaps

issued in October 2015 at Duke Energy Carolinas to hedge debt anticipated to

be issued in 2018. In January 2015, Duke Energy Progress executed fixed-to-

floating rate swaps that also use regulatory accounting. The swaps were issued

to economically convert $250 million of fixed-rate first mortgage bonds due

September 15, 2021, to floating rate with an initial rate of approximately

1.75 percent.

As of December 31, 2015, Duke Energy entered into $900 million of

forward-starting interest rate swaps to lock in components of interest rates

for the expected financing of the Piedmont acquisition. In January 2016, Duke

Energy entered into an additional $500 million notional amount. The swaps do

not qualify for hedge accounting and are marked-to-market, with any gains

or losses included in earnings. The impact on net income was not material

in 2015. The swaps will be terminated in conjunction with the acquisition

financing. See note 2 for additional information related to the Piedmont

acquisition.

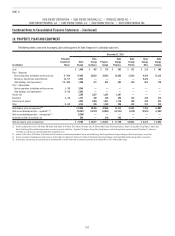

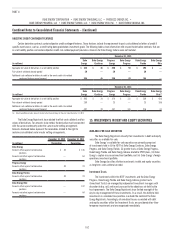

The following table shows notional amounts for derivatives related to interest rate risk.

December 31, 2015 December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Progress

Energy

Duke

Energy

Florida

Duke

Energy

Ohio

Cash flow hedges(a) $ 700 $ — $ — $ — $ — $ — $ 750 $ — $ — $ —

Undesignated contracts 1,827 400 500 250 250 27 277 250 250 27

Total notional amount $ 2,527 $ 400 $ 500 $ 250 $ 250 $ 27 $ 1,027 $ 250 $ 250 $ 27

(a) Duke Energy includes amounts related to consolidated Variable Interest Entities (VIEs) of $497 million and $541 million at December 31, 2015 and 2014, respectively.