Duke Energy 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

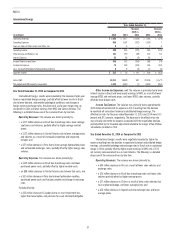

33

PART II

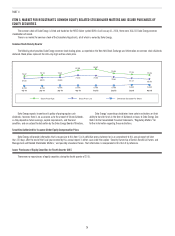

The variance in adjusted earnings for the year ended December 31, 2015,

compared to 2014, was primarily due to:

• Lower results in Latin America primarily due to lower demand,

unfavorable hydrology in Brazil, changes in foreign currency exchange

rates, a prior-year tax benefit related to the reorganization of Chilean

operations, and lower dispatch in Central America due to increased

competition;

• Higher operations and maintenance expense primarily due to the

prior-year benefit associated with the adoption of nuclear outage

levelization, amounts related to additional ownership interest in assets

acquired from NCEMPA, and higher planned fossil generation outage

costs, partially offset by lower storm restoration costs;

• Higher depreciation and amortization expense primarily due to higher

depreciable base; and

• Lower equity in earnings of unconsolidated affiliates due to lower

margins at NMC, largely driven by lower MTBE prices, partially offset by

lower butane costs.

Partially offset by:

• Increased retail pricing primarily due to rate riders in most jurisdictions,

including increased revenues related to energy efficiency programs,

equity returns related to additional ownership interest in assets

acquired from NCEMPA, and higher base rates;

• Increased wholesale net margins largely due to increases in contracted

amounts and prices and a new wholesale contract with NCEMPA;

• Retail sales growth of 0.6 percent;

• Higher results at the nonregulated Midwest generation business prior to

its sale on April 2, 2015, due to higher PJM Interconnection LLC (PJM)

capacity revenues and increased generation margins; and

• Reduction in shares outstanding due to the Duke Energy stock

repurchase (only impacts per diluted share amounts in the tables

above).

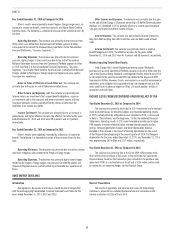

The variance in adjusted earnings for the year ended December 31, 2014,

compared to 2013, was primarily due to:

• Increased retail pricing and riders primarily resulting from the

implementation of revised rates in most jurisdictions;

• Favorable weather in 2014 compared to 2013;

• Higher PJM capacity revenues for the nonregulated Midwest generation

business due to higher prices; and

• Higher results of the renewables business due to higher production from

the wind and solar portfolios, lower costs and additional renewables

investments.

Partially offset by:

• Higher depreciation and amortization expense primarily due to higher

depreciable asset base and lower reductions to cost of removal

reserves;

• Higher operations and maintenance expense due to higher storm costs,

the timing of fossil plant outages and the impact of nuclear outage cost

levelization;

• Lower post in-service debt returns due to projects added to customer

rates; and

• Higher property and other non-income taxes.